Prop AMMs are reshaping Solana

• They now route 40% of Jupiter volume by hiding orderflow from MEV

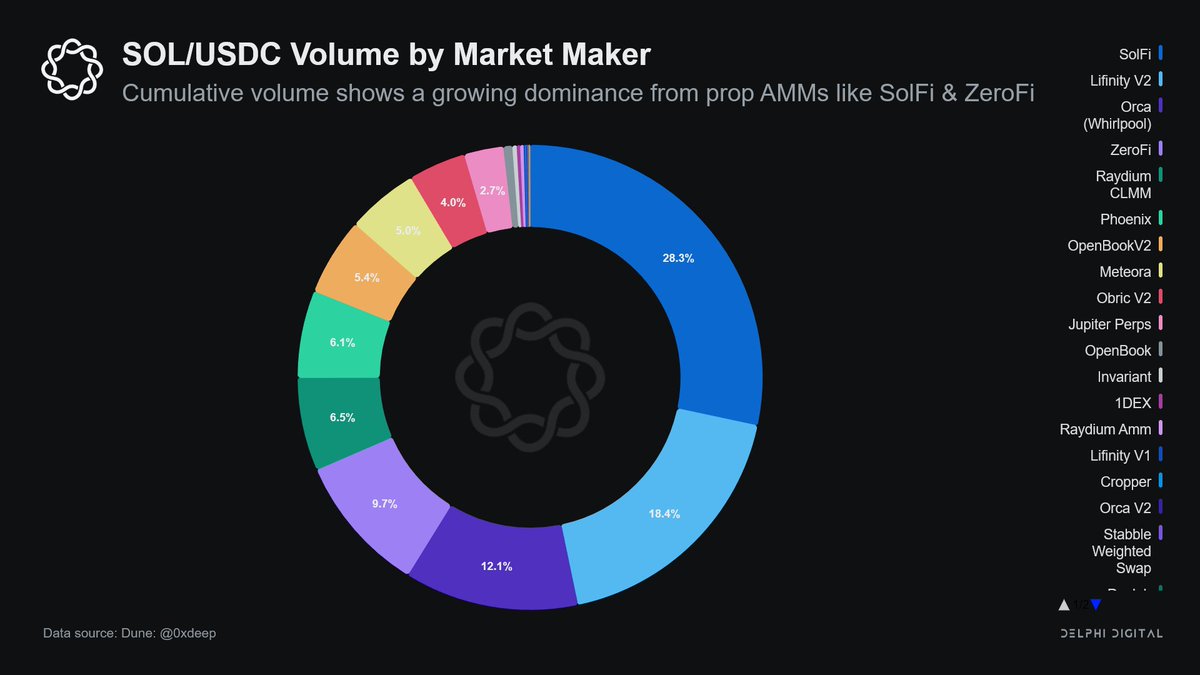

• SOL/USDC pairs see 42% of trades through these AMMs with tighter spreads

• Prop AMMs dominate liquid pairs while public AMMs are used for memecoins

Read more here.👇

Are Private AMMs taking over Solana?

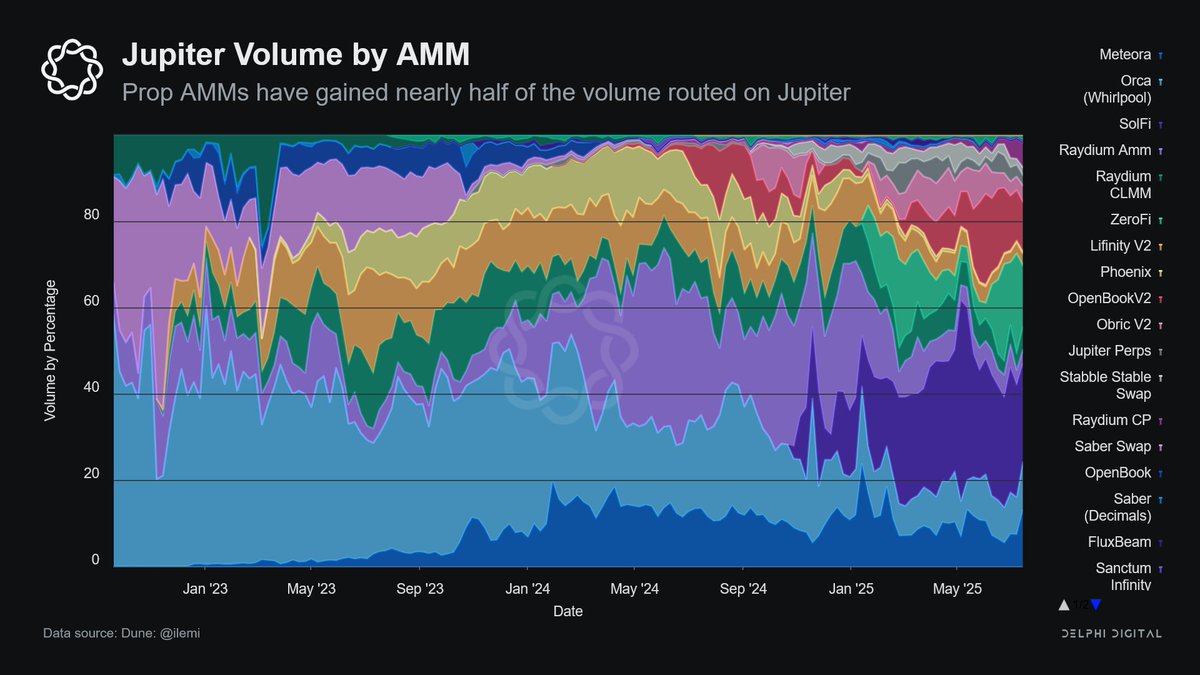

Over 40% of all trading volume on Jupiter today is routed through prop AMMs like SolFi, ZeroFi, and Obric.

Despite being completely closed source they’ve managed to capture nearly half of the volume within the last 6 months.

But what exactly is a “prop AMM”?

The concept of a proprietary AMM might seem like a contradiction. AMMs by design are open, deterministic systems.

Their role is to offer clear pricing curves and trustless access to liquidity.

The structure of a prop AMM is akin to that of an active market maker. They:

▫️Quote prices privately

▫️Don’t operate frontends

▫️Rely on vault-based liquidity

▫️Execute only through aggregators

We can basically refer to them as on-chain market makers. The goal is to close the spread and offer tighter quotes.

And while the rise of prop AMMs are consolidating liquidity towards a handful of venues; the market structure as a whole is becoming more efficient.

Market makers are noticing this trend, and traders don’t care who’s routing their trades – they care about better quotes and fills.

Solana is the early proof of this, and the broader market will increasingly stratify into aggregator-driven execution environments dominated by a small set of backend prop AMMs.

We could see a bifurcated market structure - on one end sophisticated venues dominating volume on Jupiter, and on the other, V2 style pools like Raydium capturing the tail-end of assets.

Read the full report here.

12.23K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.