How DAOs are running recurring options strategies from their treasury vaults?

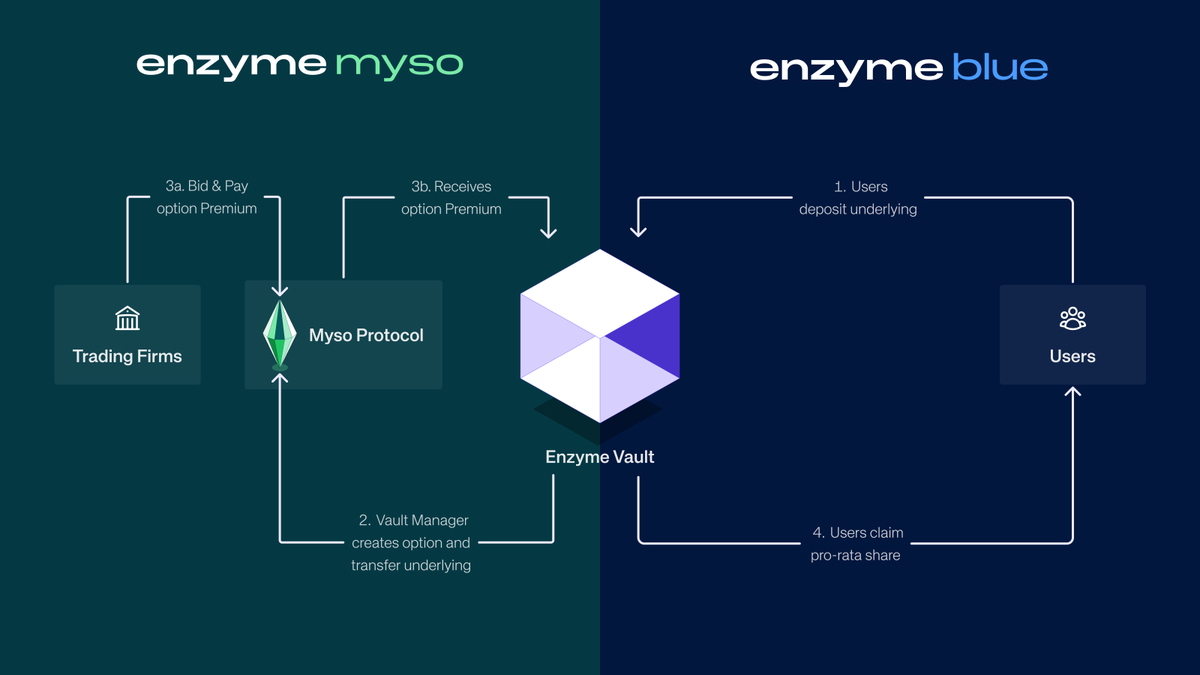

With Enzyme.Myso now integrated in Enzyme.Blue, DAOs can create a dedicated Options Vault to run recurring covered call or put strategies directly from their treasury.

How it works:

• The DAO creates an Enzyme Vault on Enzyme.Blue, sets up permissions, and funds it with idle assets.

• The vault is connected to Enzyme.Myso, which enables the DAO (or an assigned manager) to execute options trades on a recurring basis.

• All trades, yields, and flows are fully auditable and visible to the DAO community.

• Roles can be delegated or managed by the DAO’s own process.

Case in point: Compound DAO’s options vault uses this structure to regularly sell covered calls, helping the DAO target yield, maintain transparency, and customize risk exposure.

Ready to see how Enzyme.Blue + Enzyme.Myso vaults could fit your treasury?

Learn more:

1.41K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.