Stablecoins in 2025: The Hottest Trends to Watch 🧵

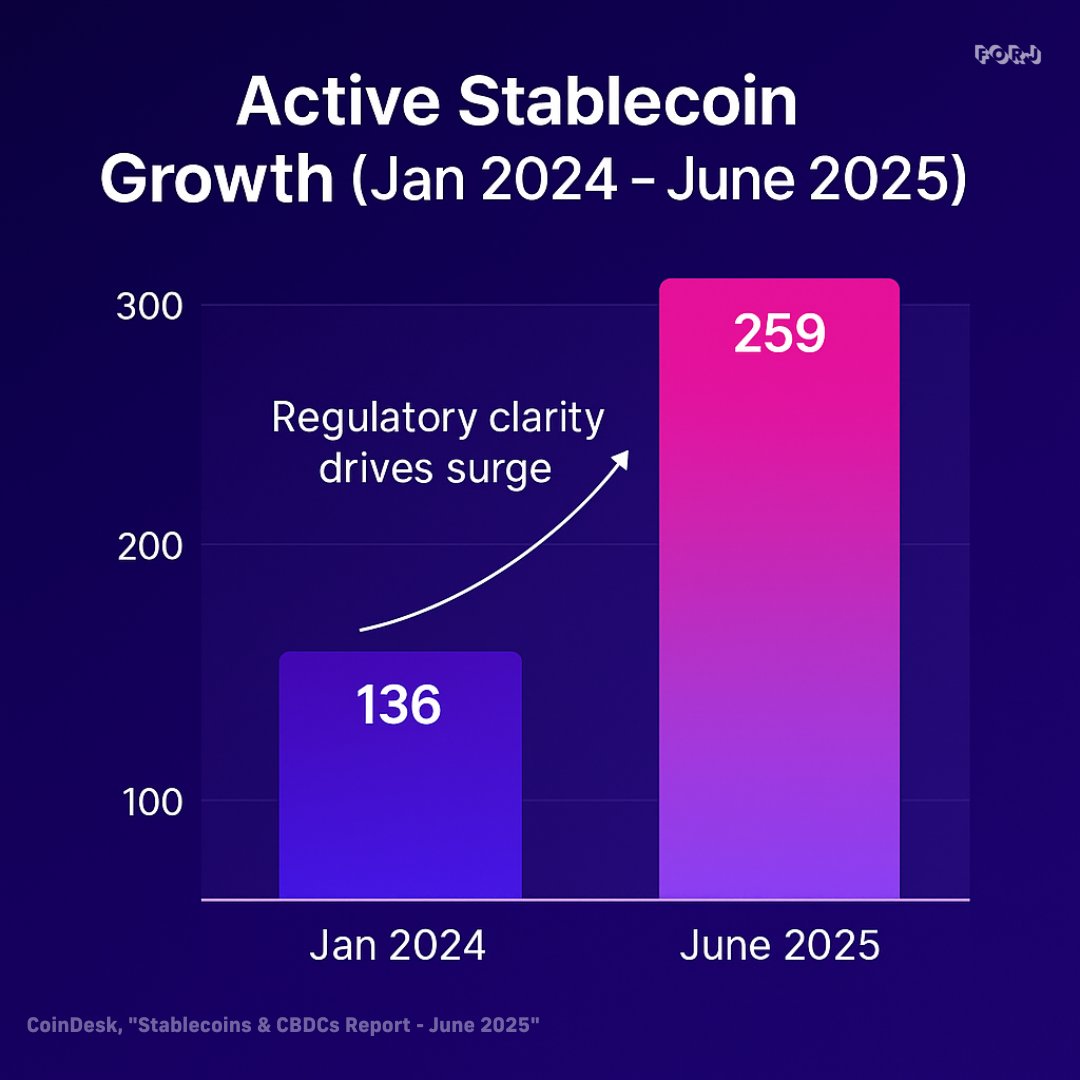

2/ Active stablecoin count rose by about 90% over 18 months

Beyond global USD stablecoins, new types like Euro, Yen, Peso, and regional or institutional stablecoins are emerging, significantly expanding the ecosystem.

