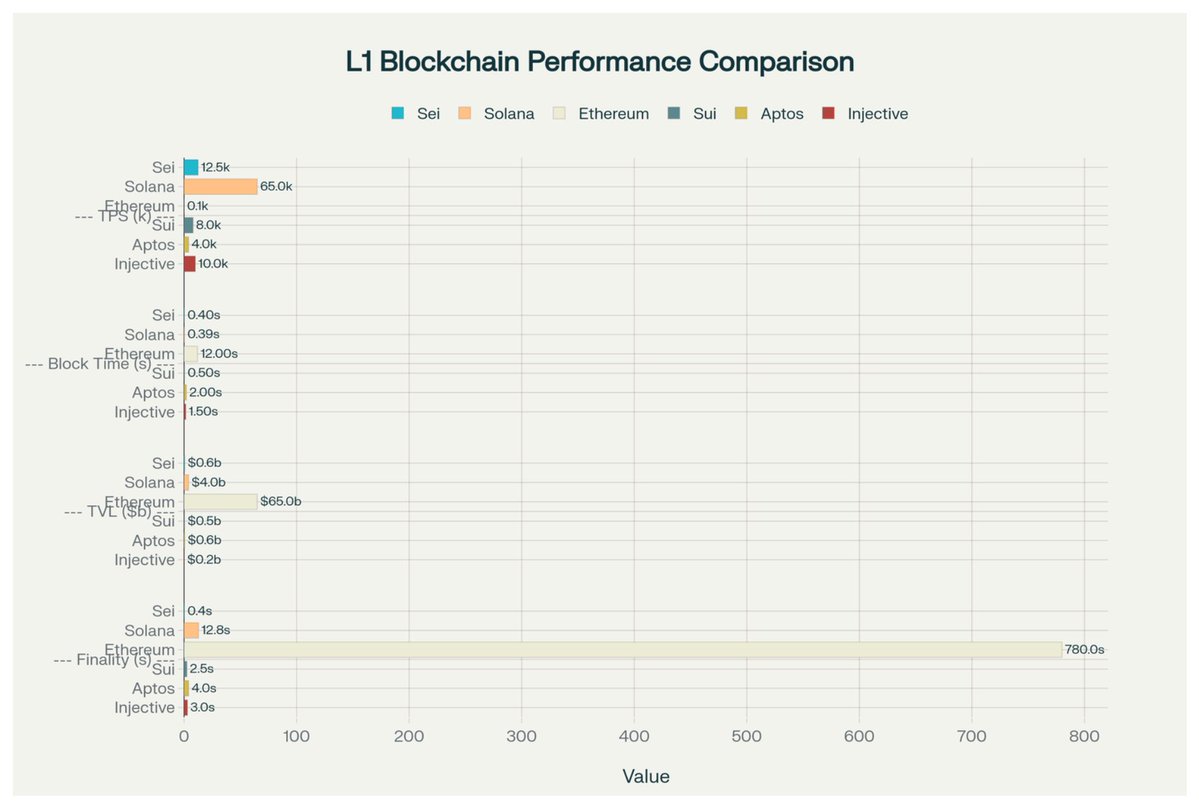

. @SeiNetwork has been performing relatively well in terms of L1 performance

In terms of just falling behind Solana in TPS, less than a second finality and many more.

what does the metrics tell you about the chain? something is coming...? 🧵

15% apr on USDC with @TakaraLend

10% apr on USDC with @YeiFinance

and all these protocols doesn't have a token yet and running points program.

Looks like @SeiNetwork running a similar playbook as Sui 2 years ago on

incentivising lending markets and boosting on-chain metric.

Will the follow the market maker move as well...?

Yes or No its still a great farm right now.

