1/6 🧵New Coin Metrics Weekly State of the Market Report

Digital asset markets cooled off after briefly topping $4T in total market cap, with $BTC, $ETH, $SOL, and $XRP pulling back from recent highs.

Full breakdown from @coinmetrics – link in replies.

Highlights:

– The GENIUS Act was signed into law, setting a new U.S. regulatory standard for stablecoins: 1:1 backing with Treasuries or cash, third-party attestations, and federal-state oversight.

– @Tether_to announced a new U.S.-focused stablecoin to comply with GENIUS, targeting institutional payments and banking infrastructure.

– @Anchorage announced it will bring @ethena_labs’ offshore-issued $USDtb onshore, using its federally chartered crypto bank to meet GENIUS compliance.

– @BitGo confidentially filed for a U.S. IPO after surpassing $100B AUC. Meanwhile, @Bullish filed to raise $100M for a NYSE listing.

– @Jito_Labs launched its Block Assembly Marketplace (BAM) on Solana, enhancing block fairness and reducing MEV with encrypted ordering and TEEs.

Read the full report for data-backed insights into how crypto’s regulatory, institutional, and technical layers are evolving.

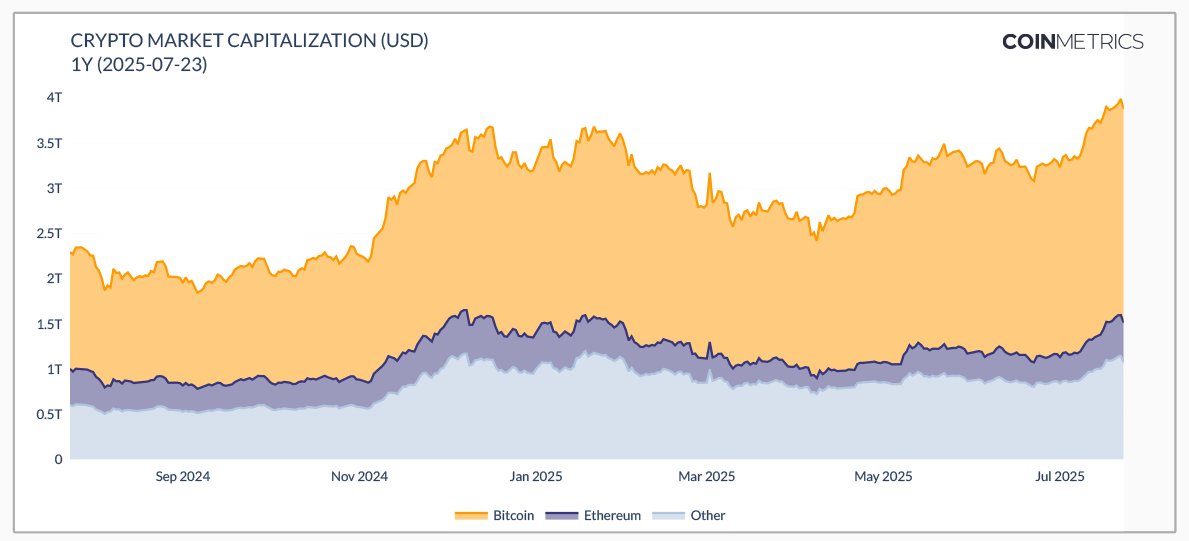

2/6 Current Cryptocurrency Market Cap.

Total MC continued rising, closing at $3.88T mid-week up from $3.79T the prior week. $BTC’s Market Cap returned to $2.36T midweek after hitting new all-time highs, while $BTC dominance continued to decrease to 60.8% from 62.2%.

