A handful of miscellaneous Blue-Chip yields

Bookmark so you can yell at me if they get diluted

🧵👇

1) @KaminoFinance

TL;DR: 530% APR (will get diluted)

I went to check out SOL loops on Kamino and got blindsided by a brand-new incentive campaign in JSOL.

Only 260K collateral so far, but nearly $3K incentives weekly, that's still additional 15% times leverage at 1M TVL.

2) @ether_fi

I just did a post on their Summer Pump campaign.

But the TL;DR is that you can get 40-80% mint-looping weETH on @eulerfinance or @aave.

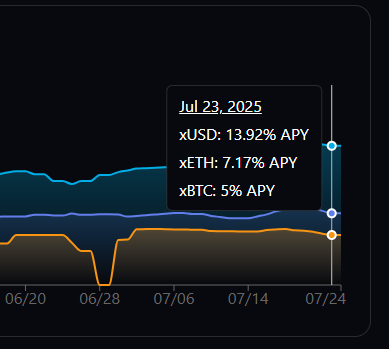

3) @StreamDefi

xBTC is the highest yield-bearing BTC I know of.

Actually hitting 5% consistent APR for weeks.

And you get points? I'll let @0xlawlol confirm.

But also, when can we leverage this?

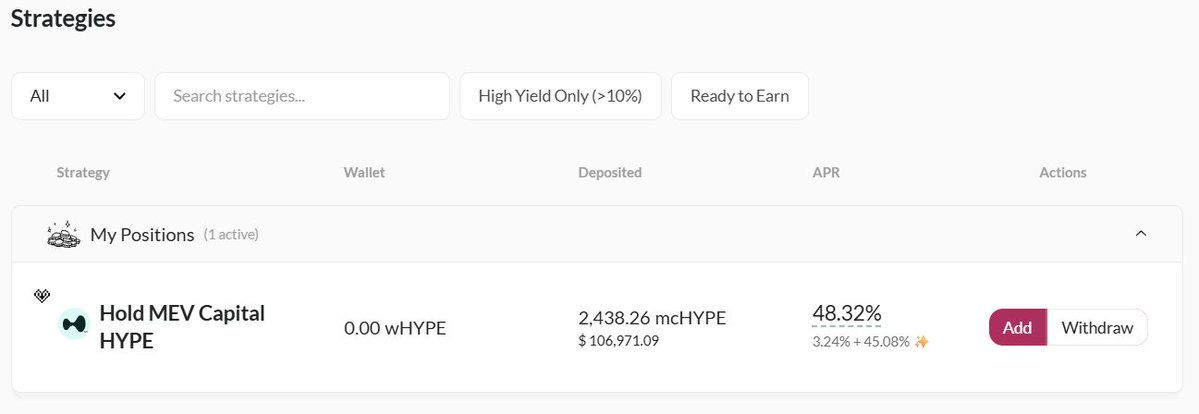

4) @0xHyperBeat and @RumpelLabs

(part 1)

TL:DR: 48% on $HYPE

There are actually a bunch of good $HYPE yields right now.

But I like this one because I can sell my tokenized points weekly via Rumpel.

However, there's a good chance these points end up being work more according to some math I did recently.

Read about that here:

