PIL Overview - Epoch 10

$LQTY stakers decide where PIL funds flow.

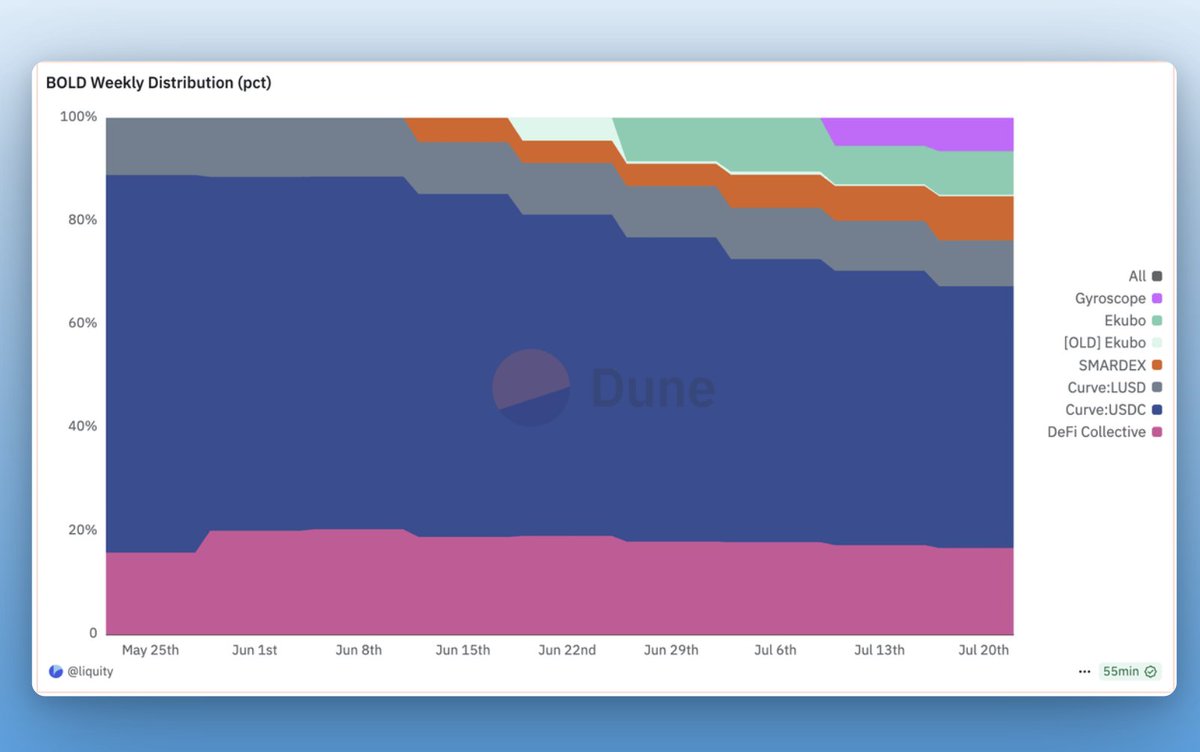

At Liquity V2’s launch, the default options were @CurveFinance and @DeFiCollective_.

Since then, three new entrants have joined: @SmarDex, @EkuboProtocol, and @GyroStable.

Let’s take a look at the numbers.

