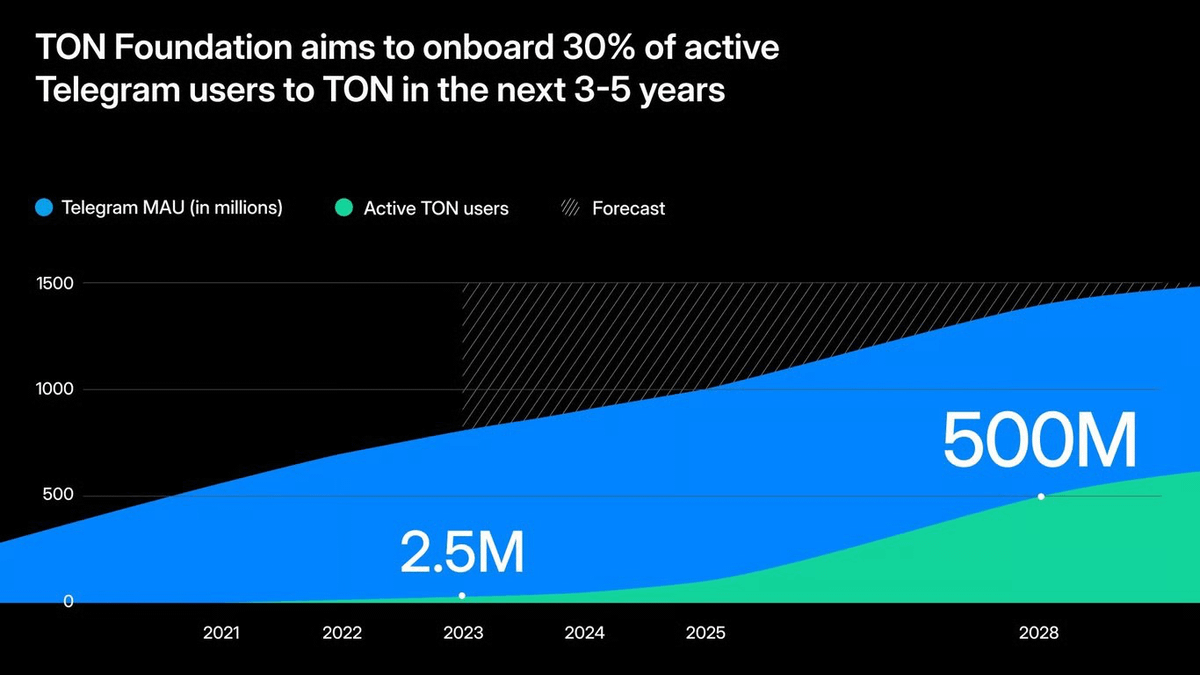

$TON might onboard 300M users in 3 years

but it won’t be memecoins or farming that powers that growth.. it’ll be clean UX, native swaps, and infra that actually works

and the protocol owning that flow right now is $STON

this one’s flying under radar. A thread: 🧵👇

2/

$TON is the most asymmetric bet of this cycle.

You're not betting on another L1.