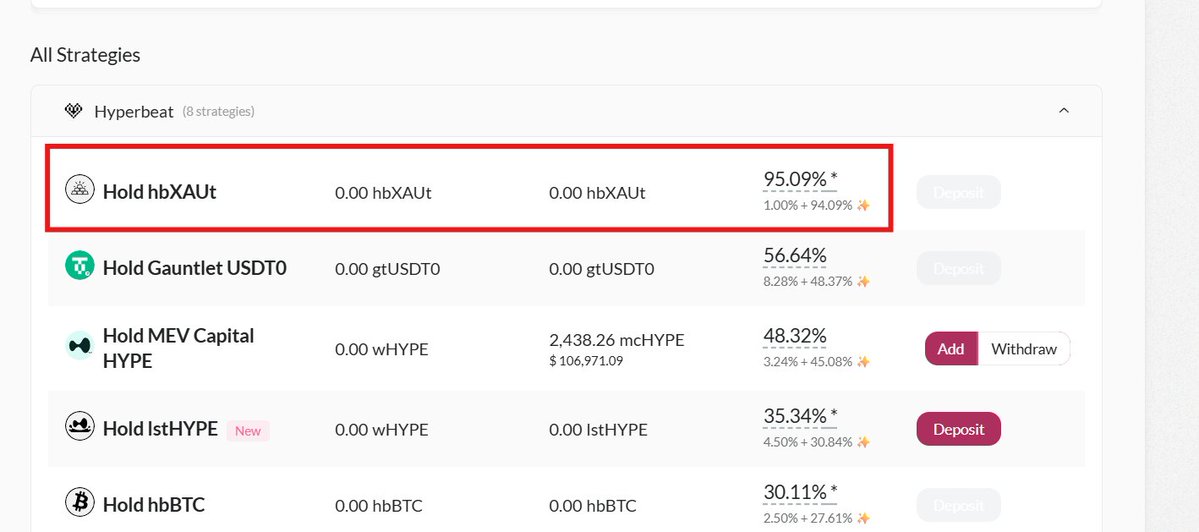

5) Gold? (@RumpelLabs part 2)

The hbXUAT vault is printing 95% in tokenized points (hearts) from Hyperbeat.

Not sure I've ever seen any Gold yields that high, tbh.