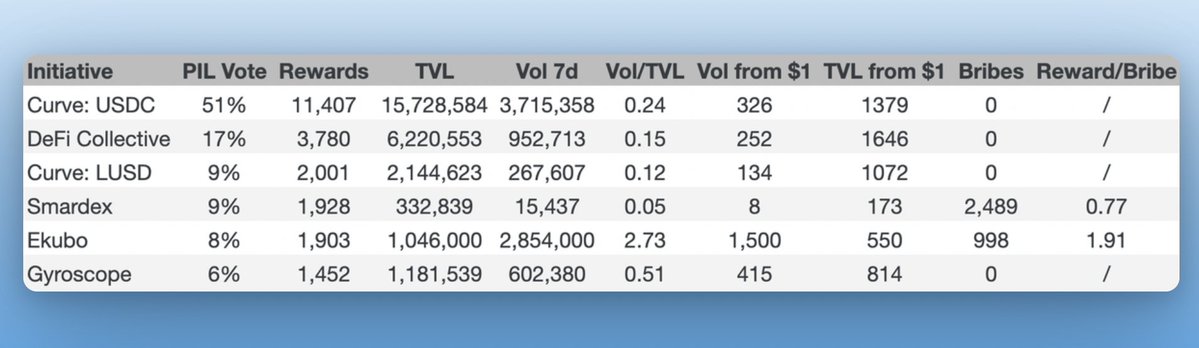

Below, the initiatives are sorted by votes received.

Curve and the Collective are getting the most, also due to the first mover advantage, but the others are catching up quickly.

However, the most important metric for the Liquity community is how much volume and TVL the rewards actually create.

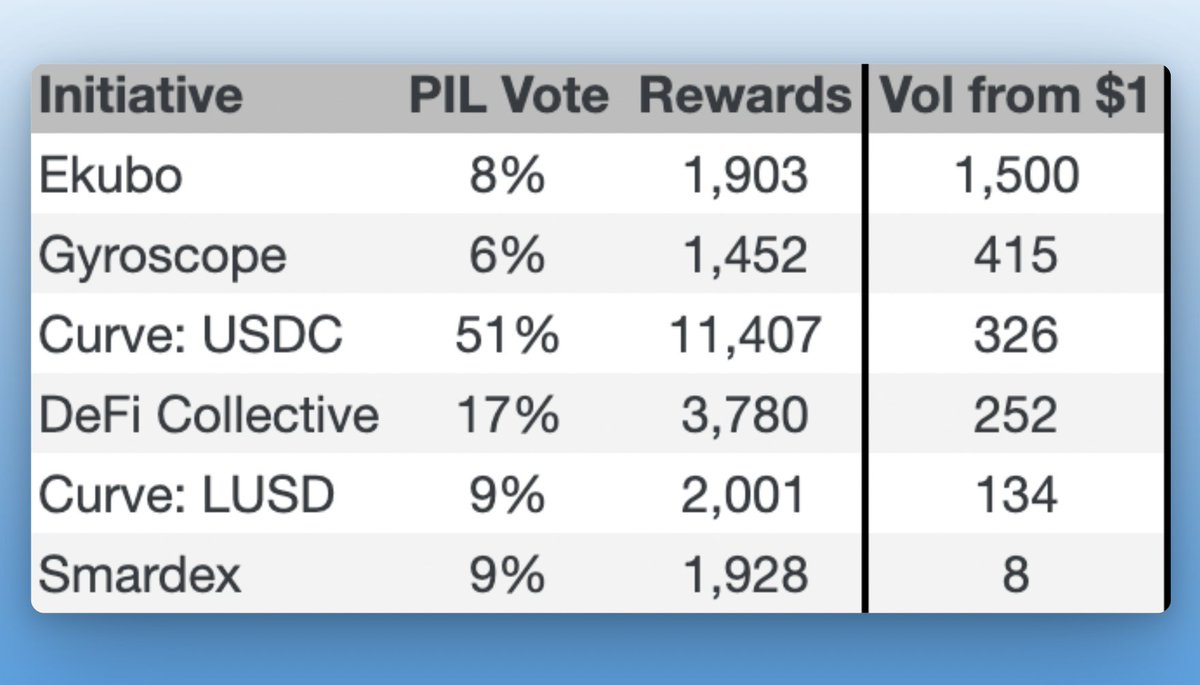

Volume Facilitated

For $BOLD users it is essential to be able to swap into other stables efficiently. High trading volume per $1 spent means that the provided liquidity was used in a very efficient way.