CM State of the Market >>

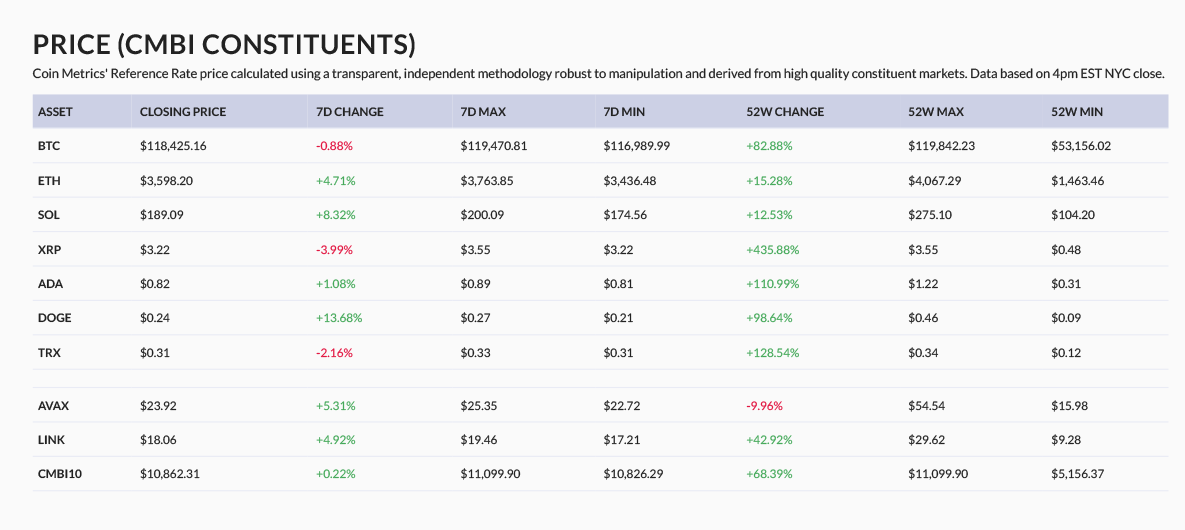

3/6 7-day week-over-week change in top cryptoasset prices based on @coinmetrics Reference Rates.

$DOGE (+13.68%), $SOL (+8.32%), $AVAX (+5.31%), $LINK (+4.92%), and $ETH (+4.71%) led the week’s gainers.

Other notable movers: $ADA (+1.08%), while $BTC (-0.88%), $TRX (-2.16%), and $XRP (-3.99%) saw modest pullbacks.

CM State of the Market >>

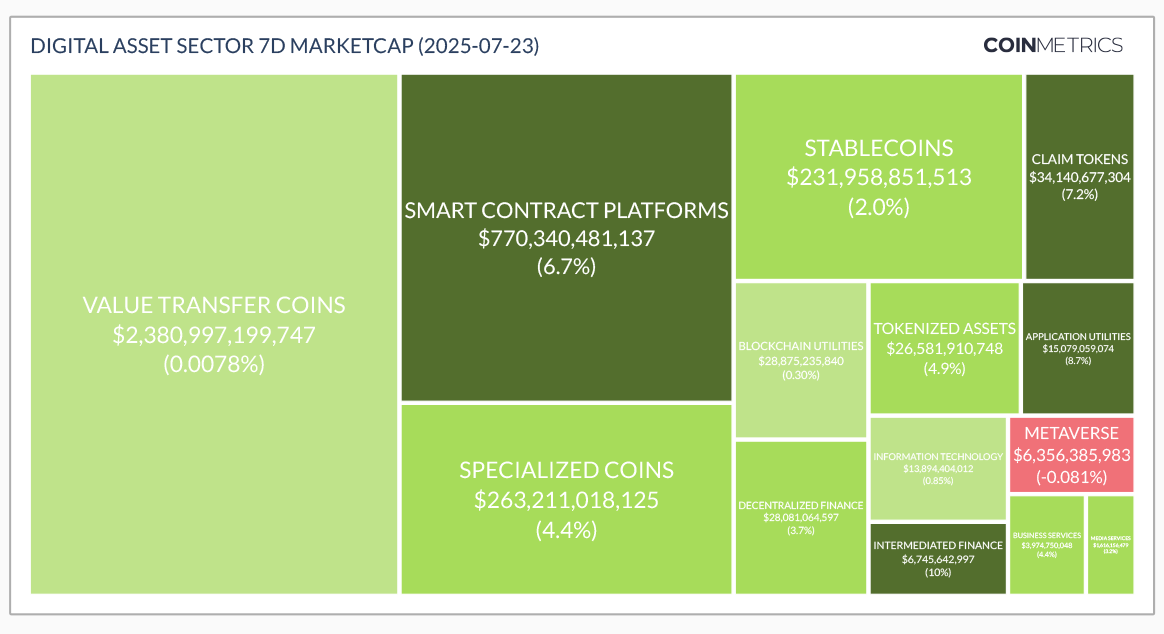

4/6 Digital asset sector performance was broadly positive last week across categories tracked by @coinmetrics.

Intermediated finance (+10%) led the gainers, followed by application utilities (+8.7%), claim tokens (+7.2%), smart contract platforms (+6.7%), tokenized assets (+4.9%), specialized coins (+4.4%), business services (+4.4%), media services (+3.2%), and decentralized finance (+3.7%).

Other movers: stablecoins (+2.0%), information technology (+0.85%), blockchain utilities (+0.30%), and value transfer coins (+0.0078%).

Metaverse (-0.081%) was the only sector to post a week-over-week decline.