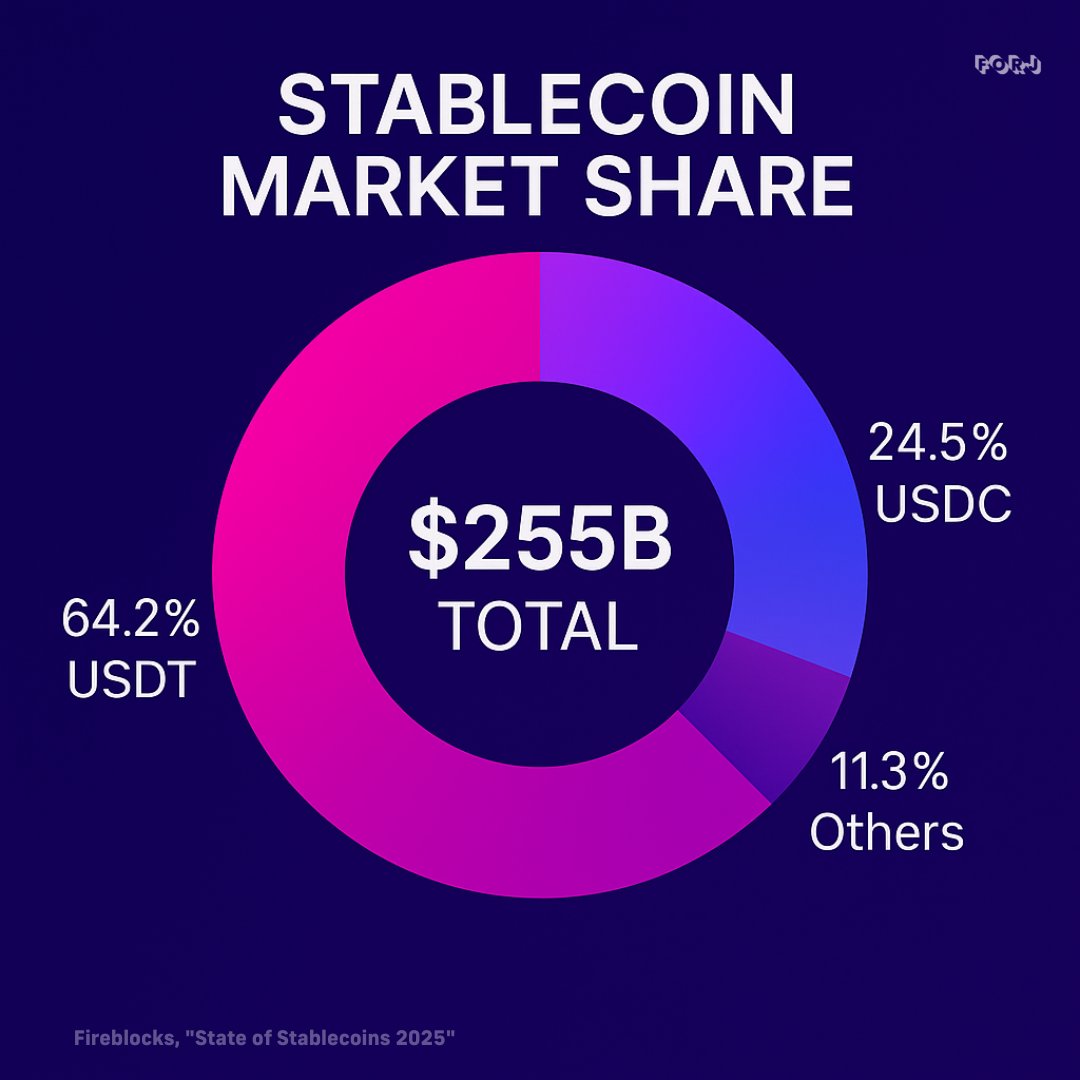

3/ Stablecoin market cap soared to $255B in Q2 2025, marking a 60% YoY surge from around $168B.

USD-backed giants, USDT and USDC, command a whopping 90% of the market.

