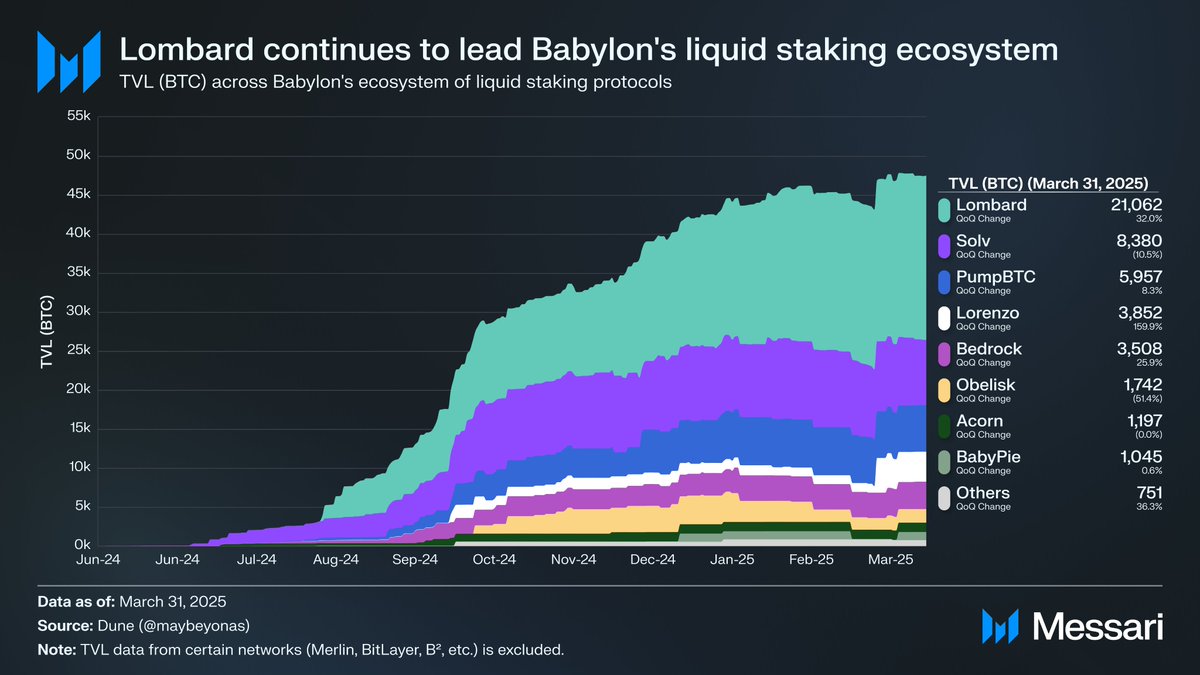

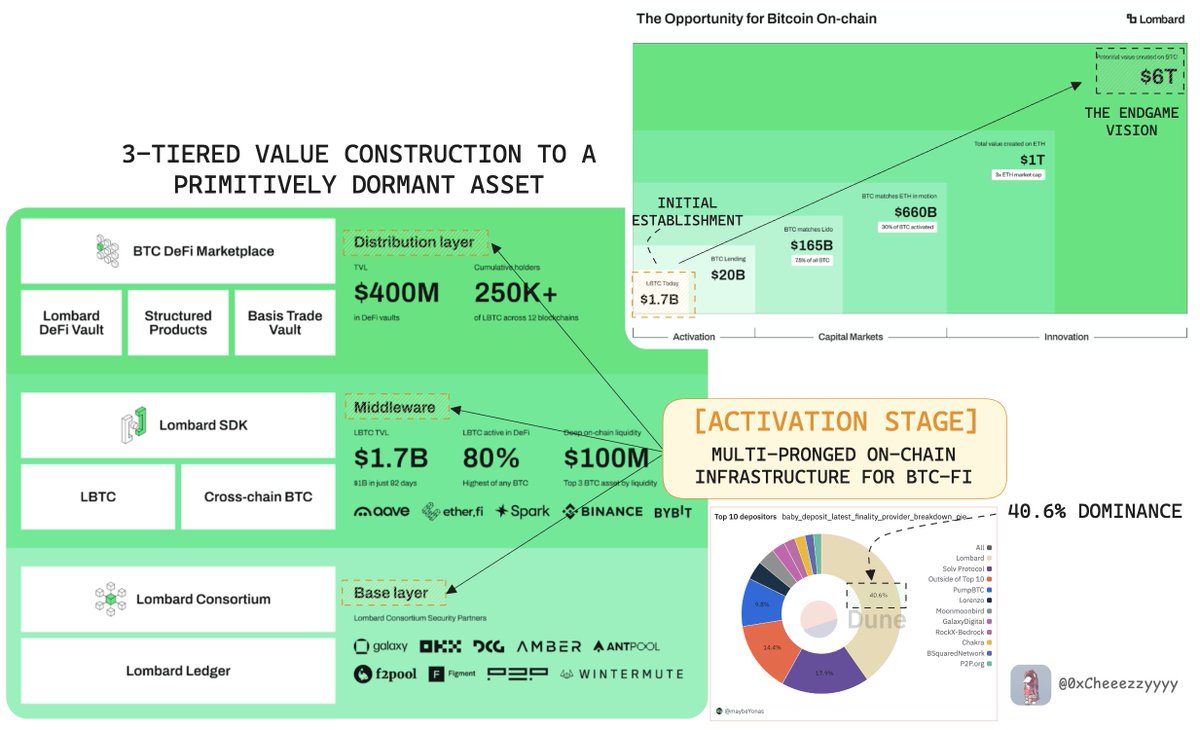

Lombard’s $LBTC has proven it’s more than just a restaking derivative in the @babylonlabs_io BTC-Fi ecosystem with 40.6% dominance.

It’s setting the benchmark.

Despite launching just last year, $LBTC has captured significant market share with over +140 DeFi integrations across top-tier protocols & deep inflows from early adopters.

This traction isn’t accidental.

It’s the result of strong execution, institutional-grade security (via the Security Consortium) + a product vision that extends far beyond just being another BTC wrapper.

With $1.7B in collateral secured $LBTC has firmly established the 'Activation Stage', the first phase in a broader roadmap which extends:

Activation → Capital Markets (next stage) → Full-fledge Bitcoin Economy

The path is ambitious, but if any project is poised to claim that ground, it’s @Lombard_Finance.

For a deep retrospective on $LBTC's performance + trajectory, @Solofunk_ breaks it down with top insights.

Highly recommended read 👇

1.25K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.