This is where Ekubo and Gyroscope stand out. By pairing BOLD with USDC and using efficient AMM models, they have quickly captured over 40% of total trading volume, with steady growth.

Ekubo shines here, facilitating 4x more volume than the others, boosted by bribes to $LQTY stakers. Gyroscope also had a good start, overtaking Curve despite receiving only a fraction of the PIL incentives.

Both platforms also offer sustainable LP rewards in the 15–20% range.

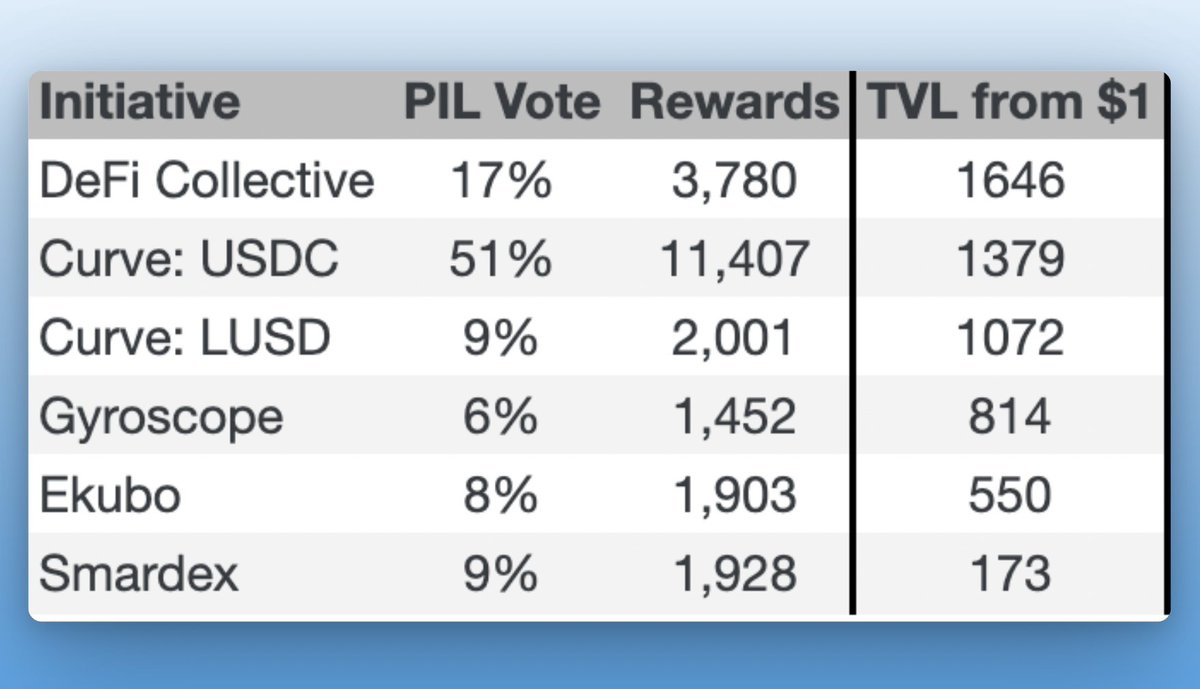

TVL Attracted

The cost to attract liquidity is important too, especially for larger swaps: the lower the cost the more liquidity is available. Additionally, the more BOLD is held in LP positions, the better the yield becomes for Stability Pool depositors.

In terms of TVL, the long-standing initiatives generate the most liquidity per unit of PIL incentives. DeFi Collective leads, followed by the Curve pools.

The Collective amplifies its impact by matching PIL rewards with their own treasury funds. Curve likely benefits from its lindyness, attracting capital more easily due to the perception of reduced risk.

Conclusion

The data clearly shows the impact of PIL rewards. LQTY stakers have a unique opportunity to direct these rewards toward initiatives that deliver the most value for V2 and drive further growth.

Efficient use of PIL funds directly benefits stakers - the more effectively these incentives are allocated, the greater the long-term rewards for them.

5.3K

39

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.