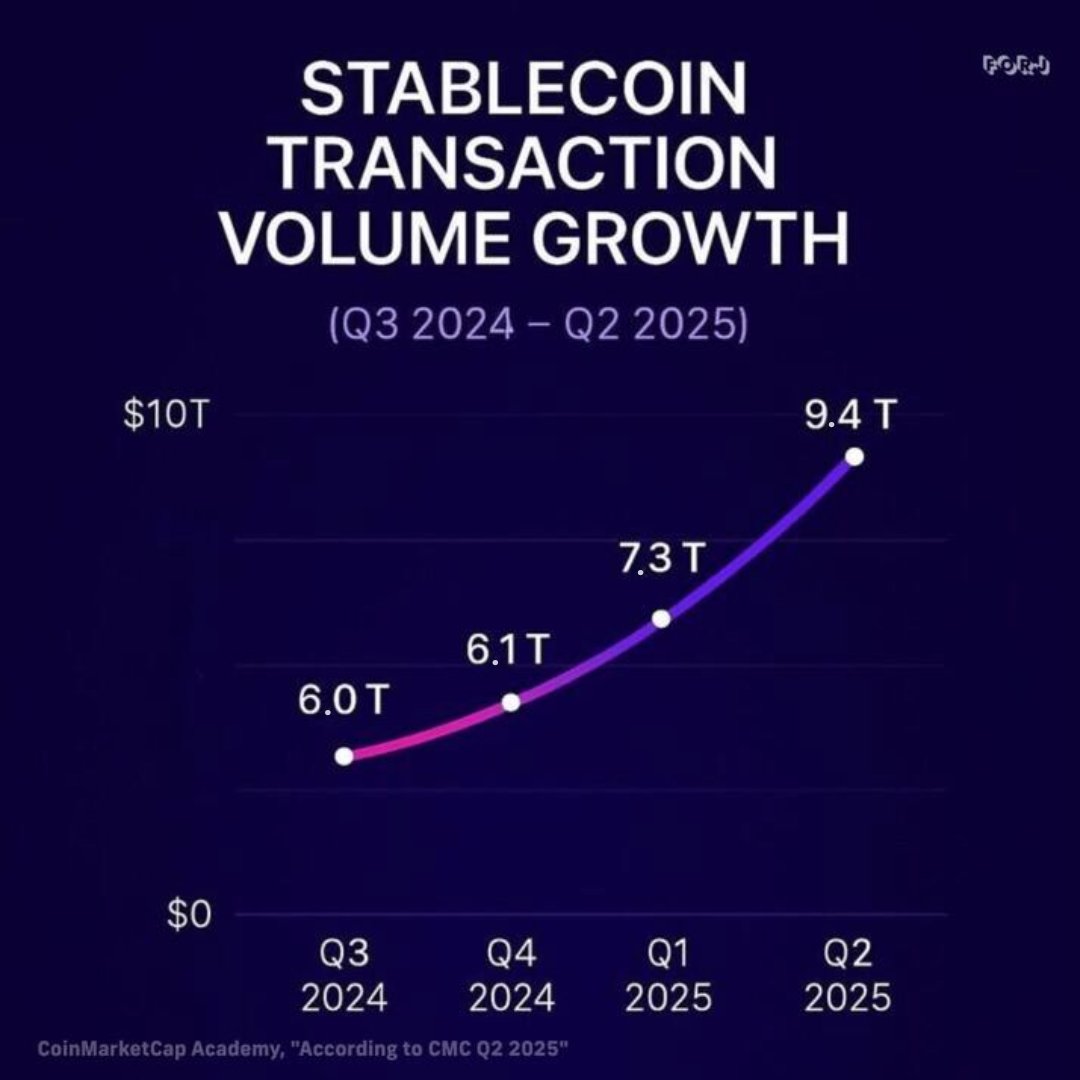

4/ Stablecoin settlement volume hit $9.4T in Q2 2025.

That’s a 54% increase in just nine months.

Stablecoins are becoming foundational to modern digital payments.