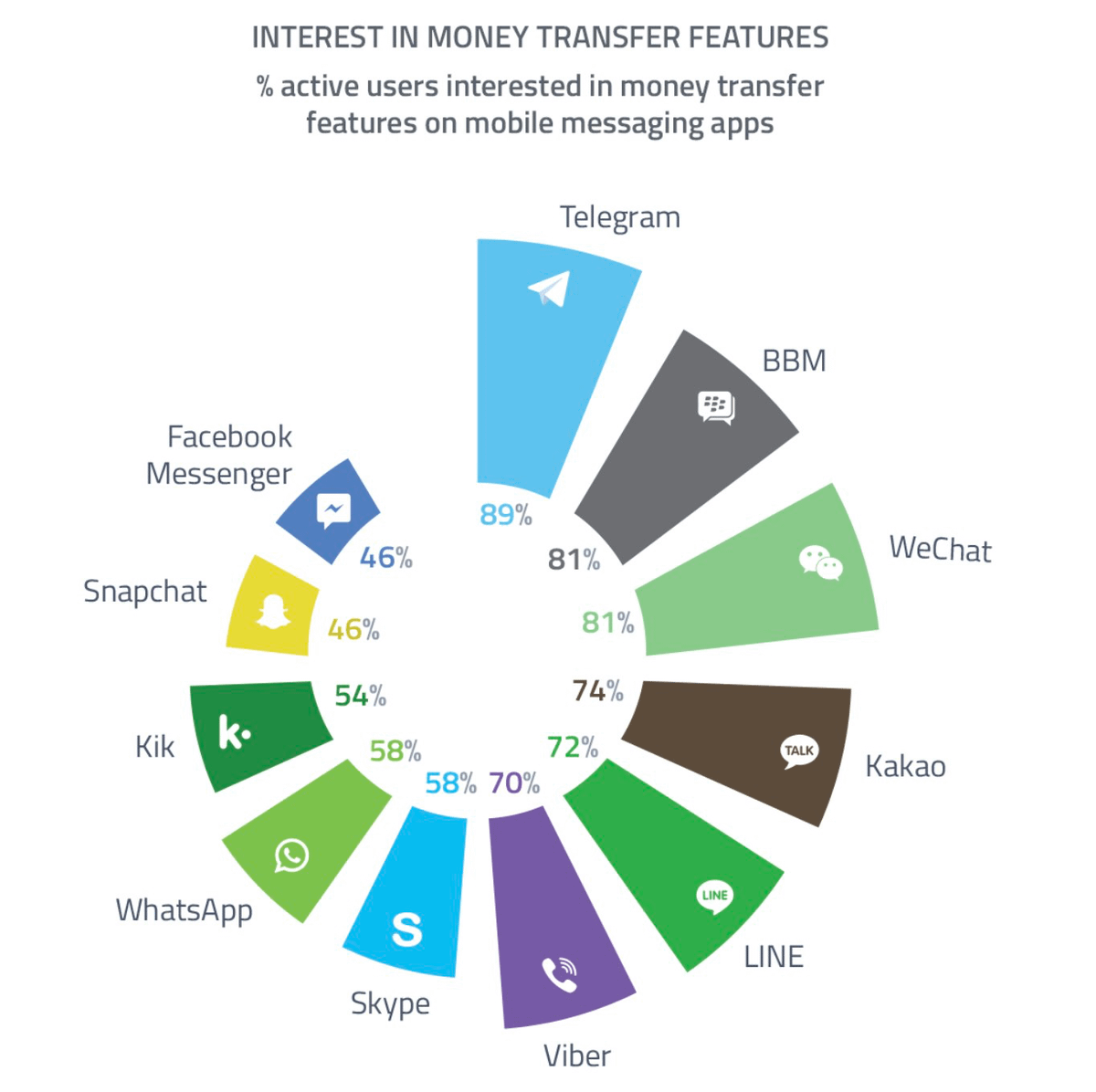

You're betting on Telegram becoming a sovereign fintech OS.

It's already has 1B+ users and they plan to onboard 30% of that userbase to TON in next 3 years.

3/

All while quietly laying the rails for that shift.

Just look at the pattern:

▸ Mini-Apps now settle via TON

▸ xAI deal and Kuchika bank integration

▸ Native in-chat swaps & 140+ fiat onramps live

▸ USDT & tokenized gold (XAUt₀) inside Telegram wallet

4/

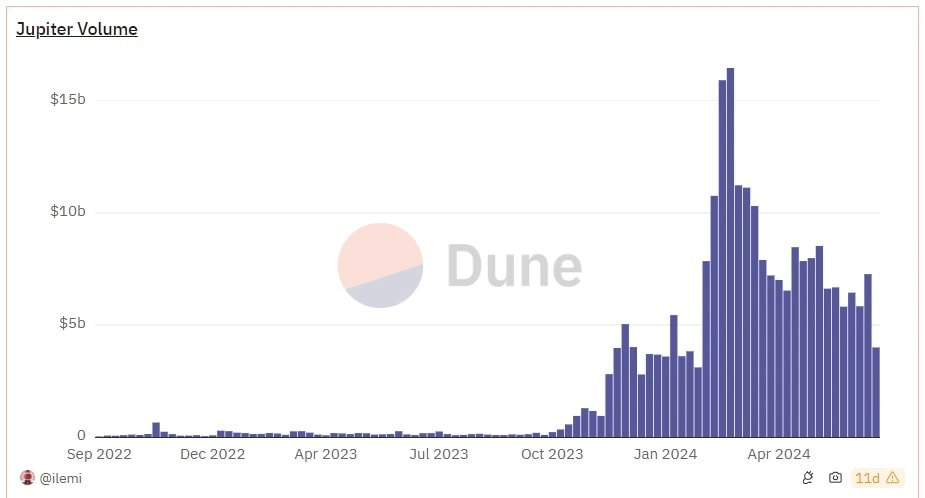

Historically, such inflection points reward the clearest conviction.

