You know $USDT, but do you know its original name was Realcoin?

Or that its first competitor, $NBT, an algorithmic stablecoin, suffered a crypto "bank run" and died?

Stablecoins from 2014 to 2016 were different.

🧵

II. "Wait, were there stablecoins in 2014?"

Absolutely.

From 2014 to 2016, the stablecoin concept was born. Projects launched during this time were foundational experiments, each testing a different approach to creating a price-stable digital asset.

III. BitUSD (2014)

BitUSD was introduced by @bytemaster7 on @bitshares. It was the first stablecoin to demonstrate that you could create a dollar-pegged asset using only other cryptocurrencies as backing.

"What was the mechanism?"

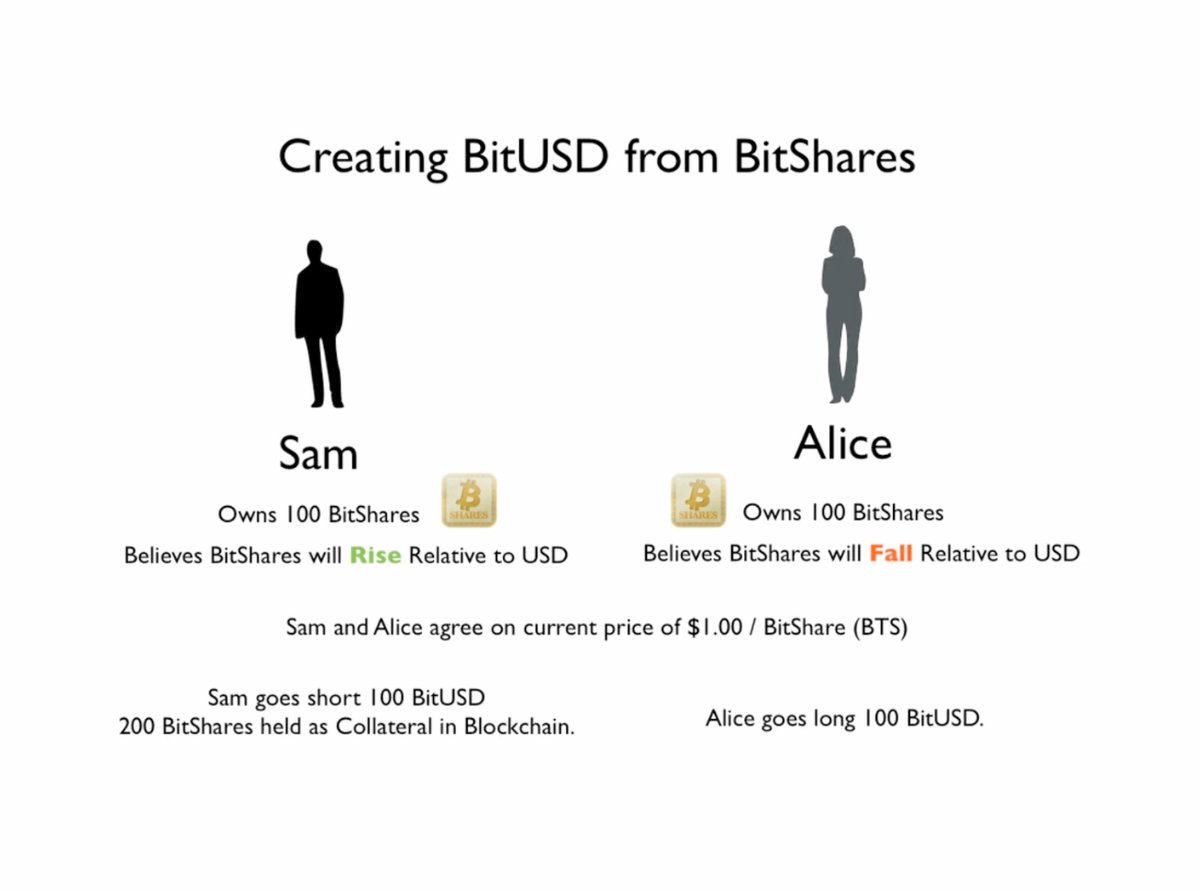

IV. To mint BitUSD, you had to lock up the native token, $BTS, into a smart contract with over-collateralization (at least 2:1).

This meant that to create $100 of BitUSD, you needed to lock up at least $200 worth of $BTS to absorb the price volatility of the $BTS collateral.