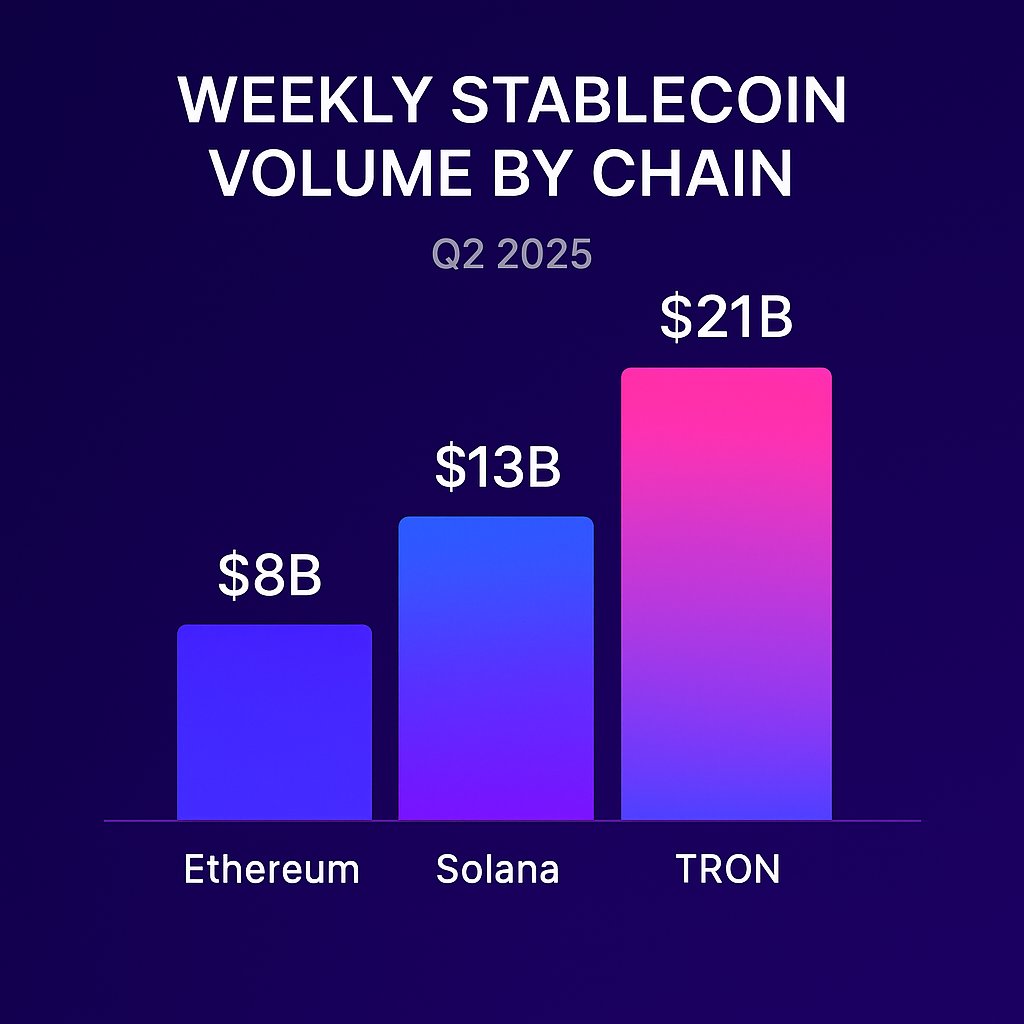

5/ Ethereum, Tron, and Solana remain the primary rails for stablecoin transfers.

Tron leads USDT volume, especially in P2P and cross-border use cases—over 75% of all Tether transfers occur on Tron.

6/ The U.S. GENIUS Act could push the stablecoin market to $2T by 2028 👀

It mandates 1:1 reserves and audits, boosting trust.

Standard Chartered, Treasury Secretary Scott Bessent, and the Ripple CEO all predict a $1-2T market by 2028.

7/ Yield-bearing stablecoins like PYUSD are booming

This year's unprecedented TVL acceleration highlights the growing trust built through transparency and improved auditing among stablecoins.

8/ Total Dollar Volume of Stablecoin Transactions (by Region)

North America and Asia-Pacific see the largest absolute stablecoin flows measured in dollars transacted, thanks to the size of their markets and investment activity.

