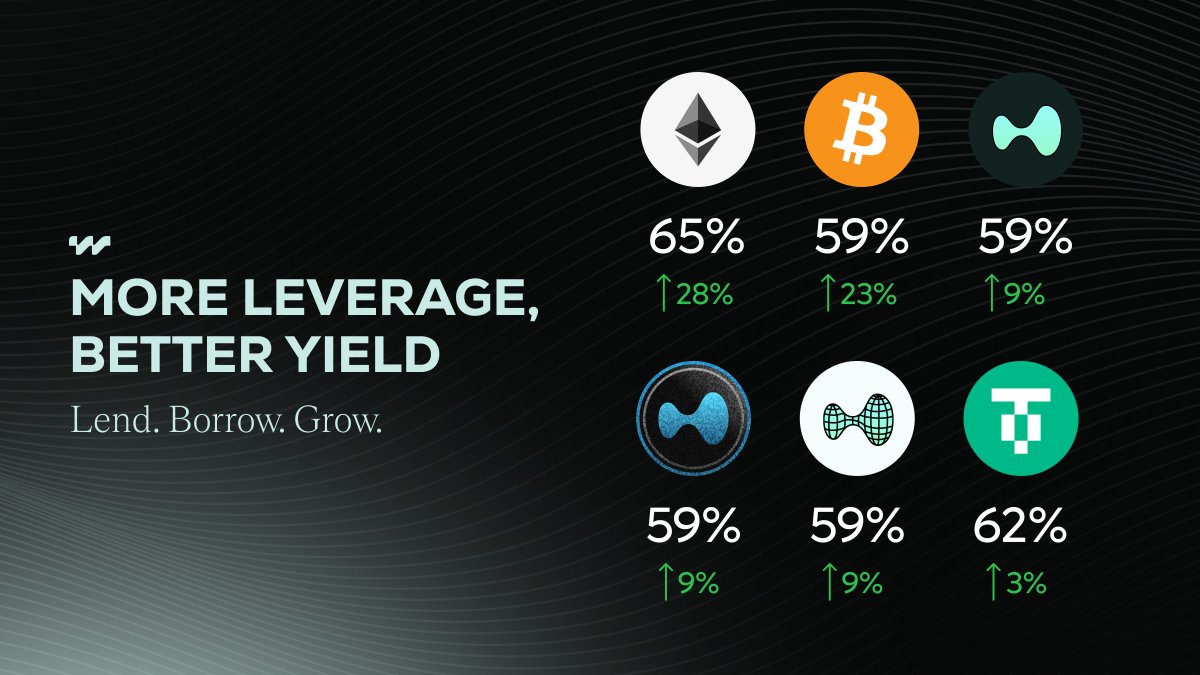

Hyperlend has raised the kHYPE LTV ratio by 9%, allowing kHYPE suppliers to borrow at up to 59% LTV.

As well as reaching 3.55m kHYPE (~$156.4m) in collateral.

Heavy liquidity on your kHYPE coded.

We are pleased to announce that, starting today, July 28, 2025, we are raising LTV ratios.

This plays an important role in providing users with increased capacity and flexibility across the platform. You can now borrow more against the same collateral, which means that extra headroom lets you put idle collateral to work in other strategies without needing to top up your position.

Raising the LTV ratio allows you to enter multi-step loops, which can be thought of as collateralized leverage, delta-neutral spreads, or yield stacking. The main benefit of it is that you can execute strategies without the need to deposit new assets.

Bank smarter, HyperLend.

7.97K

78

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.