Shouldn't token buybacks be done onchain using existing rails instead of buying "in the open market"?

An interesting example is @aave, which has been doing buybacks since April, buying 63,518 $AAVE for ~$13.8M (h/t @Token_Logic for the dashboard).

These trades were executed on CoW swap, with practically all of them being filled by a solver and not routed through any AMM.

What if those trades we executed in as a range orders/cash-secured puts on Uniswap?

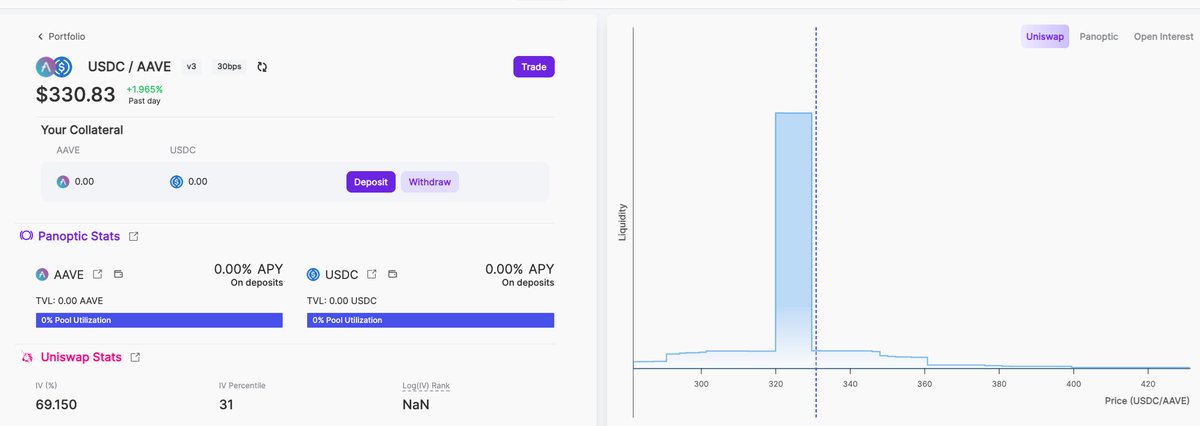

Basically deploy 35k worth of USDC in the Aave-USDC Uniswap v3 pool, just below the current price.

This would create a natural buy wall to support the price, which incidentally is not unlike the liquidity distribution in the Aave-USDC-30bps pool:

If the price increases and the position is still USDC, then roll up that put and re-deploy that liquidity right below the current price again.

If the price decreases, then position is 100% $AAVE: withdraw those funds and pocket a minimum of 0.3% in fees (much likely more).

Do this every day for 3 months with a ~10% wide position and the DAO would earn an extra ~15-25% apy from the fees.

2.62K

25

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.