CM State of the Market >>

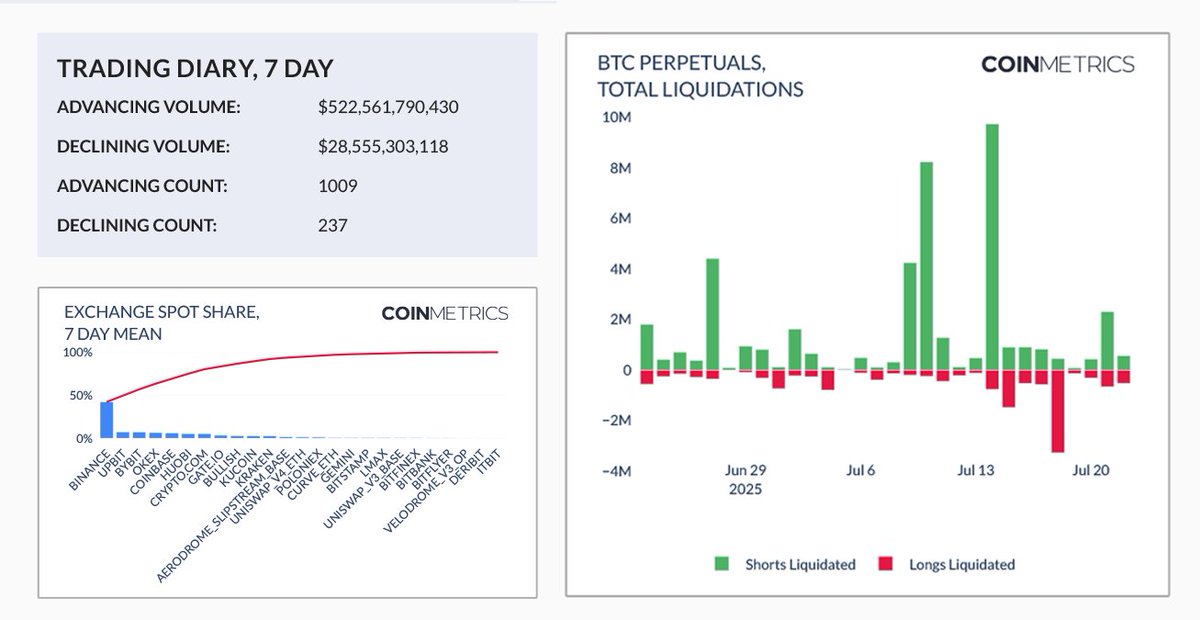

5/6 Crypto markets advanced last week, with gains seen across a broad set of assets. Of the 1,246 assets tracked by @coinmetrics, 1,009 advanced while just 237 declined.

Advancing volume totaled $522.6B, far outweighing declining volume at $28.6B - a strong signal of sustained bullish momentum.

In derivatives markets, $BTC long liquidations peaked early in the week before giving way to greater short liquidations as prices rebounded.

CM State of the Market >>

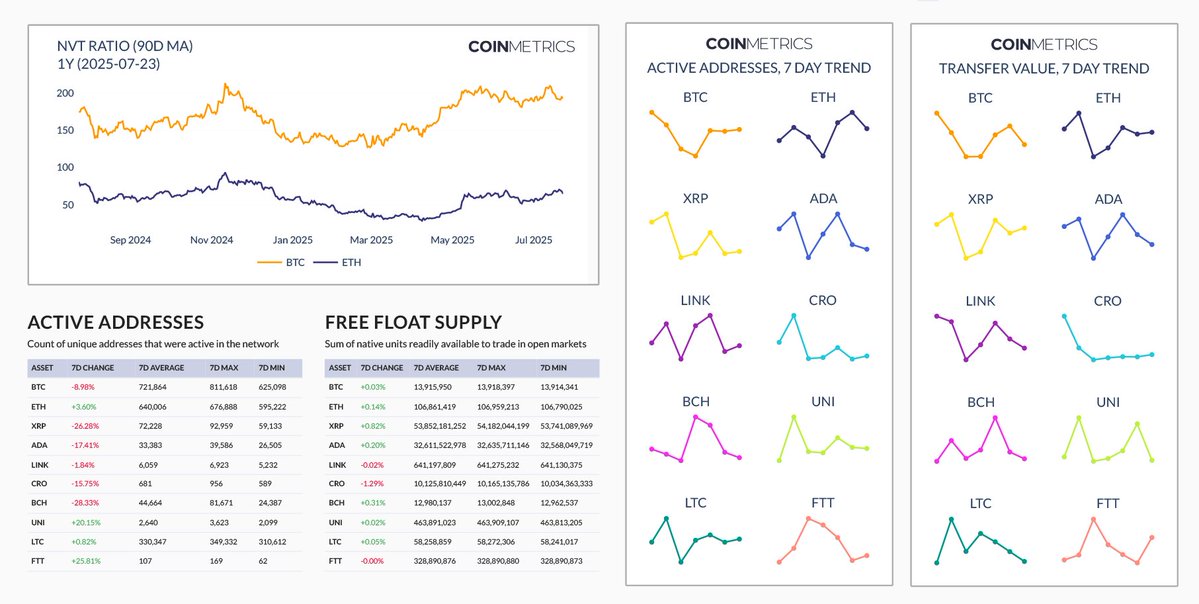

6/6 On-chain activity was mixed across major crypto networks, according to @coinmetrics network data.

$FTT (+25.81%), $UNI (+20.15%), $ETH (+3.60%), and $LTC (+0.82%) all showed increases in active addresses.

Declines were seen with $BCH (-28.33%), $XRP (-26.28%), $ADA (-17.41%), $CRO (-15.75%), $BTC (-8.98%), and $LINK (-1.84%).

CM State of the Market >>

53.67K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.