Hyperliquid

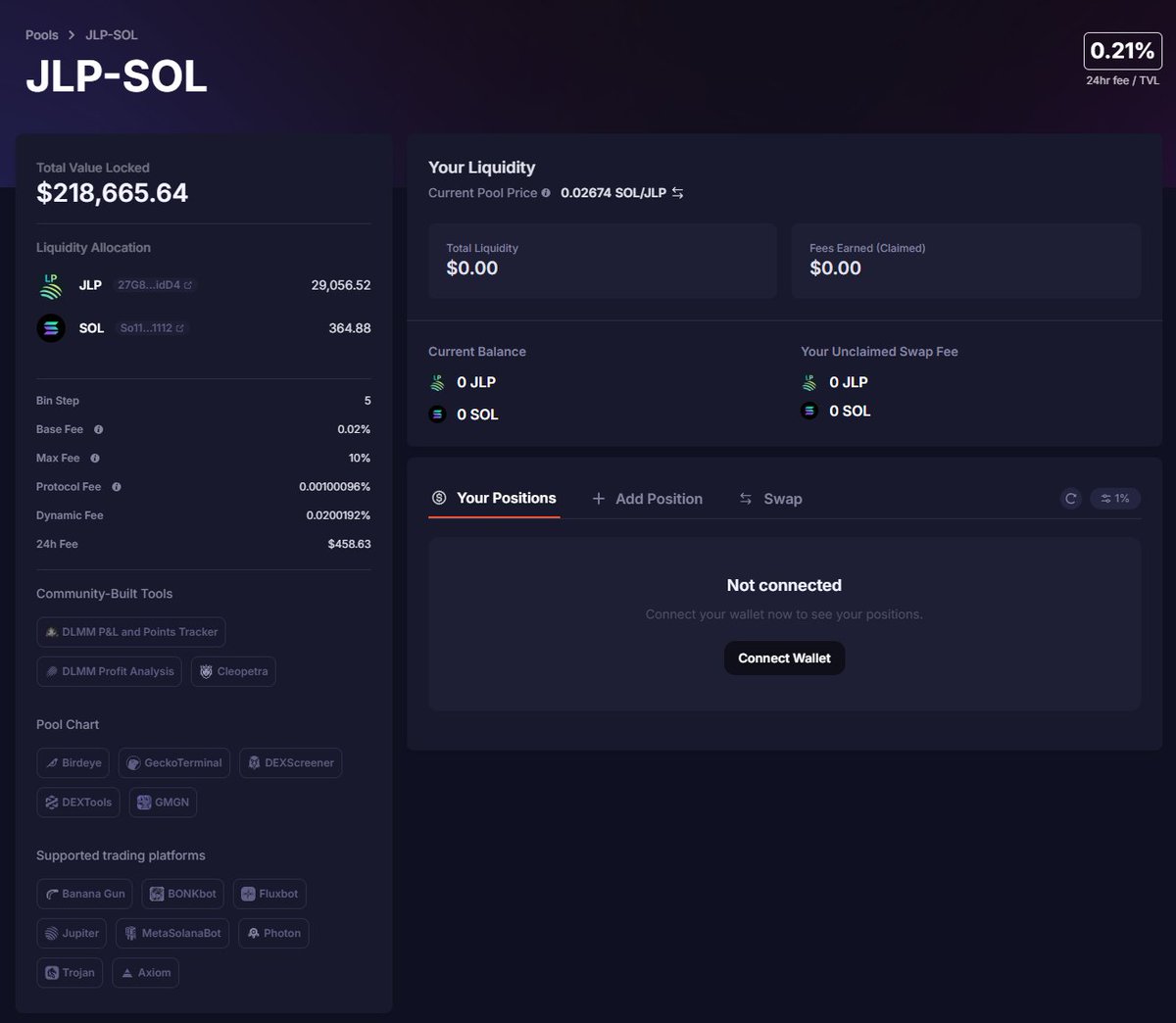

6) @MeteoraAG

Arguably the most slept-on pool in Solana.

JLP<>SOL is highly correlated and prints a wild APR consistently for months on end.

$450 in fees in 24hr on 220K of liquidity.

That's 75% APR AVERAGE.

Obviously higher for tighter liquidity.

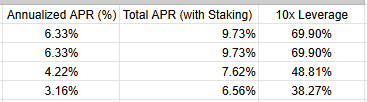

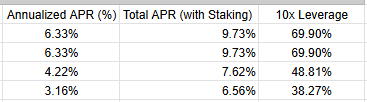

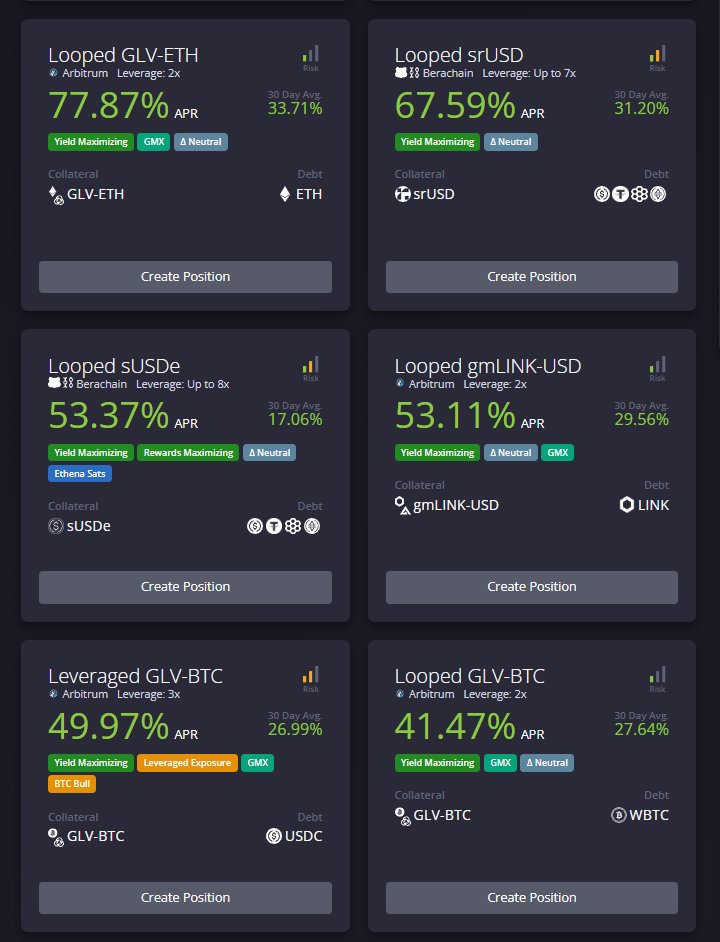

7) @Dolomite_io

I've talked about the "glove" @GMX_IO products before.

