Exactly one year ago, in July 2024, @SeiNetwork data became publicly trackable on @Dune

Since then, the network has evolved at an impressive pace, moving from a quiet Layer 1 into one of the most active ecosystems in crypto 🔥

The growth has not been limited to one sector, it’s been broad, sustained, and compounding

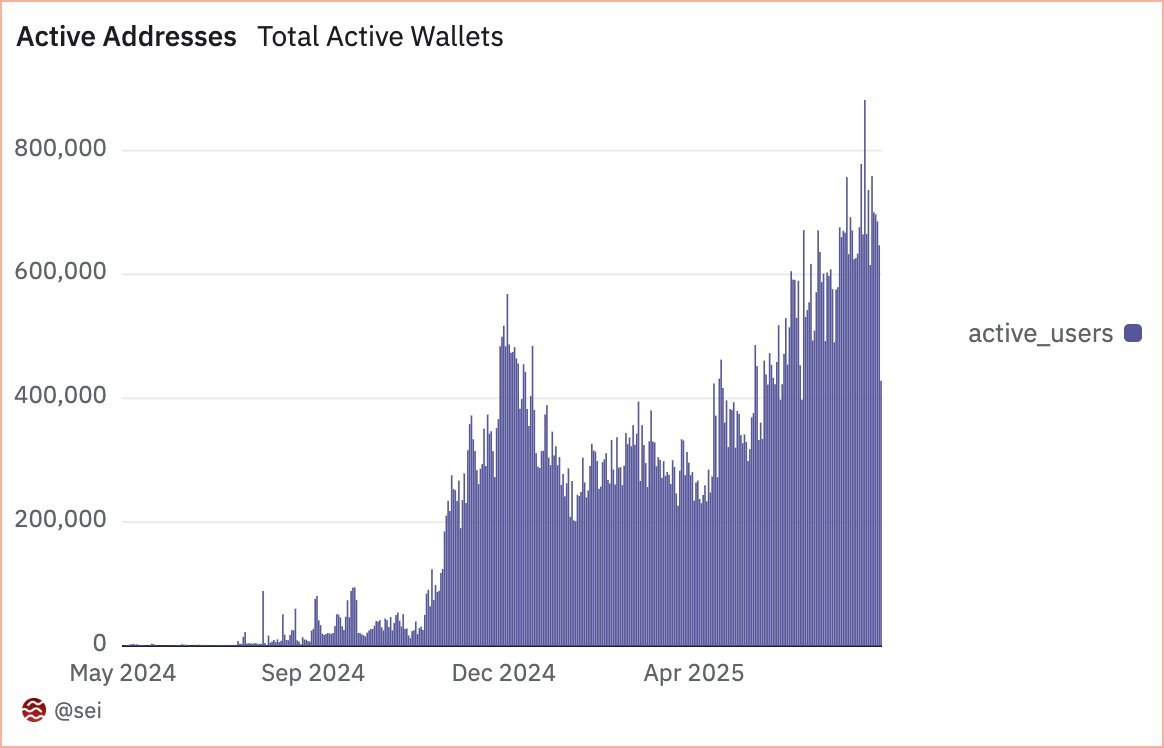

Daily active users have grown from around 1,300 to over 685,000.

That’s not just a spike, it’s the result of consistent traction, driven by the rollout of DeFi protocols and high-engagement games throughout Q2 and beyond.