🔹 TLDR

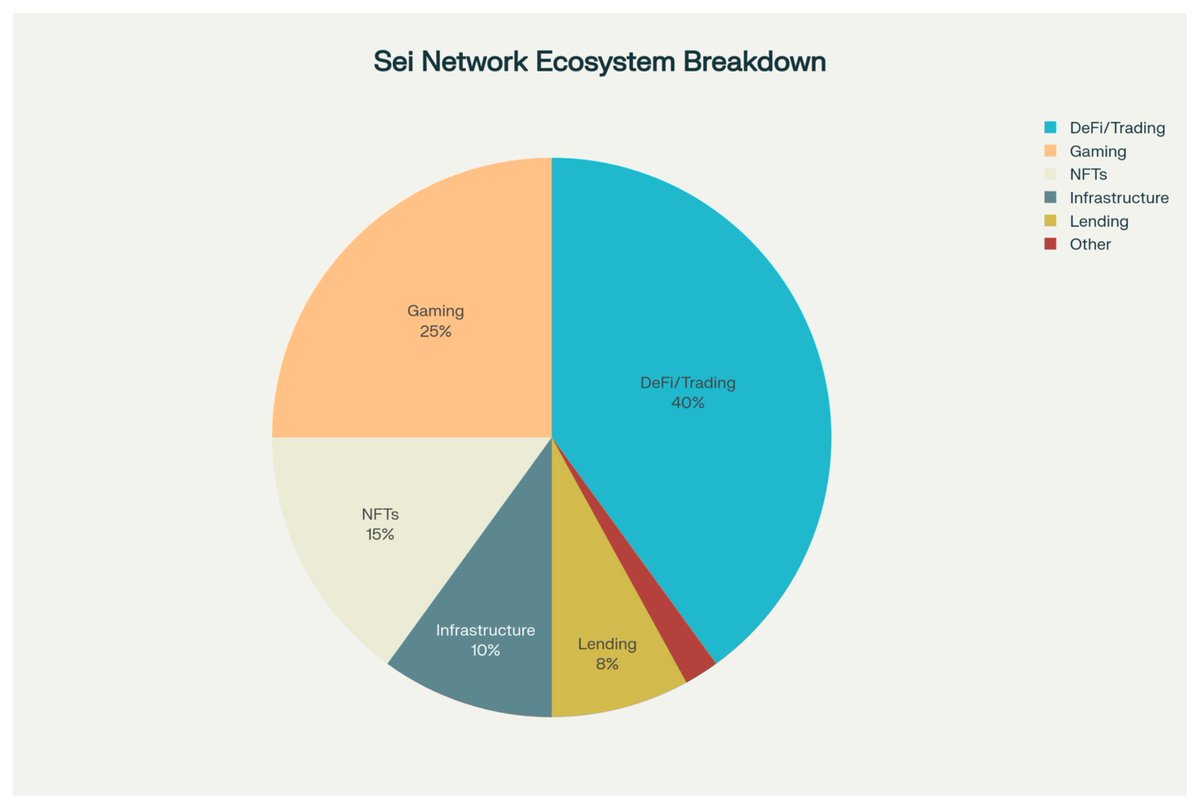

SEI ecosystem is heavily focused on DEFI, Gaming and Infra and they have the stats to prove it.

In this thread I'll do a little analysis on their state of DeFi citing metrics from analytic tools...

Before you go further, you have to catch up with my DeFi eco thread on SEI...

🔹 DeFi on SEI..