They're effectively BTC and ETH neutral CLPs on GMX that you can leverage on Dolomite.

The average APRs hover between 15% and 30% but are 77% on ETH and 40% on BTC at the moment.

@arbitrum everywhere?

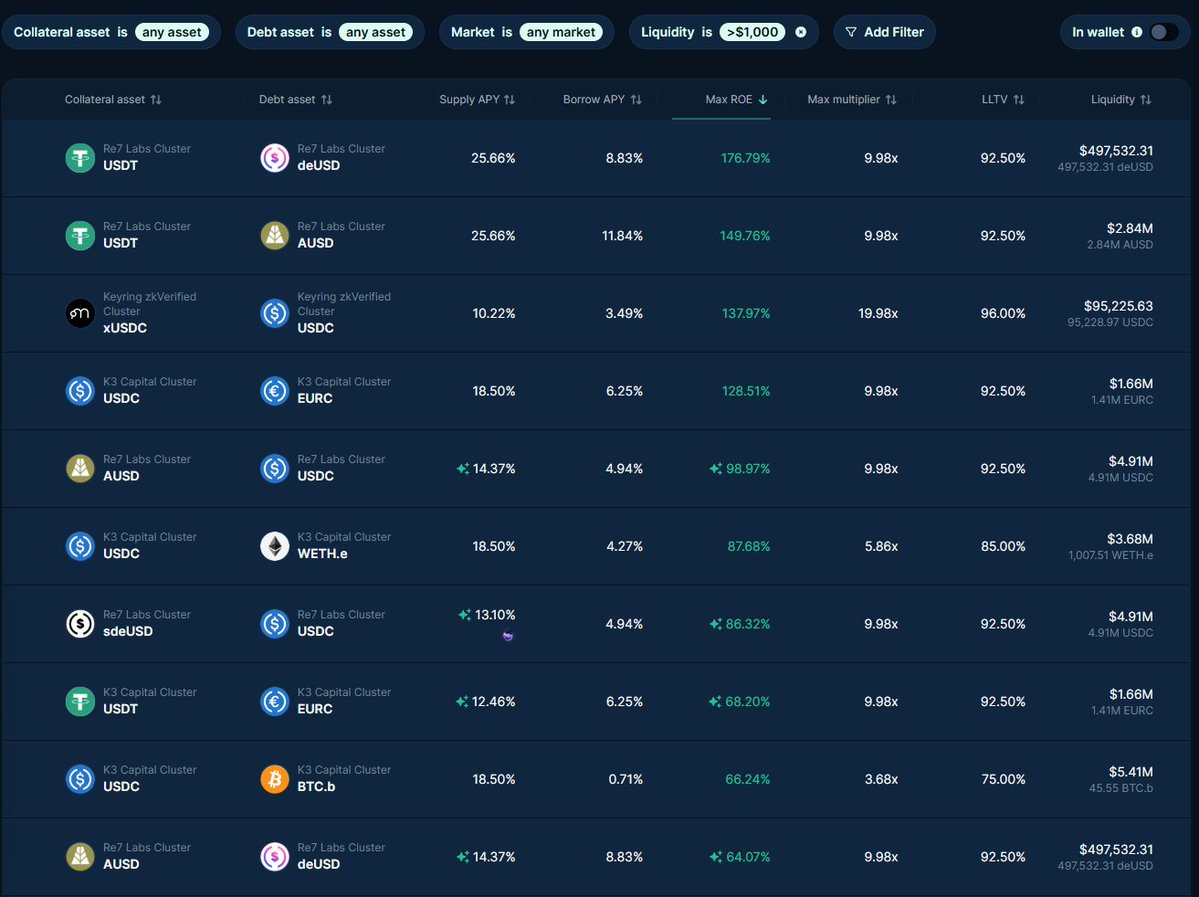

8) @eulerfinance and @avax

It's a wild time to be farming Avax, imo

Stable loops on Euler paid in wAVAX consistently exceeding 100% APR.

