On the question of whether $ETH prices are fearful of high prices, I have a data that can provide an alternative perspective:

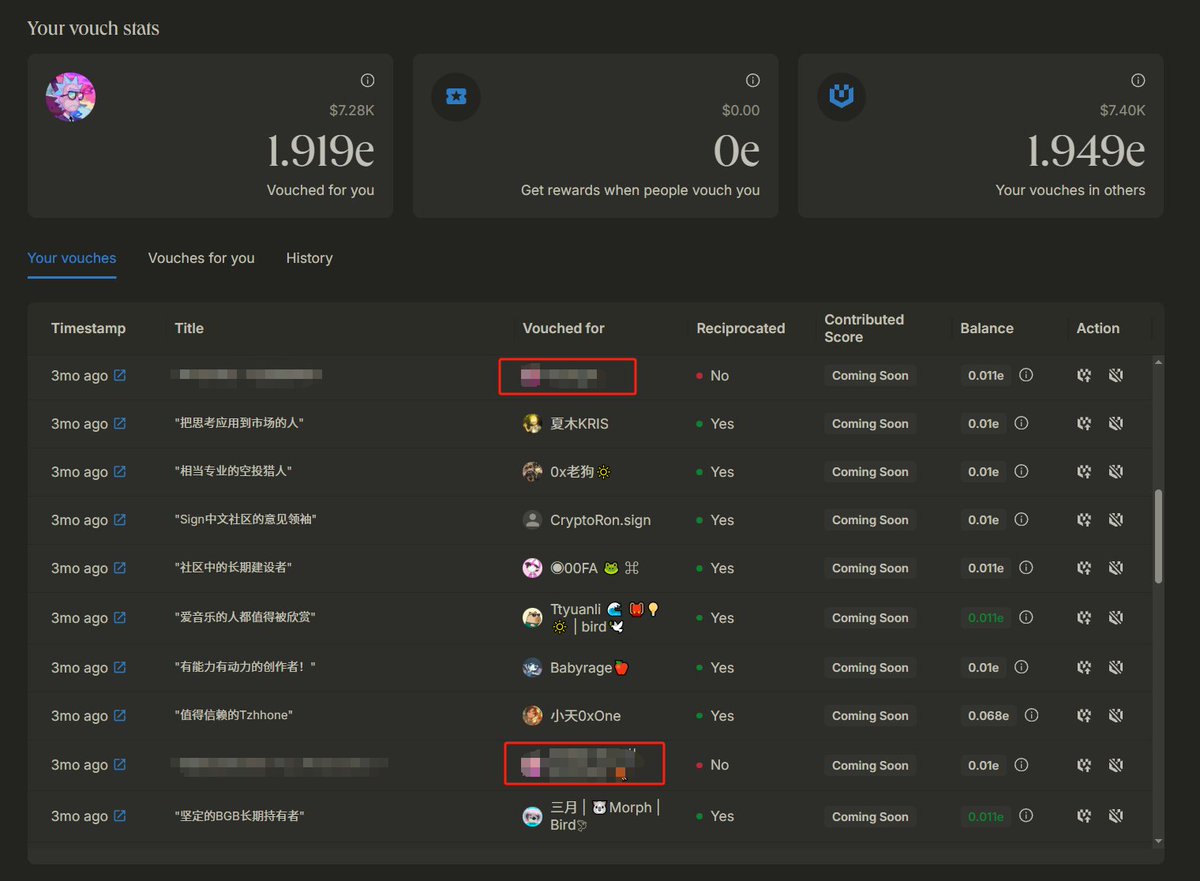

That is Ethos, which was very popular some time ago! Since this project is currently entering a period of depletion of traffic, many players who use ETH as collateral on it have gradually begun to withdraw...

The reason is not that I think these ETH are risky, but because I feel that ETH is rising very well and want to sell it for profit!

Most players stake very little ETH on it, generally less than 1 ETH, so observing their unlocking behavior can be reflected as a side reflection of retail investor sentiment.

After ETH broke through $2500, I can see 5~6 people every week who have unsecured and completely unlocked all the guaranteed ETH, and their unlocking represents the belief that ETH will not rise in the short term...

As long as this unlocking behavior can continue, it means that people are still handing over their chips to the main force, and the bullish trend of ETH has not stopped.

After all, who would destroy their hard-earned credibility for 1 or 2 ETH?

Only retail investors...

From my point of view, even if the players on Ethos are not optimistic about this project, they will not easily unstake, after all, the reputation score will drop a lot when the guarantee is released, and I will also release the guarantee for me, and I can see that their score is directly deducted 30~50 points...

Therefore, it can be concluded that only those who care about this little amount of money will do this...

That must be retail investors...

Otherwise, it is even more impossible to explain why the more ETH rises, the more people unguarantee...

$ETH The historical chip peak area officially completed the breakthrough after the weekly close in the morning!

At present, there is only a little residual supply left at a high of $3,800, and if it can continue to break through, there will be almost no trap in the secondary market of ETH!

If the weakness of ETH in the past three years comes from the suppression of long-term high supply, then after three years of continuous consumption, the supply has almost been released, and breaking through this last supply zone will bring about a similar phenomenon of supply disappearing at the chip level.

To put it simply, there are only profitable chips left in the supply and demand relationship, and there is no supply of chips!

In this case, only a small amount of demand is needed for the price to continue to rise, and it is expected that ETH will continue to shrink and rise for 1 month until the volume appears.

Of course, the premise of all this is that the current market has the ability to complete the breakthrough of this last supply zone.

As for trading ideas, my suggestion is that the advantage of holding spot is greater than that of futures, once it breaks through in the future, the volatility will not be small, and the rhythm of rising by 20% and falling by 10% will often occur.

I took 30% of the spot in 3638 as planned, all according to the long-term plan, and if the price can break through to a new high, I will take 20% of the profit, leaving the remaining 50% spot to hold for a long time.

If you want to take it for a long time, you must take profit appropriately, otherwise as the price continues to rise, you will accidentally make "I have made enough money, clear the position!" Such an operation.

This leads to missing the final orgasm market!

30.89K

54

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.