$BTC Market Daily Report — 7.29🔥

Daily Chart

1) Yesterday, we were still rejected at 1195, and here we have bounced back down, still showing a bearish trend.

However, we need to watch 1156; if 1156 breaks, the target is 110. If 1156 holds, and even if 117 holds now, there is still a chance to continue upwards to test 12.

Then we need to see if we can stabilize above 1195; only if we stabilize can we look for new highs or secondary highs.

Hourly Chart

1) Currently, the hourly structure is showing a downtrend; here we should first pay attention to whether ML can stabilize after the raid.

This is also an order block (ob); if it stabilizes here, we can continue to look upwards for a test of 1195.

If it breaks down, we will still look at the 1156 order block position.

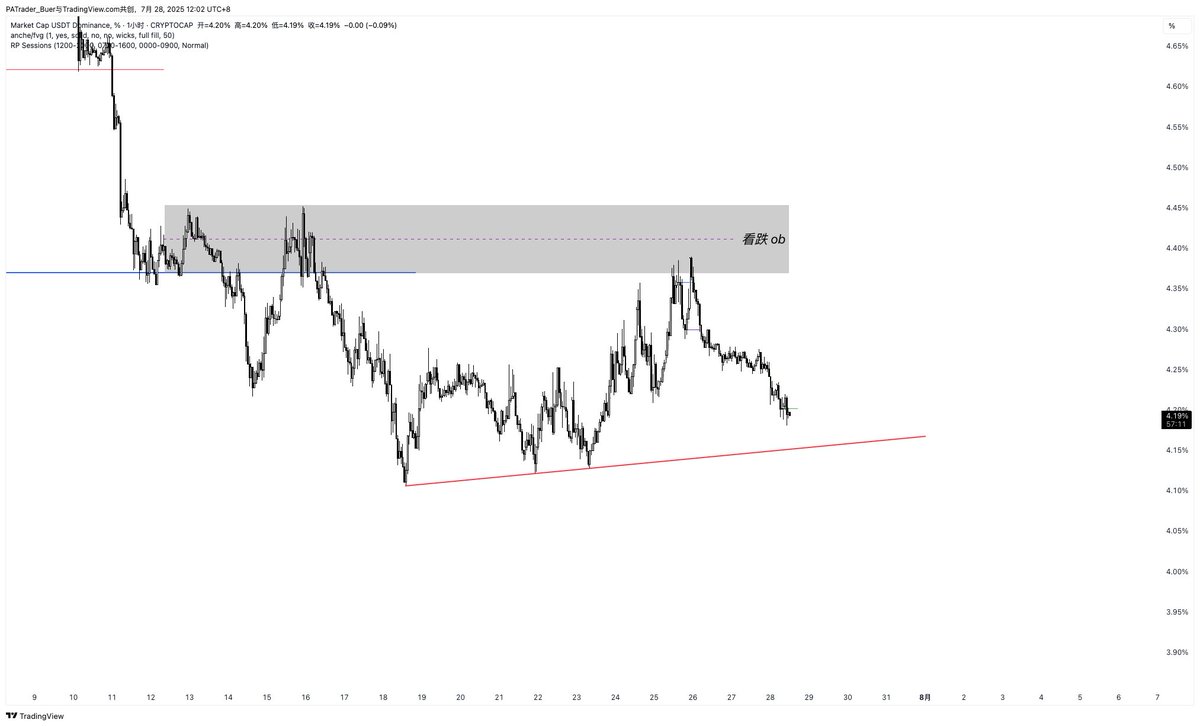

usdt.d

Currently forming a convergence; we still need to watch for a bearish order block above, rejecting further downward movement. In other words, if the bearish order block is rejected, BTC will still rise; only if it breaks through can we look for further downward movement. Watch for new lows below.

$BTC Weekly Market Report — 7.28🔥

Weekly Chart

1) BTC dipped down last week to gain liquidity and is currently closing higher at 1192 (above the previous 2 weeks' bodies), which is actually quite good and indicates a bullish expectation.

2) The expectation here is to see a new high.

However, the new high still needs to break through 121 and then see if it can hold above 1195 after a pullback. This has been mentioned for a week now.

3) This week's macro focus is:

Thursday 2:00 PM - Federal Reserve FOMC announces interest rate decision.

Friday 8:30 PM - US July unemployment rate and non-farm payroll data.

4) Personal Opinion:

This time, it is highly likely that there will be no interest rate cut; we are still watching to see if there will be any hints about a cut in September.

If there are hints + unemployment data, it could lead to a wave of expected increases.

That means reaching a new high, but I believe this expected increase is not sustainable.

We need to pay attention to the pullback after the rise.

So if there is a significant pullback, I might focus on September 10.

Daily Chart

1) The daily chart clearly shows a downward liquidity grab followed by another upward test of the bearish order block.

2) Last Friday, I reminded to buy after the liquidity grab at 1156, with the target being 1195.

The short-term target has been reached. Now we just need to see if it can break through 121 and then hold above to continue upward.

3) If it cannot break through, then it will continue to oscillate, and we will look at the 1156 range—L test again.

If it breaks through, then pay attention to the range-H test and see if it can reach a new high.

Currently, I personally lean towards bullish.

Hourly Chart

1) You can see that after the liquidity grab below, the upper idm and range—h are waiting for liquidity to be grabbed.

So currently, it still leans towards bullish.

2) Here, pay attention to the H4 pullback for a bullish order block at 1184 for buying opportunities; the accumulation here still looks bullish.

$USDT.d

As mentioned last time, testing the bearish order block was rejected, which is our buying opportunity for BTC.

Now after the rejection, Usdt.d continues downward, looking forward to grabbing liquidity at idm and also expecting to create new lows.

This also indicates that BTC continues to look bullish.

17.71K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.