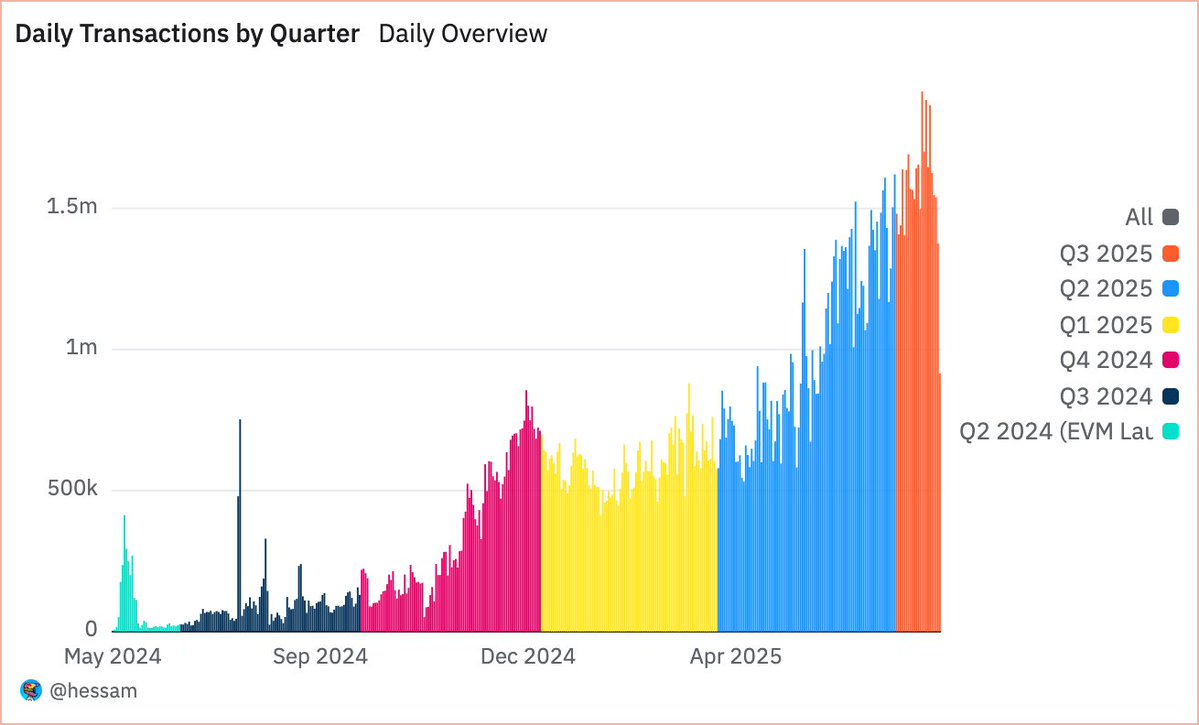

These users are not just arriving, they’re staying. Transaction volume reflects this engagement.

$SEI now processes over 1.6 million transactions each day, up from just 57,000 a year ago.

The number of active contracts has also multiplied, showing steady developer activity across lending, liquid staking, stablecoins, and tokenized assets

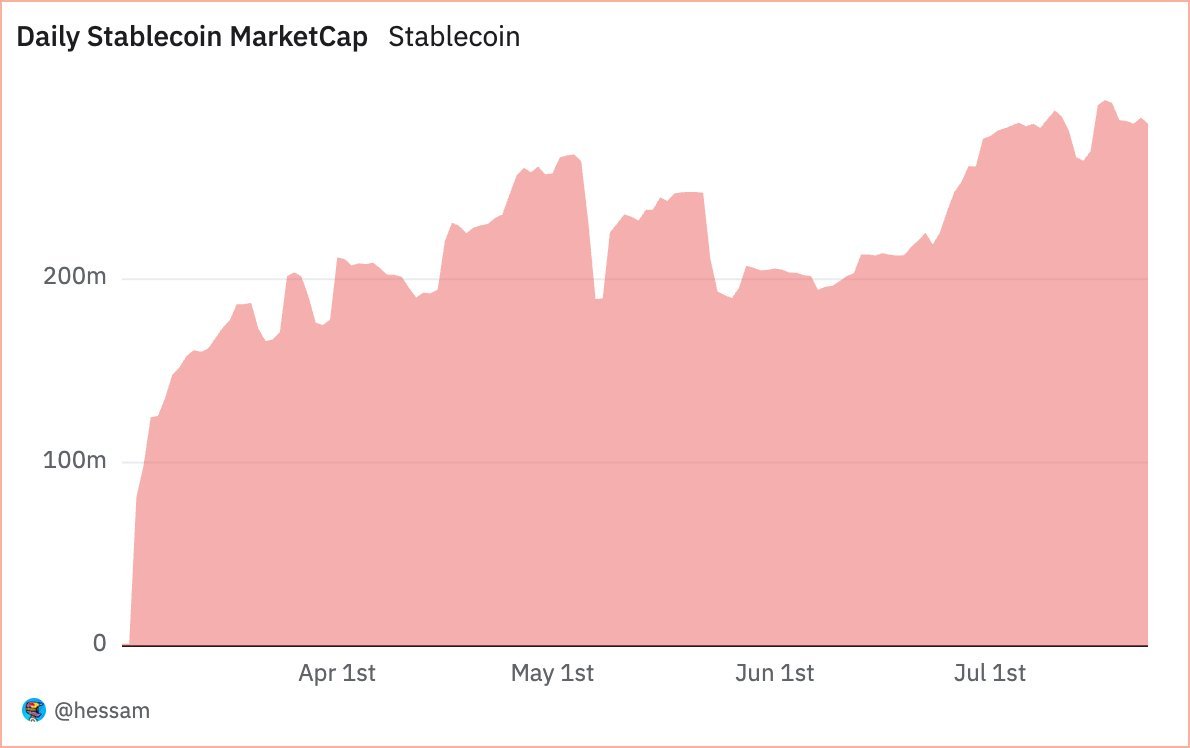

On the liquidity side, the growth is equally clear.

Total value locked has jumped from $100M to $687M.

Stablecoin supply now sits at $284M, and more than $52M has been bridged in from chains like @arbitrum, @base, and @ethereum.

With native @USDC, USDY from @OndoFinance, and @chainlink CCIP already integrated, Sei is becoming a serious execution layer for stable-value and cross-chain capital flows

Gaming is not a side story here, it’s a major driver.

Projects like @worldofdypians, @hotspring_HQ, and @archerhunter_HQ are each posting six-figure daily transaction counts, proving Sei can support real-time applications at scale without friction

DEX volume has also climbed sharply, averaging between $15M and $20M per day, compared to just ~$5M last year.

Recent peaks have crossed $30M, with platforms like @SailorFi, @okutrade, and @SymphonyAg leading the way and keeping capital circulating natively

What we’re seeing is not isolated growth, but coordinated expansion across users, applications, and liquidity.

It’s a chain executing across the fundamentals, and the progress has been verifiable from day one 👇

39.57K

134

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.