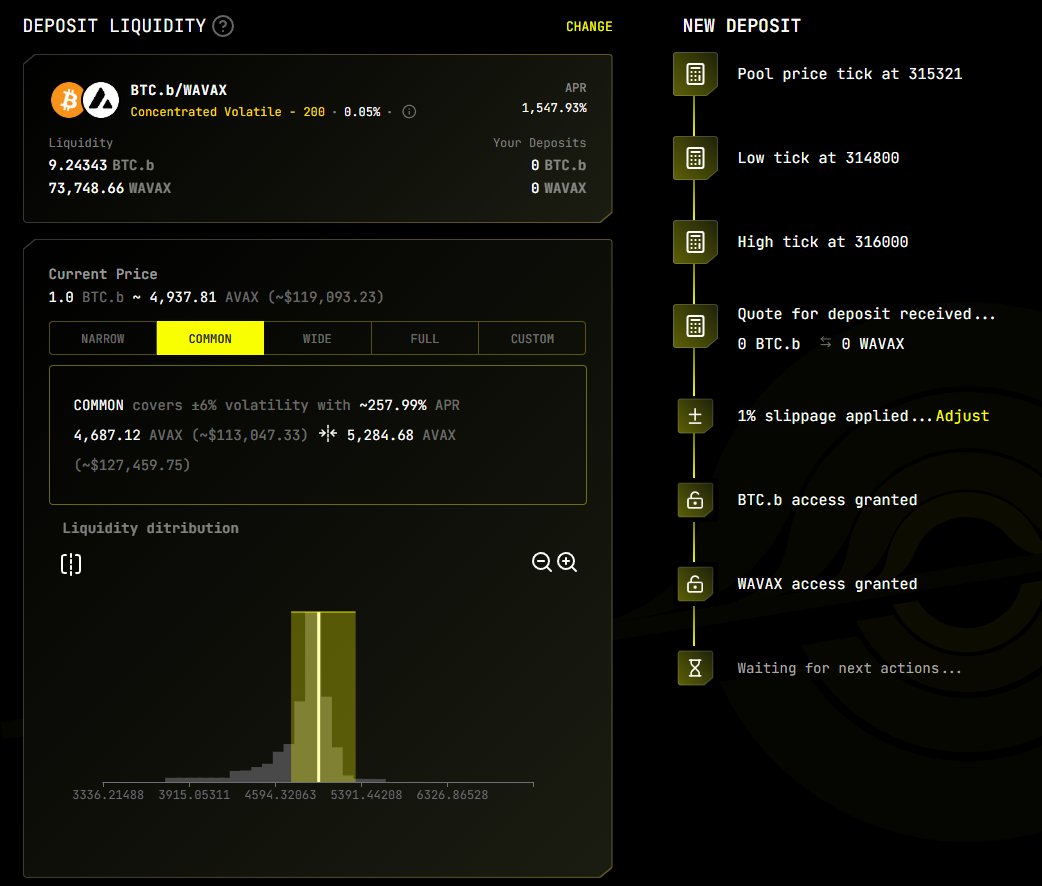

9) But also @BlackholeDex

250% APR for AVAX/BTC feels compelling as Avalanche starts to pick up market share and mind share again.

10) @ResolvLabs

$RLP deserves to be a blue chip here imo.

It technically behaves like a yield-bearing stable, but at 20% APR recently, it's been on fire.