▸ Uniswap during ETH's DeFi wave

▸ Jupiter during SOL meme season

Which means the base liquidity layer on TON becomes the highest-leverage bet here

5/

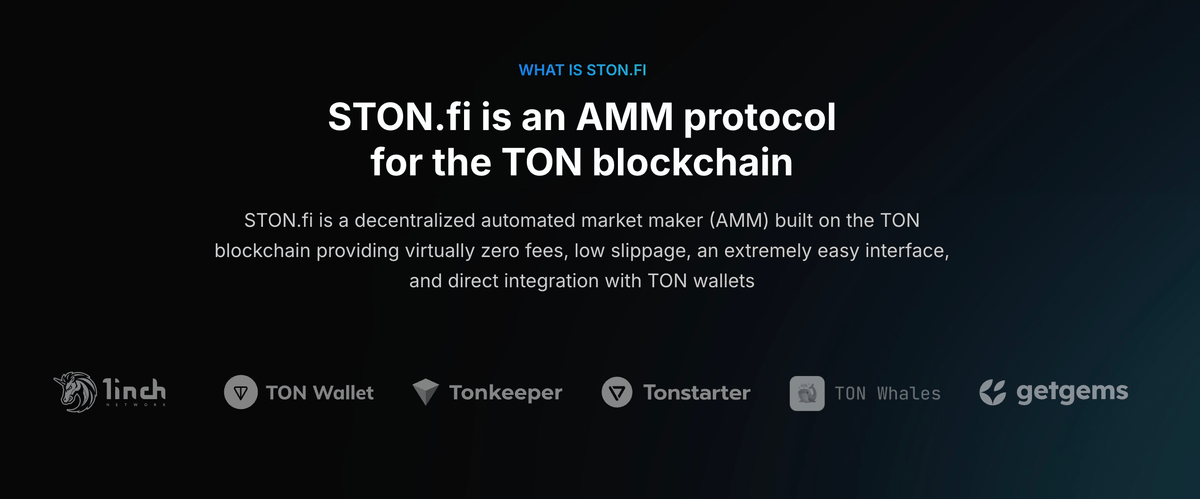

The clearest exhibit of that thesis : @ston_fi

It's the native swap layer of Telegram's financial system.

One tap inside Telegram → pick your token → swap.

No friction.

No extensions.

No seed phrases.

Just a clean easy UX

6/

➱ Market Monopoly

At time of writing, STON handles over 54% of TON's DEX volume and 82% of total trader share.

▸ $6.1B+ in cumulative volume

▸ 5.4M wallets

▸ 26M+ swaps

It's not competing for mindshare.

It owns the flow.

7/

➱ The Growth Curve

UNI and JUP became default liquidity layers for their chains:

▸ JUP: ~1M MAU vs 300M SOL wallets

▸ UNI: ~18.4M MAU vs 250M+ ETH wallets

Now imagine 30% of Telegram’s 1B users onboard to TON (~300M)

Even with just 5% adoption, STON would serve 15M MAU - putting it in Uniswap territory

8/

And that's achievable.

Since both UNI/JUP initially faced friction with Wallet installs and Learning curve.

STON skips all of that.

It's embedded directly inside Telegram.

No wallets. No extensions. No friction.

So it has native access to 1B+ users by default.