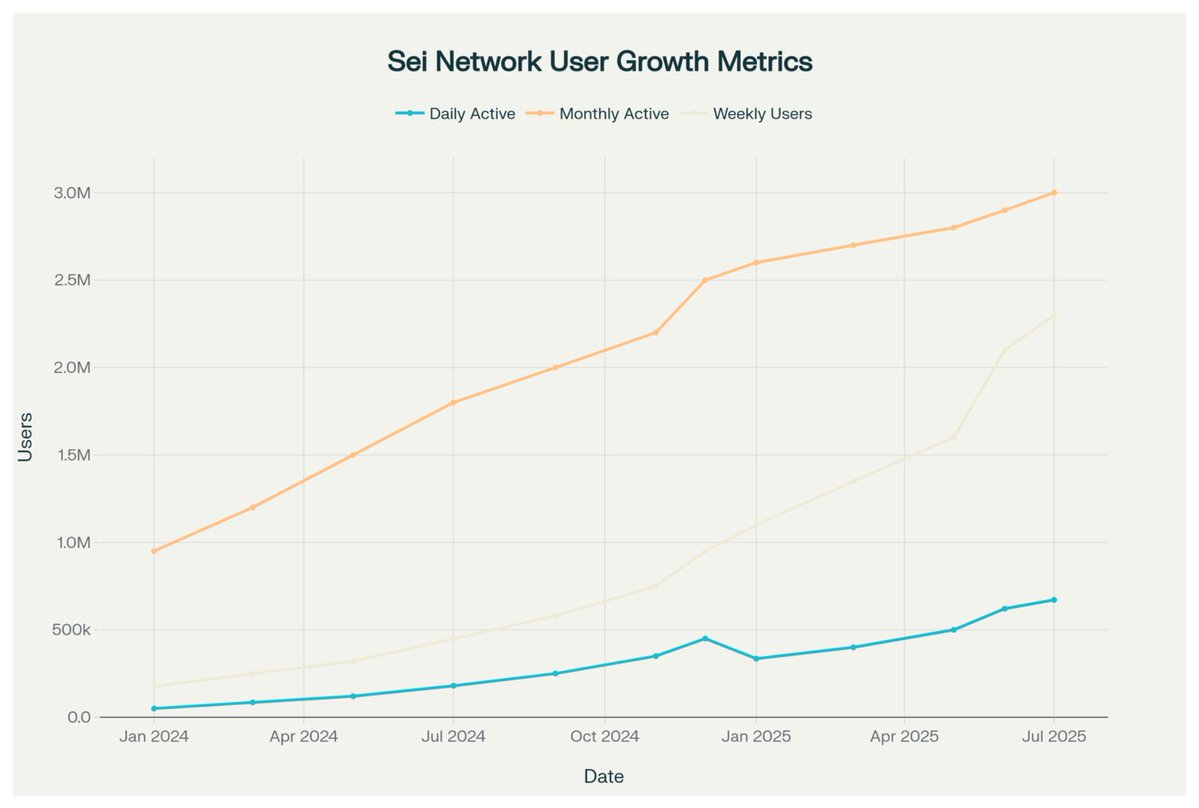

Generally, SEI total users has peaked 3m all time users (that's a huge number considering their onchain product offering atm)

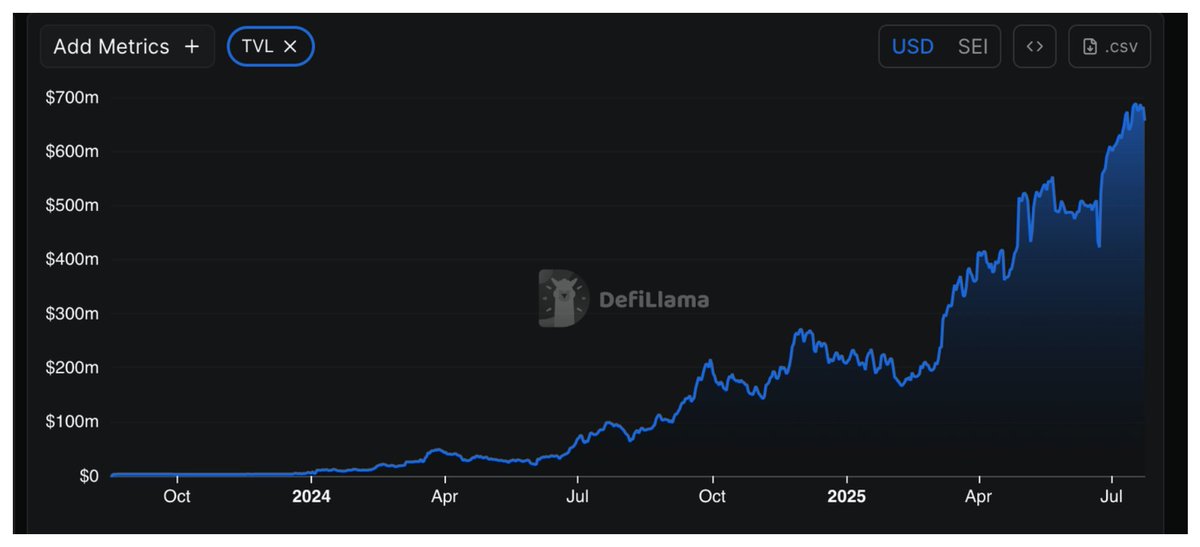

TVL looking strong at this level (good response to the up movement we have been having in the market)

FYI- a huge chunk of this TVL is stables being farmed on some of SEI's leading protocols

SEI currently has over $240m in stablecoins and 80% in $USDC dominance, following their native USDC integration.

