$HYPE: Onchain Liquidity Infrastructure Scaling Rapidly

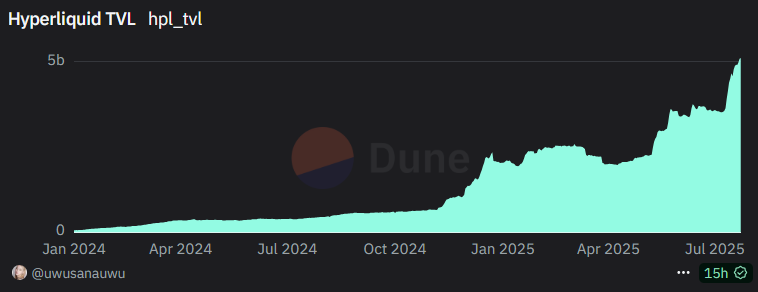

- TVL at $5.1b ATH, up +42% in 30d, +132% in 90d; $426M staked collateral.

- Open Interest at an ATH of $14.7b, ranking 6th largest crypto exchange.

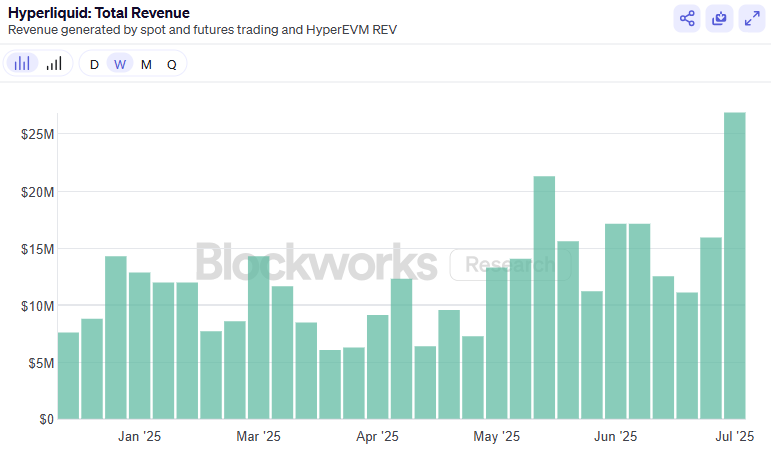

- 24h fees hit $6m ATH; weekly revenue ATH of $27m+, annualizing ~$1.4b; majority from HyperCore, HyperEVM ~$179K weekly.

- USDT, USDe, XAUt0 are live and composable on Core + EVM; hwHLP vault (~9.1% APY) launched.

- Builder Codes fuel monetization; Phantom wallet integration on pace for $1m monthly fees and $1–2m revenue/month for Hyperliquid.

- Assistance Fund hold 27m $HYPE with ~$725M profit and $1.2b NAV.

- $888M $HYPE locked via SONN treasury launch backed by $305M cash + $583M token raise.

- Hyperliquid shifts from DEX to liquidity infrastructure platform with AWS-like vision; liquidity depth drives builder growth, product innovation, and compounding revenue streams.

@HyperliquidX

4.51K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.