11/

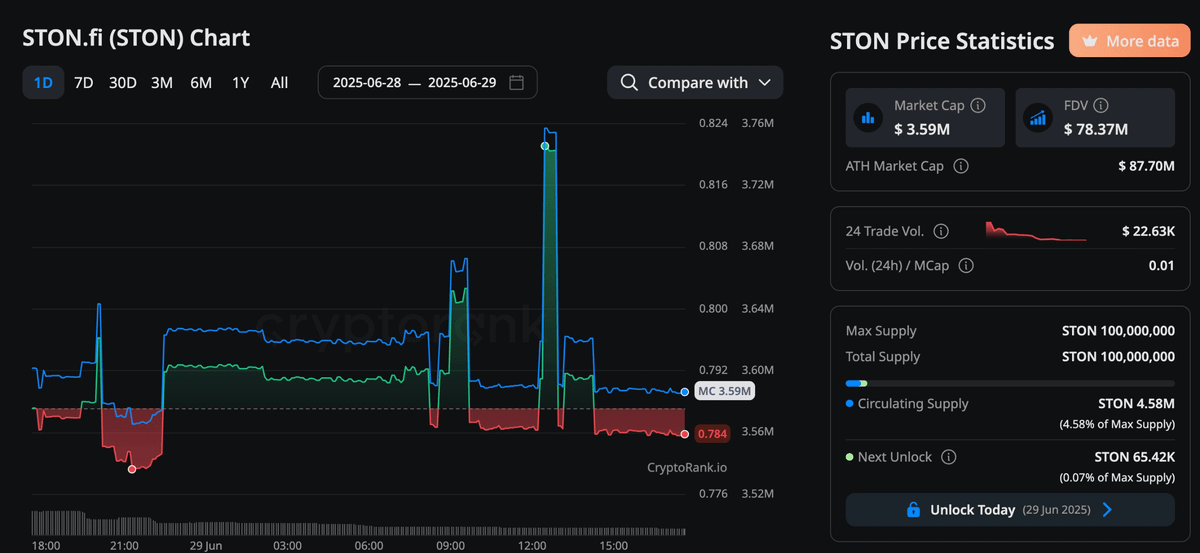

➱ Tokenomics

$STON is the native token and recently got listed on CEXs like KuCoin.

STON is the utility token powering the protocol STON is live on centralized exchange Kucoin STON isn’t just a token.. it’s the backbone of the ecosystem.

It fuels key protocol functions and will play a central role in governance. Yes, DAO is coming