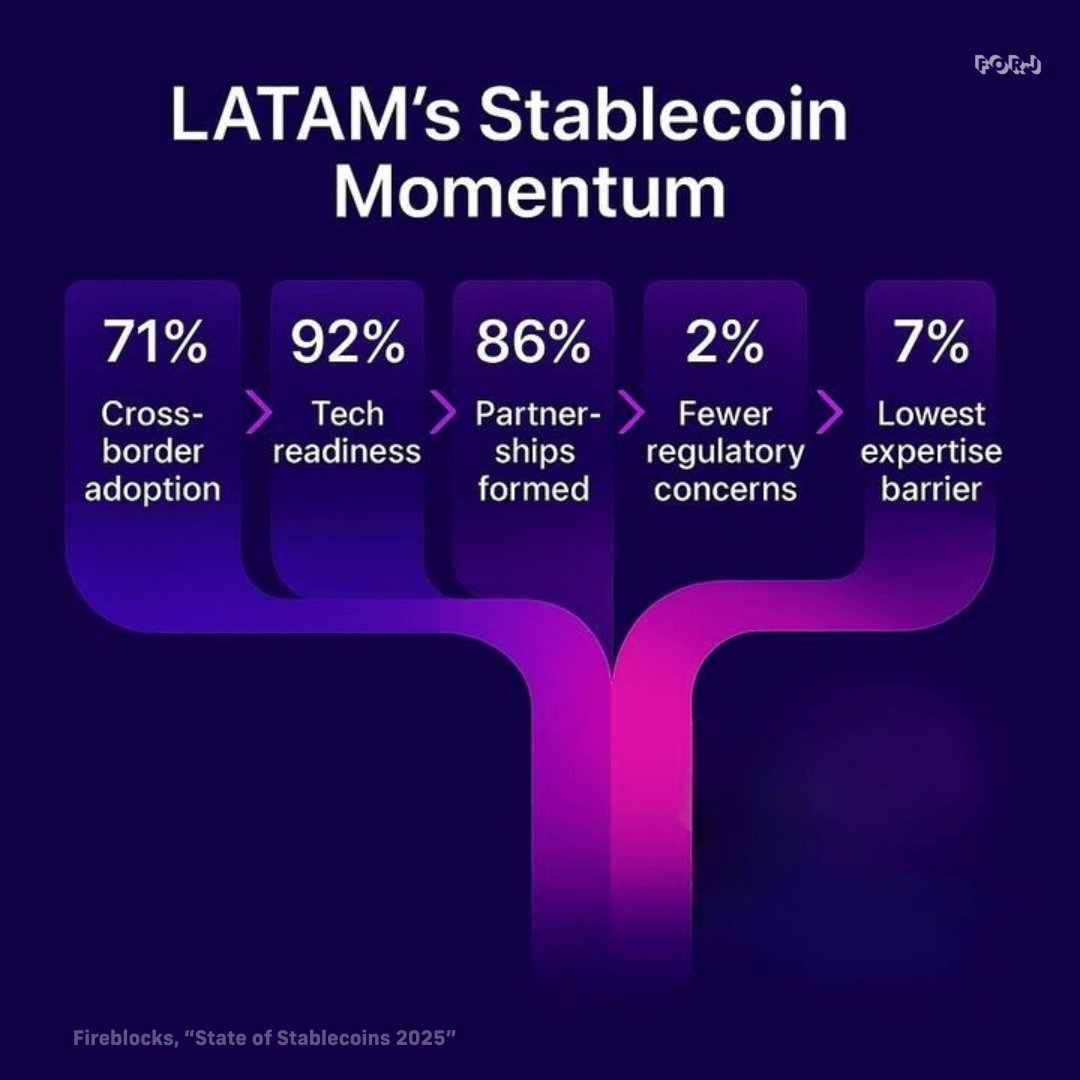

9/ Latin America loves stablecoins

Leading in small business sector adoption.

71% of firms use them for cross-border payments.

Digital alternatives are making transactions significantly faster and more affordable than traditional banks.

