4 shifts between Top Crypto-Native Protocols vs. Traditional Digital Economy Firms

1️⃣ Onchain Verifiable Revenue ≠ Web2 Ads & Subscriptions

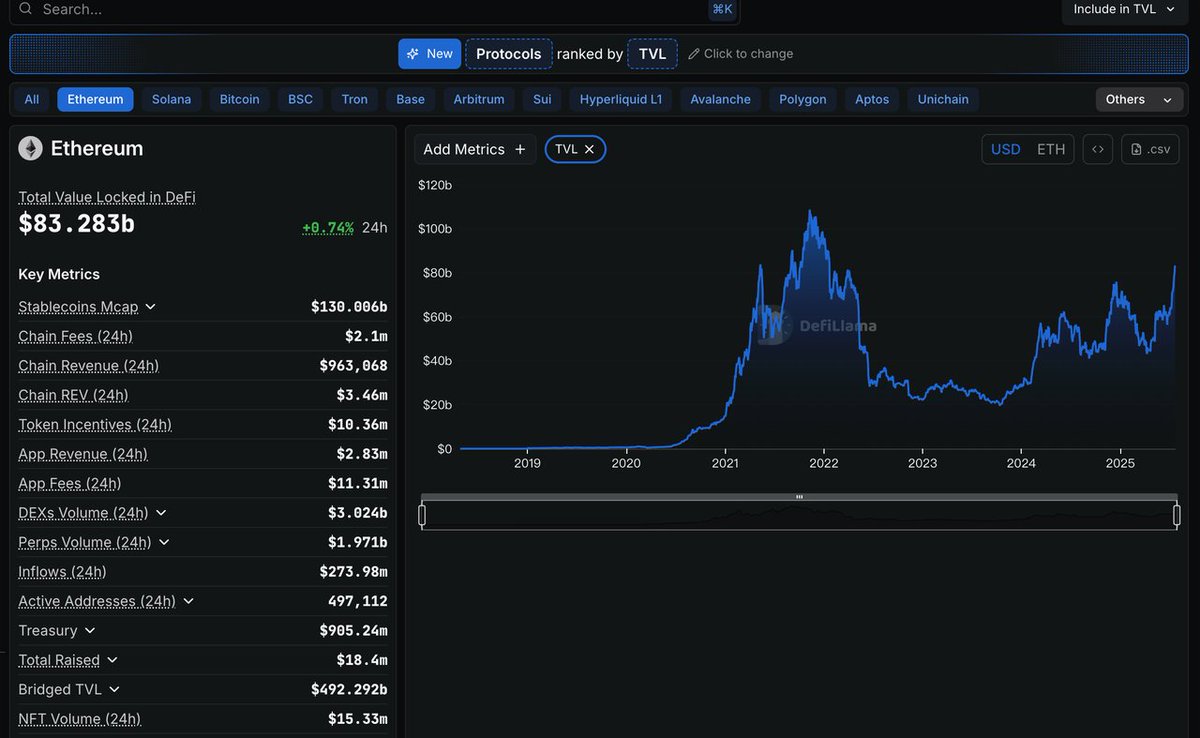

Crypto protocols generate recurring cash flow onchain—transparent and sustainable:

@Aave: $60M + annual revenue (lending)

@LidoFinance: $99M annual revenue in 2024 (liquid staking)

@Uniswap: $140.3M revenue in Q1, 2025, with 20M+ MAUs (DEX)

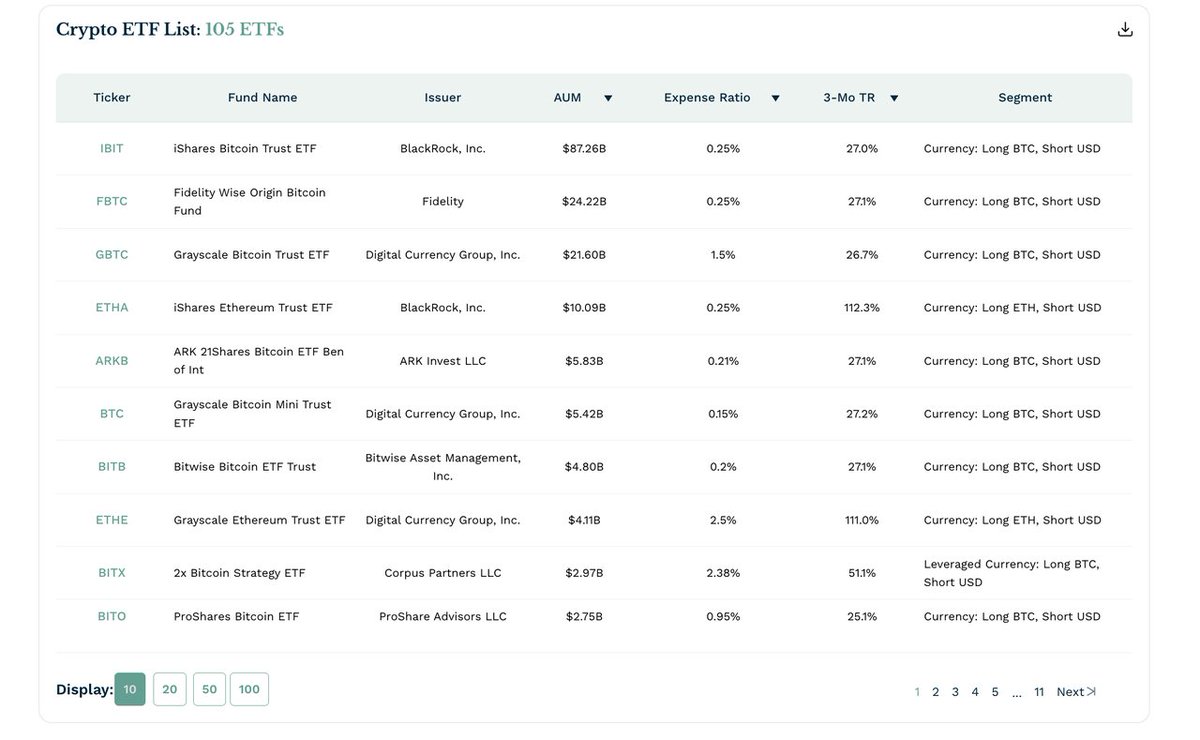

2️⃣ Crypto “ETF Alternatives” in Mainstream Markets

105 crypto-related ETFs live globally; $IBET (BlackRock ETH ETF) saw $1.5B net inflows in 7 weeks

Buying listed shares as other easy vehicles to hold crypto, like #COIN,#SBET #MSTR

3️⃣ Product = Community: A Totally Different Growth Engine

Web3 dapps ( zora, MetaMask, OKXWeb3 wallet, FriendTech, Phantom, hyperliquid, Polymarket, meme communities) grow by “holder → voter → owner,” fueling network effects & community loyality

Web2 apps hunting for users' attention, relying on paid acquisition & centralized virality tools

4️⃣ Developer Flywheel: Community-Driven Innovation

@ETHGlobal, @buildonbase, @solana: developers doubling YoY—modular stacks, forkable code, DAO collaboration

Highly concentrated competitive landscape by mainstream tech giants face fixed biz models

Crypto-native protocol scaled in decentralised way of business model, user's role fundamentally.

15.5K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.