12/

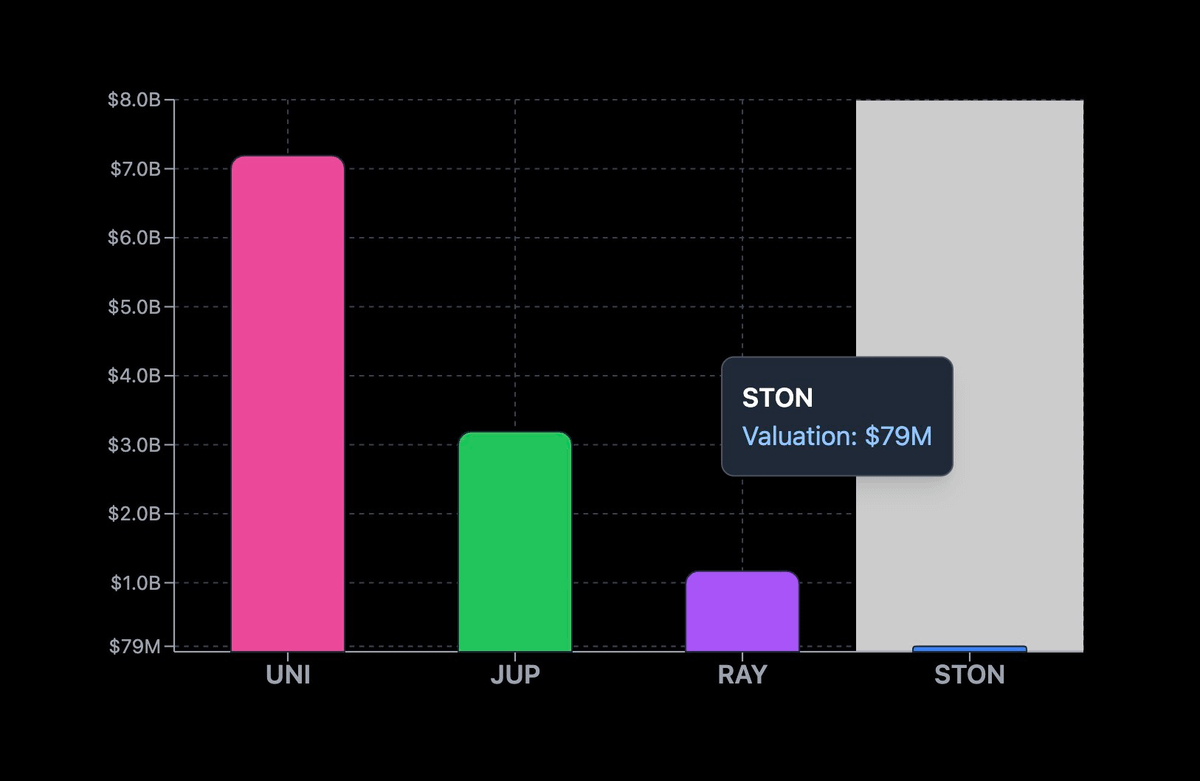

Comparing valuations of similar infrastructure projects

▸ UNI: 7.19B

▸ JUP: 3.19B

▸ RAY: 1.17B

▸ STON: 79M

STON is undervauled compared to other infra-layer DEXs.

If it continues to dominate TON’s flow, current valuation leaves plenty of room imo

13/

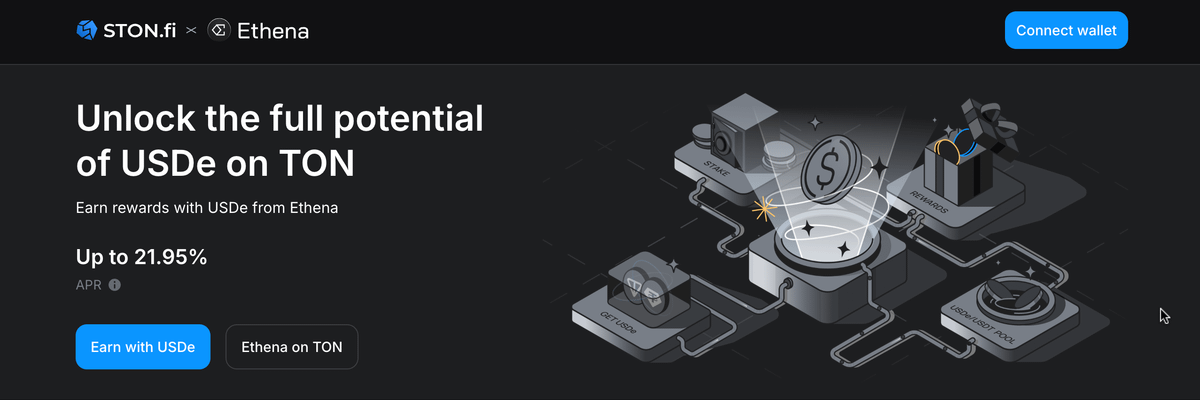

STON isn't sleeping on liquidity either. A full TVL flywheel appears to be in motion here

the program just has been updated.

• Hold tsUSDe by staking USDe → tsUSDe price appreciation + Ethena rewards + extra APY

• Provide liquidity in tsUSDe/USDe pool → trading fees + extra APY

LPs are quite eating well.

15/

➱ Dev-Side Flywheel

STON’s SDK gives Mini-Apps one-click access to all TON liquidity.

One integration → full pool access → atomic execution.

As Mini-Apps scale, STON becomes the liquidity backend by default.

16/

Final Thesis

STON is what Uniswap would’ve been if it launched inside Telegram, not a browser.

▸ Native rails

▸ Built-in UX

▸ No friction

▸ Liquidity flywheel

▸ Growing protocol fees

All happening on TON. Quietly.

That’s a wrap!

Got any questions about this thread? Drop them in the comments, and I’ll be happy to help.

Stay updated by joining my Telegram:

And if you found this useful, I’d really appreciate a follow: @Axel_bitblaze69

Thanks for reading! 😉

I hope this thread brought you some value!

Make sure to follow @Axel_bitblaze69 for:

• More valuable crypto insights

• Real-time alpha & airdrop updates

If you found this helpful, feel free to like/retweet the first tweet below!

17.18K

45

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.