Back in February, I highlighted how undervalued Maple was.

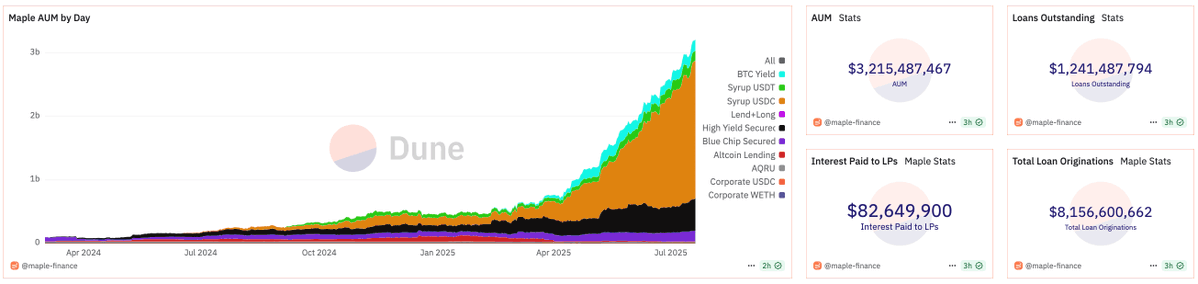

$570M of TVL, a growing product pipeline, and a $85M market cap.

Five months later, TVL is $3.2B (+460%) and $SYRUP trades 5.4x higher.

Here's what happened and why Maple is still mispriced.

🗓️ MARCH

@BitwiseInvest. one of the largest crypto asset managers, allocated capital to Maple, further solidifying Maple’s growing reputation among tradFi players.

In the same month, Maple got listed on Coinbase and was added to @Grayscale’s Top 20 Index for Q2 2025.

Two validations from major players in the industry that strengthen Maple's leading position in the institutional RWA lending sector.

Lastly, syrupUSDC went live on Morpho, curated by @gauntlet_xyz and @MEVCapital.

🗓️ APRIL

In April, Maple announced a key integration with Spark.

Spark allocated an initial $50 million USDC into SyrupUSDC to diversify into institutional credit markets.

This partnership strengthens Maple’s positioning as a go-to asset manager for both DeFi-native and traditional players.

🗓️ MAY

May was one of the best months for Maple, as the protocol saw its TVL grow by 61%, from $1.1B to $1.9B.

In this month, the team announced probably the most bullish news of this year, a deal to secure Bitcoin-backed credit facility with @Official_Cantor, a major investment bank managing $15B in capital.

This facility could scale up to $2 billion, offering institutional investors leverage on their BTC holdings.

🗓️ JUNE

In collaboration with @chainlink, @KaminoFinance, @Paxos, @jito_sol, and @orca_so, Maple launched syrupUSDC on Solana, along with $500k of incentives to bootstrap its TVL.

Maple also integrated with Lido, introducing a stablecoin credit lines backed by $stETH.

Before we move on, a few stats worth highlighting:

• $8.4B in total loans originated.

• $1.2B in active loans.

• ~$9M in annualized revenue.

• syrupUSDC almost at $1B TVL while providing an average 6.5% APY.

🗝️ WHAT'S THE SECRET BEHIND THIS GROWTH?

1. DeFi Composability

Integrations into @eulerfinance, @KaminoFinance, @pendle_fi, and other DeFi protocols have played a key role, attracting yield farmers to engage in loop and PT/YT strategies for higher yields.