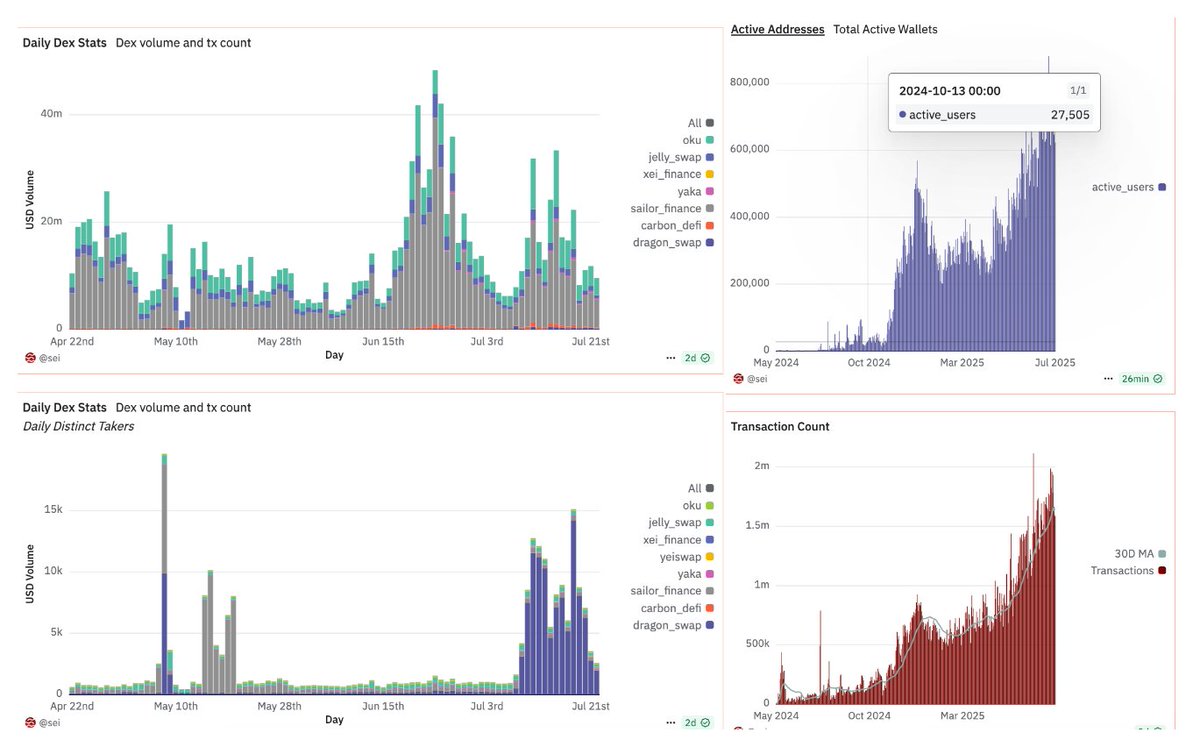

🔹 Dex volume showing off strenght in the sub ~$10M range

Average mean txn of about 200k/day since July, we can only go up from here.

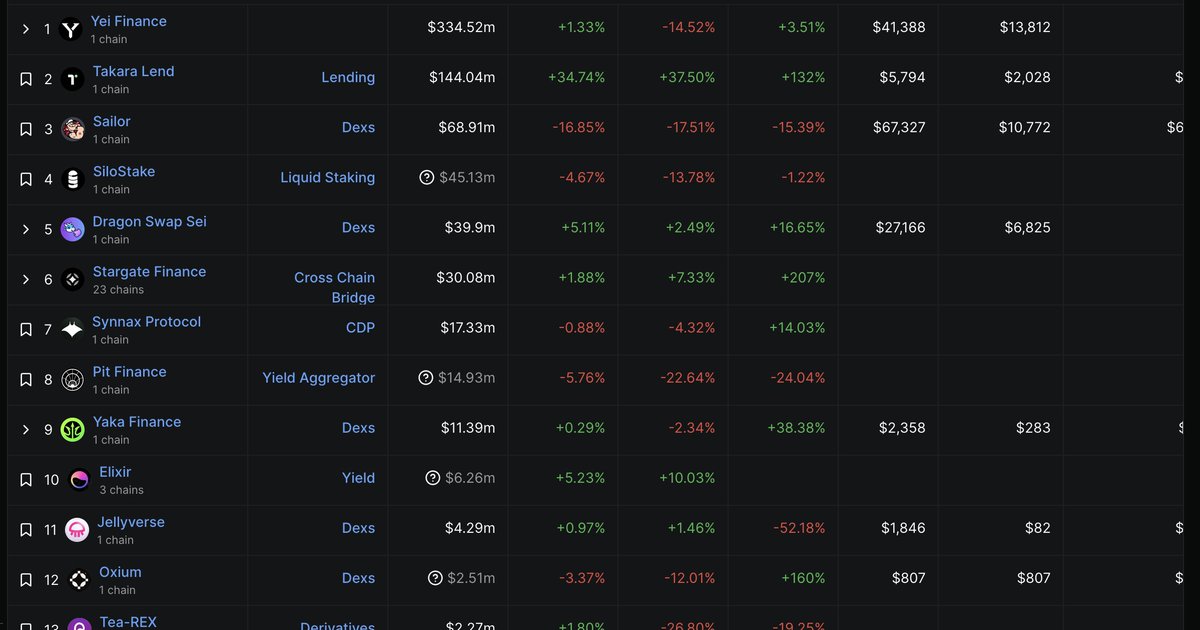

img 2 shows what the top 13 protocols on SEI look like with half of them having a net positive monthly change.

🔹 my thoughts.

As long as there's activity on a chain, there's room for many upside possibilities.

I've seen this happen many times ( before a chain goes parabolic, it is first marked by real user activity) once everyone else clocks it, boom it goes...

I hope u found this insightful or valuable somehow. Feel free to support me on substack, use my referral link, or just come chat with me on Medium Rare.

2.59K

20

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.