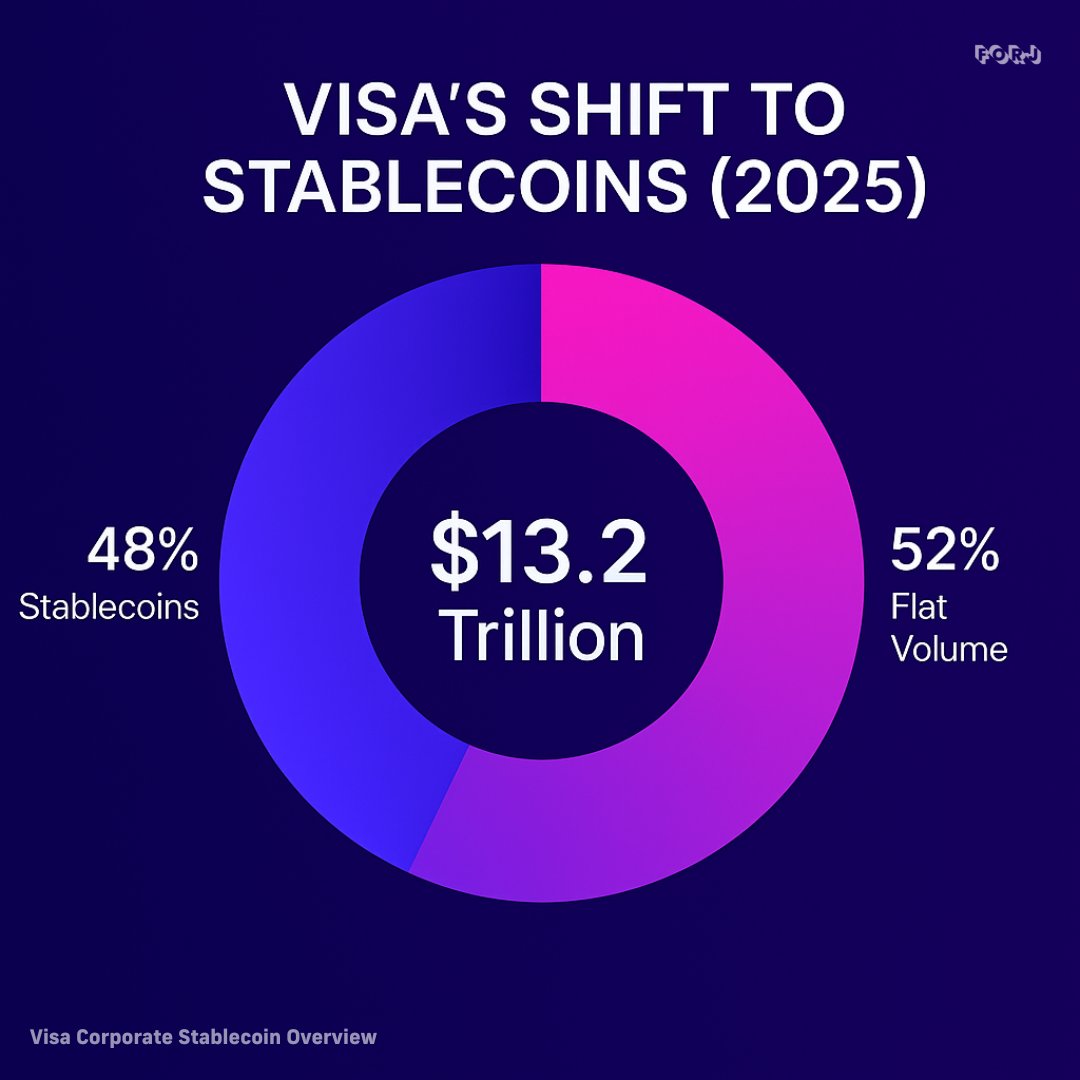

10/ Visa processed $6.4 trillion in stablecoin transactions, growing 63% year-on-year.

Stablecoins now make up 48% of Visa's transaction volume.

With over $27 trillion transacted in 2024-2025, stablecoins rival Visa and Mastercard in settlement volume. The trend is accelerating.

11/ Stablecoins processed more than double the volume of Visa and nearly triple that of Mastercard.

This scale suggests stablecoins are becoming the default rails for global value transfer.

12.87K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.