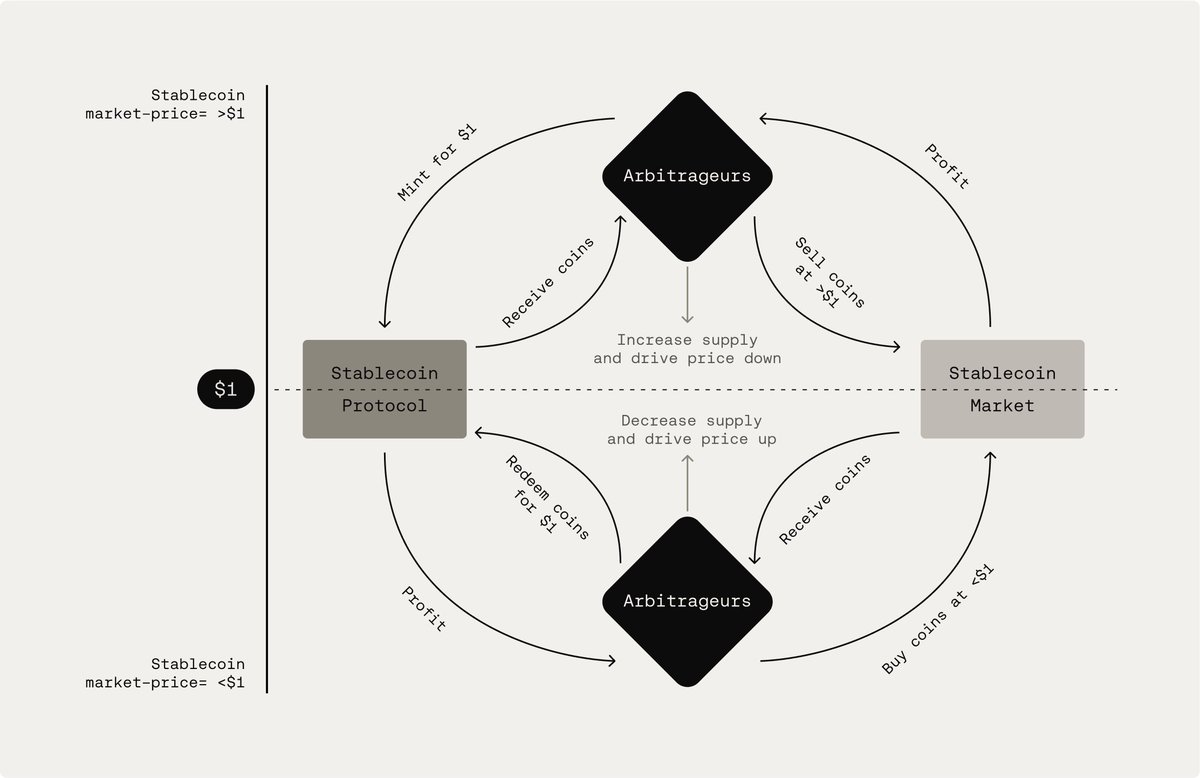

V. If BitUSD's price fell below $1, traders were incentivized to buy the cheap BitUSD and redeem it for $1 worth of BTS, pocketing the difference and driving the price back up.

If BitUSD rose above $1, users with collateral could mint new BitUSD for $1 and sell it on the market for a profit, increasing supply and driving the price back down.

VI. The issue with @bitshares was its complete reliance on the stability of its collateral, BTS.

During a "black swan" event, when BTS crashed, the collateral became insufficient to support the outstanding BitUSD, causing a catastrophic de-peg.

VII. NuBits (2014)

@OfficialNuBits took a much more complex and ambitious approach.

It aimed to maintain its peg not with collateral, but by algorithmically managing the token's supply, much like a central bank manages a fiat currency.

VII. @OfficialNuBits used a dual-token model:

- NuBits (NBT): The stablecoin, intended to be worth $1.

- NuShares (NSR): An equity-like token that granted voting rights and received rewards from the network.

VIII. To lower the price, the system would issue more $NBT.

To raise the price, it would incentivize users to take their $NBT out of circulation (a process called "parking") in exchange for interest payments funded by the system, effectively reducing supply.

Also, $NSR holders voted on the interest rates for parking.

IX. For a time, @OfficialNuBits held its peg.

However, in 2016, $BTC rally created a "crypto bank run." A.k.a. Users rushed to sell their $NBT to buy $BTC.

X. The algorithmic mechanism was overwhelmed and couldn't offer high enough interest rates to persuade people to hold $NBT instead of $BTC.

The peg broke decisively, and @OfficialNuBits never recovered.

XI. Tether (2014)

Initially launched as Realcoin and built on a protocol layer of Bitcoin called Omni, Realcoin introduced the simplest model of all: a centralized entity holds real-world assets and issues a token representing a claim on those assets.

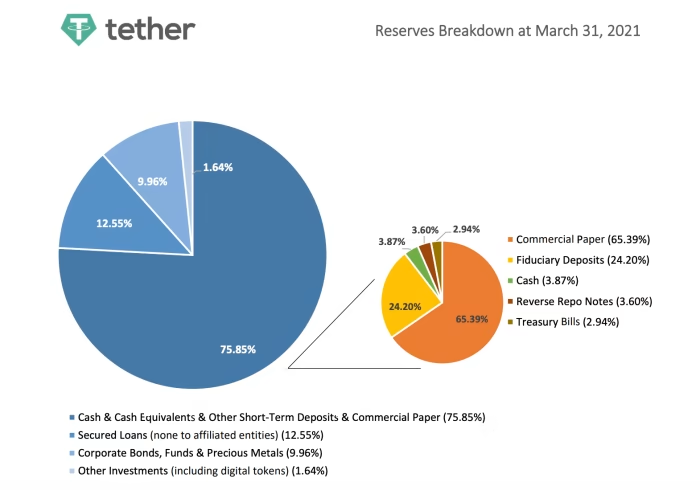

XII. The promise was straightforward: for every $USDT in circulation, the company behind it, Tether Holdings Ltd., held one U.S. dollar in a bank account.

This 1:1 backing was meant to guarantee the peg.

XIII. This model was incredibly successful because it was easy to understand.

Though, its primary weakness is the need for trust in a central entity. That's it.

XIV. A stablecoin is only as good as its promise to be redeemed for $1 of value. When that mechanism fails under stress, as with NuBits, confidence is permanently lost.

Last but certainly not least, I recommend that you follow these chads:

@splinter0n @0xDefiLeo @the_smart_ape @0xCheeezzyyyy @DOLAK1NG @YashasEdu @0xAndrewMoh @eli5_defi @_SmokinTed @RubiksWeb3hub @kenodnb @lstmaximalist

I hope you've found this thread helpful.

Follow me @belizardd for more.

Like/Repost the quote below if you can:

44.26K

63

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.