To add a point, this model definitely has some bubble components in it; it rises quickly and falls just as fast. After $MSTR broke its historical high at the beginning of 2021, it immediately dropped by more than 70%. It took several years of a bear market before it finally rose back and broke the previous high again.

I'm just sharing my perspective on this round; whether ETH's micro-strategy can hold in the long run is still too early to say, after all, no one knows what the next cycle will be like.

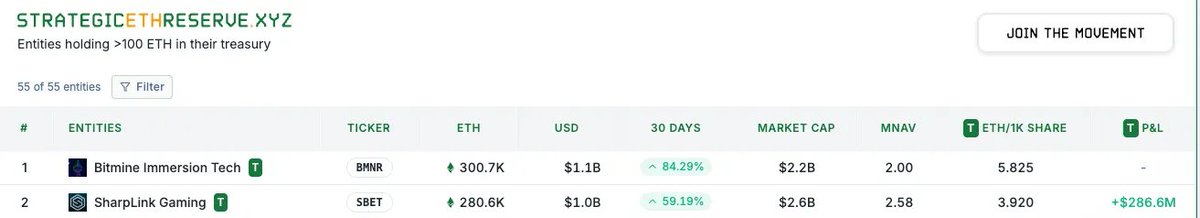

The competition for the Ethereum version of MicroStrategy is too fierce! 🤯

@BitMNR has been crazily buying $ETH in recent days, and yesterday their holdings officially surpassed 300K, directly overtaking @SharpLinkGaming to become the new leader. The price of ETH continues to rise, breaking through 3400! 🚀

Recently, I chatted with some friends in investment banking and found that they haven't really participated in this wave of MicroStrategy stocks. We, the old investors who have been cut in the crypto space for a long time, finally feel like we are ahead of the big institutions on Wall Street and are reaping the rewards.

How far can this wave of enthusiasm go? We can look back at the classic script: the rise of $MSTR.

The success of $MSTR can be roughly divided into three stages:

1️⃣ First Stage (2020/8): Setting a Precedent

They announced the purchase of 21,454 bitcoins for $250 million as a major treasury reserve asset. The market was skeptical, believing that a software company was being too aggressive, and the stock price didn't perform well.

2️⃣ Second Stage (2020/12): Strategic Turning Point

They announced the issuance of convertible notes to raise funds, sending a clear signal to Wall Street: $MSTR is not just holding bitcoins, but is also using financial leverage to turn the company into an active "bitcoin acquisition tool." The stock price rose 33% in a month following the news, and Wall Street began to discuss it, but the concept was not fully accepted yet.

3️⃣ Third Stage (Early 2021): Wall Street Frenzy

As Bitcoin entered a super bull market in early 2021, MSTR's stock price also entered the craziest phase. Wall Street began to realize MSTR's profitability, and the stock price experienced an epic surge. From about $500 at the beginning of the year, it reached a historical high of $1,300 on February 9, 2021 (pre-split price).

It can be seen that the biggest profits occurred during a parabolic move in just a few months. With the experience of $MSTR, the rise of ETH MicroStrategy will definitely be much faster, as companies like Sharplink and Bitmine have already started issuing stocks and bonds in just two months.

In my view, the Ethereum version of MicroStrategy is currently in the second stage, and entering the third stage will mark the true beginning of a crazy surge. 🔥

4.23K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.