Here’s what just happened in D.C. with crypto.

3 major bills passed the House, and they could reshape how the US handles stablecoins, crypto regulation, and CBDCs 🧠🧵

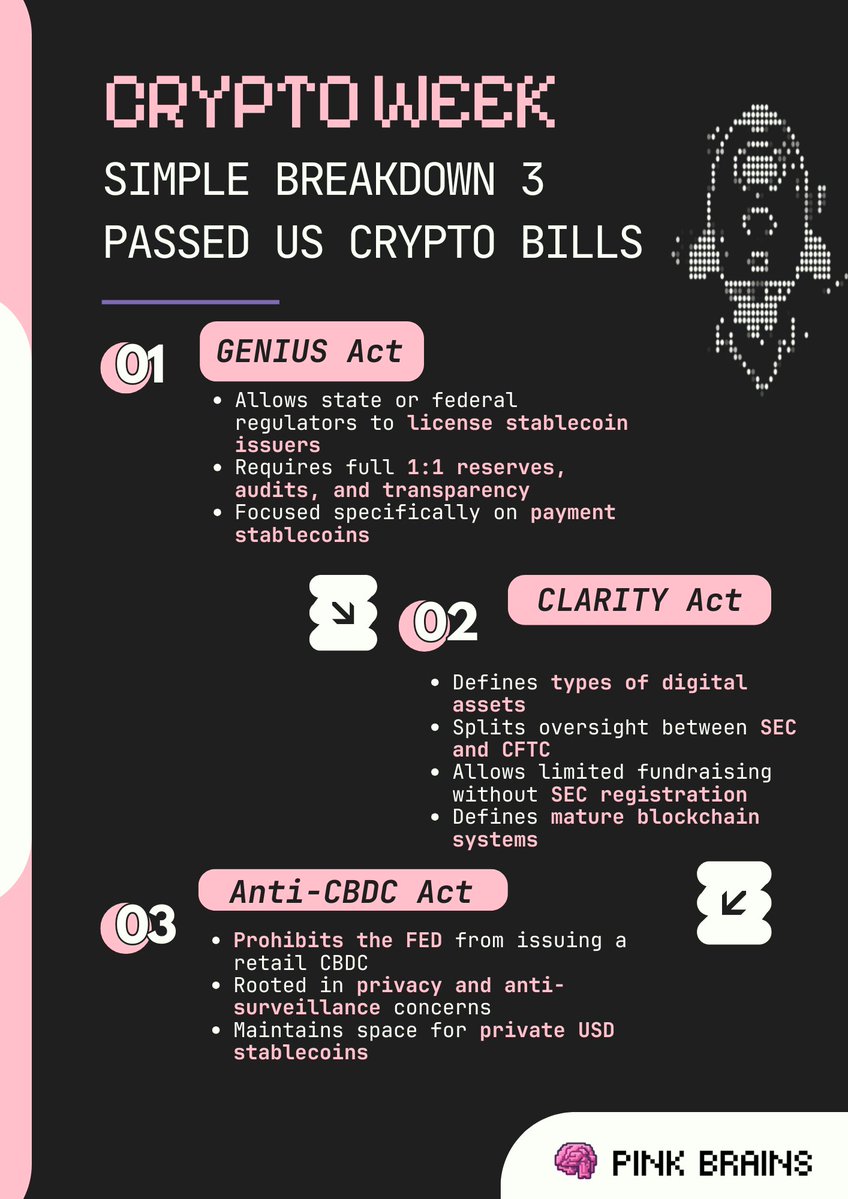

1. GENIUS Act: This one sets rules for stablecoins

It allows both federal and state regulators to oversee issuers, but with clear requirements: full 1:1 reserves, audits, and transparency.

The idea is to make sure stablecoins are safe and well-regulated, without shutting the door on private issuers.

👉 How does it impact?

- Opens the door for Circle, banks, and fintechs to issue USD-backed stablecoins legally

- Reinforces USD dominance in digital payments. especially as a counterweight to foreign CBDCs like China’s e-CNY

2. CLARITY Act: This is the big one for the rest of crypto

It gives legal clarity on when a token is a commodity, and when it’s a restricted digital asset, and determines who regulates what (SEC or CFTC)

Before this, that line was blurry, and it’s caused a ton of friction.

In short:

- SEC: handles restricted digital assets and investment offerings (tokens initially offered as part of investment contracts, usually via SAFTs)

- CFTC: handles digital commodities and trading (if a token is decentralized and used primarily for utility or exchange)

👉 Here’s the key point:

Not every blockchain’s native token is automatically a commodity. Projects have to prove their network is decentralized and meets the legal definition of a “mature blockchain system.”

But there’s flexibility too.

Projects can raise up to $75M/year under disclosure requirements, without SEC registration, as long as they have a clear roadmap to decentralize within 4 years.

So, how is a crypto project defined as decentralized?

From FIT21 (the original of the CLARITY Act), some of the criteria are:

- Token value comes from actual use/adoption

- Anyone can run nodes, validate transactions, join governance...

- No single entity (or group) can control >20% of voting power or token supply

- Programmatic operation of the protocol, fully open source code

- Legacy chains (pre-July 2025) can qualify more easily if >50% of tokens are held by the public

3. Anti-CBDC Act (219–210): This one’s more political

It bans the FED from issuing a retail CBDC (a government-run digital dollar that you hold in a FED wallet)

Supporters say it’s about privacy: they don’t want a world where the government can track or freeze your spending.

Instead, the bill leans toward private sector stablecoins as the better path forward for digital dollars.

Why is this bullish for our industry?

A real shift is happening. Congress is starting to take crypto seriously, not as a fad, but as infrastructure.

"If passed, CLARITY Act would be so bullish for crypto", @DefiIgnas

Lawyers of CT, explain this:

CLARITY act establishes a "mature blockchain system" framework for lighter regulation of truly decentralized networks.

I found sources saying that Bitcoin, Ethereum, Litecoin pass the criteria while Solana, Cardano, and BNB Chain do not due to foundational control.

How do regulators actually evaluate it?

Another cool clause is tokens initially sold as securities can transition to commodities if the underlying blockchain becomes decentralized.

CT argues for years what is "Decentralized" yet how will The Suits decide?

P.s. I can't believe I have to post this. CT from two years ago would be full with threads answering this question.

Now, it's full of useless shitposts.

If passed, CLARITY act would be so bullish for crypto.

This is what we know so far. The Acts will be subject to many debates and adjustments.

However, the message is clear:

- Stablecoins can freely grow, but under real rules

- Crypto projects have a clearer legal framework to build in the US

- Keep digital dollars in the hands of the private sector

If these bills make it through the Senate, this will be the biggest policy shift for crypto in the US to date.

What's your thought?

16.47K

24

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.