It can also be leveraged for 30-90% APR on @eulerfinance

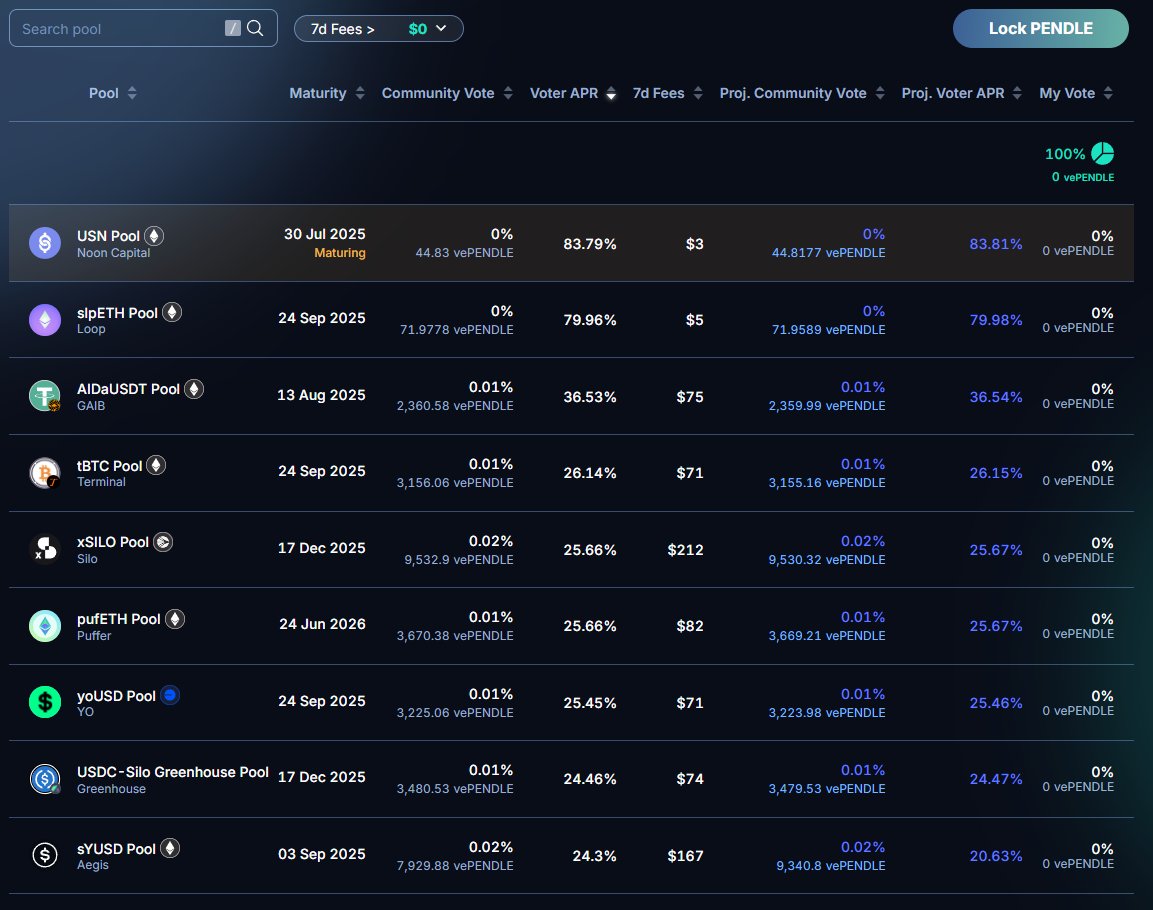

11) @pendle_fi

I think people forget they can get yield on vePENDLE regularly.

20% to 80% APR for dynamic voters at full lock.

And Boros is coming soon. I'm also hyped for what's launching next week.

That's it!

Thanks for reading.

Ambassadorships mentioned:

- EtherFi

- Avax

- Resolv

- Euler

- Pendle

54.79K

180

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.