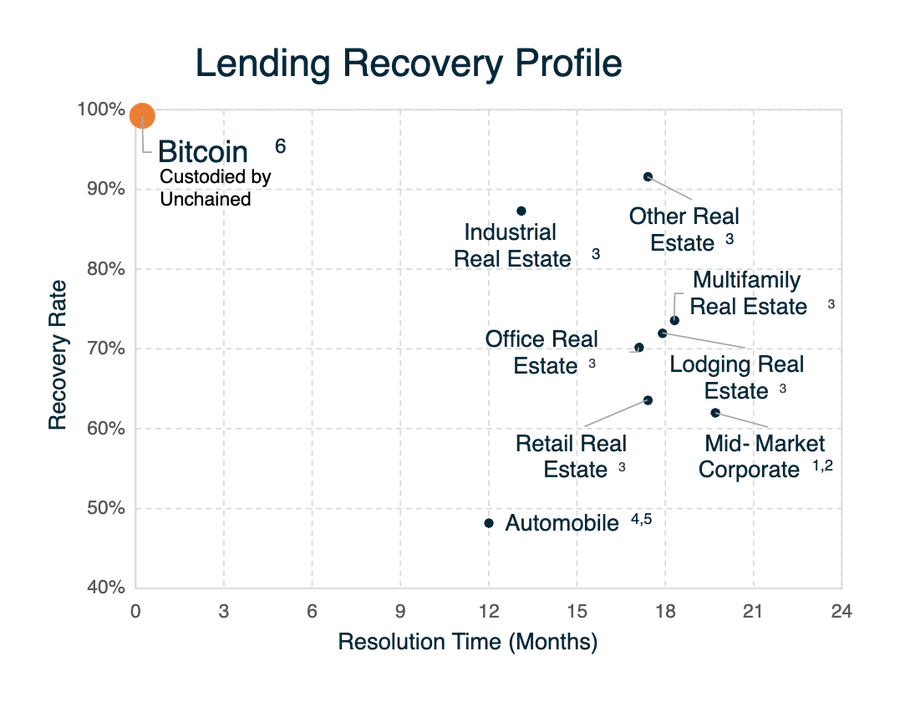

2. Bitcoin

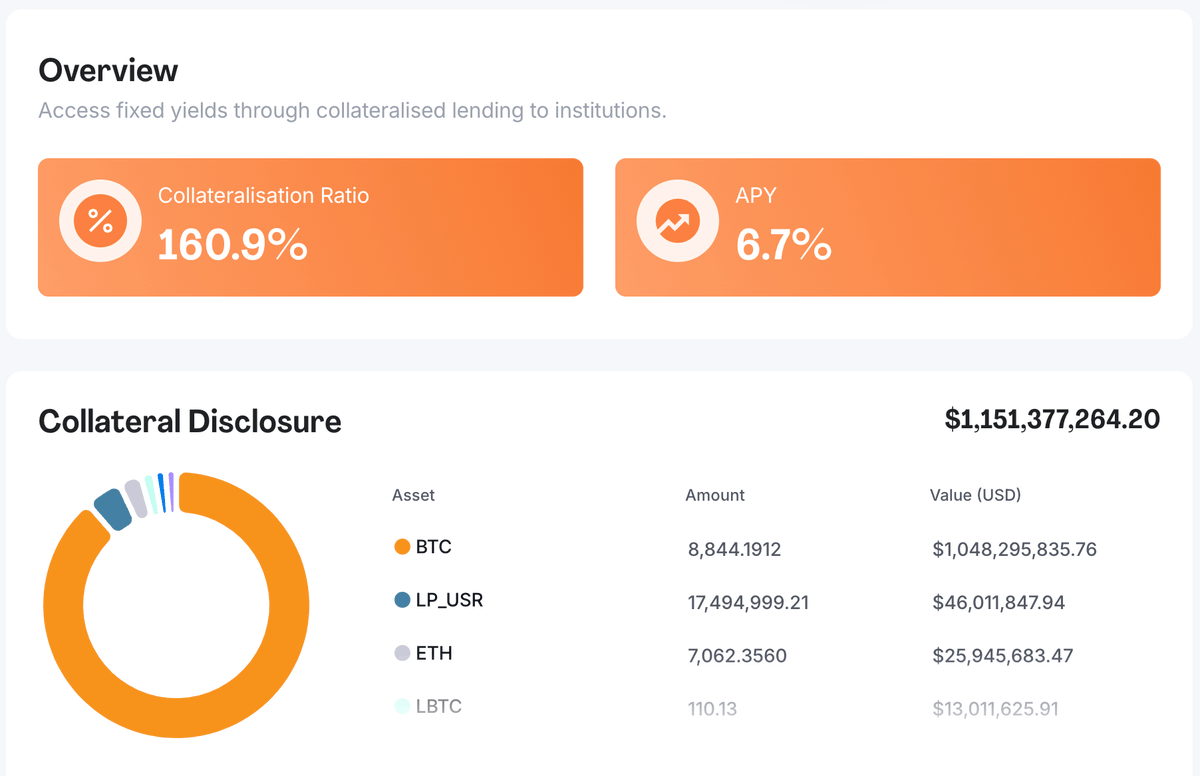

Out of $1.1B TVL of SyrupUSDC 90% is in Bitcoin.

This is a trend that will even accelerate from here, in my opinion. As Bitcoin continues to gain interest from tradFi, more and more entities will seek ways to make their capital work and not sit idle.

I talked deeply about BTC lending in this article. I highly suggest you reading it:

3. The Pivot

Unlike its earlier focus (undercollateralized loans), Maple is now fully focused on overcollateralized lending (syrupUSDC currently has a 160.7% collateralization ratio), and this has heavily reduced default risks and, by consequence, made the platform more attractive for individuals and institutions.

🖊️ FINAL THOUGHTS

Maple has experienced impressive growth in recent months, with its TVL climbing to over $3B.

At the beginning of the year, the team stated their goal for 2025 was to reach $4B in TVL by the end of the year across the following distributions:

$1B in syrupUSDC/USDT

$1.5B in their BTC yield product

$1.5B from the rest of their Maple Institutional product suite

Although the allocation might differ from the original vision, Maple is on the path to smash this goal and keep capture market share over the coming months.

This growth highlights both the increasing demand for high-quality yields among accredited investors and the impact of SyrupUSDC, which opened up institutional yield to retail users.

Then DeFi composability amplified the interest, showing just how powerful integrations with platforms like Pendle, Euler, Morpho, & co, can be when you’re bootstrapping or scaling a product.

TradFi players are starting to catch up on this, and we saw it when BlackRock’s $BUIDL was integrated with Euler a month ago. I expect to see a lot more of this in the coming months.

On the other hand, it's fair to note that Maple has a long way to go. The platform still needs to prove it can sustain steady growth for its active loans, which are fundamental as the yield generated by syrupUSDC depends directly on them.

Nevertheless, I believe the team will be able to keep the momentum and ultimately position the protocol as the bridge between DeFi and tradFi, facilitating institutional access to DeFi.

25.6K

55

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.