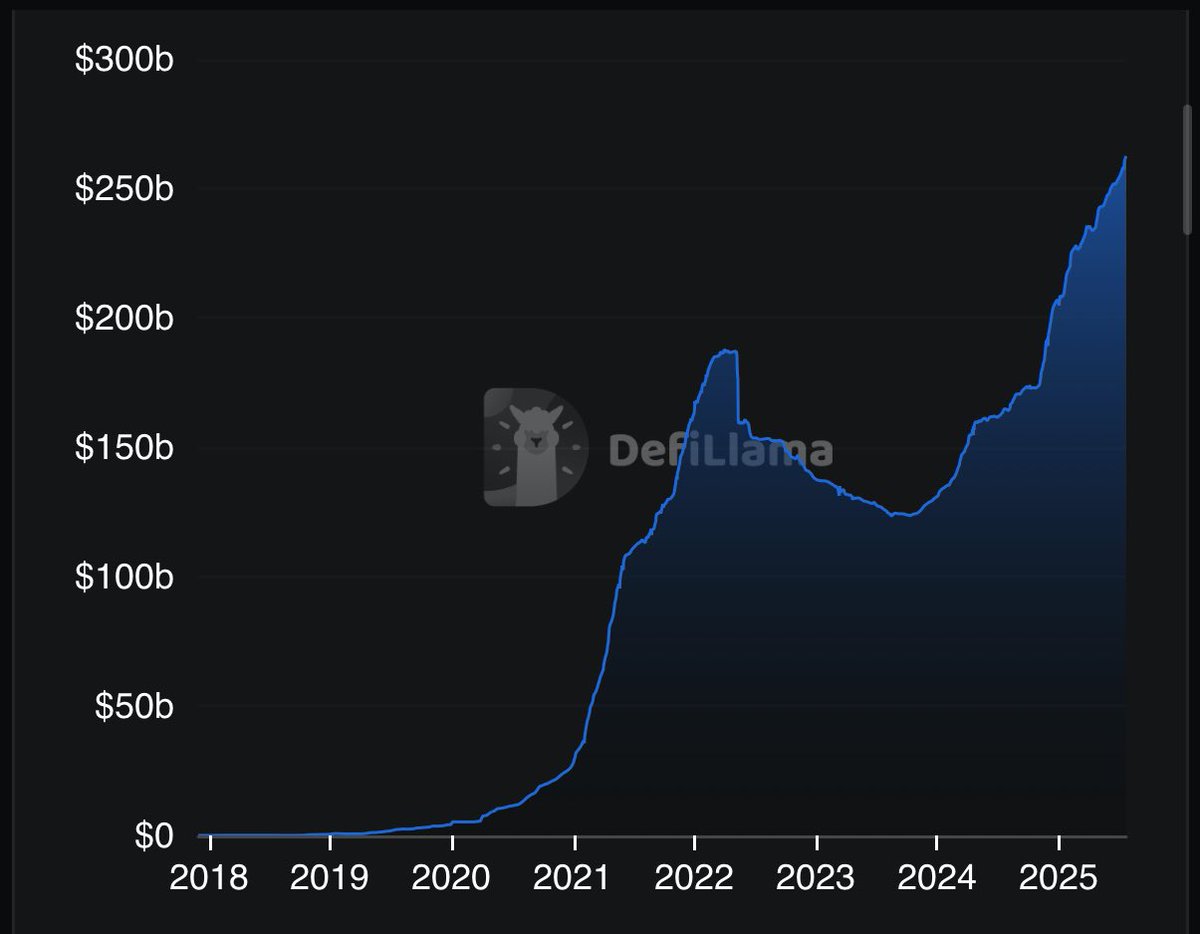

To add just a bit: stablecoins on Ethereum hitting $130bn with total stablecoins MCap reaching $260bn+

What a chart.

But we’ll still hear “crypto is ded” rants when the markets inevitably cool down 👀

Breaking news from yesterday and thoughts

- JPMorgan Chase is considering allowing customers to borrow against their crypto holdings as early as next year

- Western Union CEO told Bloomberg they’re exploring ways to integrate stablecoins into its digital wallet infrastructure

- $410 Billion PNC Bank partnered with Coinbase to offer crypto access to customers and provide banking support to Coinbase.

- Solana surpassed $100billion market cap

- Pantera backed @TheEtherMachine raised $1.5B to use 400k ETH to offer institutions direct, regulatory compliant access to ETH defi yield

- Coinbase launched nano Bitcoin and Ethereum prep futures for US traders

- SVM L1 @FogoChain launch public testnet, raised $8M in January. Dubbed the Hyperliquid of Solana as they aim to deliver 40millisec block speed etc

- $9M raised in seed AI Trust layer @Mira_Network to take Kaito snapshot, they allocated 0.5% supply to Kaito top LB

- Aave DAO has approved a proposal allowing the Kraken backed Ink chain, to launch a white label version of Aave V3 (use Aave v3 tech but branding and control, Ink’s)

3.57K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.