if you know that $BTC is going to be dramatically repriced higher in short order, the way to maximize long term shareholder value is to buy as much of it as quickly as you can - not to play short term games with the mNAV to please low iq high time preference options traders.

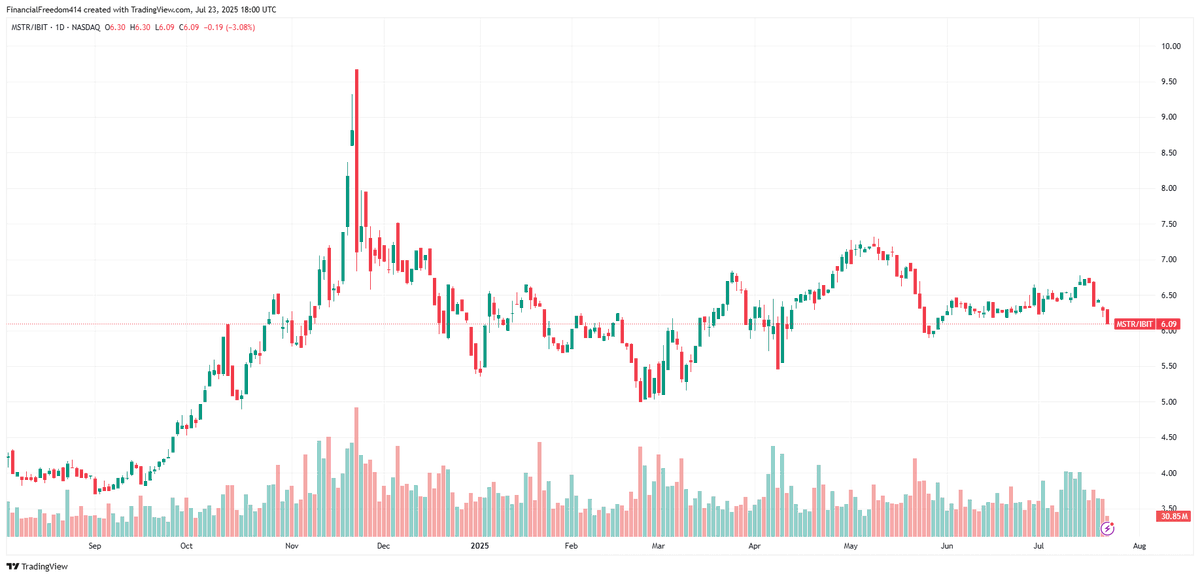

@saylor just took 2 months of $MSTR to $IBIT ratio recovery and crushed it within 2 weeks.

Sentiment is not good on $MSTR, we're seeing the biggest cheerleaders totally change their tune Strategy's playbook.

About a year ago I said that my play was to just hold spot Bitcoin in $IBIT because it removed this dynamic of management. Well, I'm glad I went far heavier in $IBIT, than I did in $MSTR.

The question is, why would anyone buy and hold $MSTR right now rather than just holding Bitcoin or $IBIT?

There upside is clearly much more favorable in $IBIT right now and you don't have to worry about constant dilution with every incremental rise in the price of Bitcoin.

Please chime in.

@HashMonie

some of you managed to become bitcoiners without learning the *basic principles of saving / investing / financial markets.*

1. you can only invest long term. anything short term (especially trading and doubly so for options trading) isn’t investing. it is gambling.

because…

2. no one can consistently and reliably time financial markets.

and, pursuant to (2)

3. a company cannot consistently and reliably control the forward multiple of earnings / assets at which the market values its equity.

And therefore,

4. the most responsible long-term wealth retention strategy for a company is to exchange said forward multiple, as aggressively as possible, for productive / non-dilutable assets, provided shareholders retain title to an increasing per share quantity of that productivity or those assets.

And that means:

5. mNAV is speculation. BTC/share is value creation.

41.08K

413

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.