Is the GENIUS Act the next altseason catalyst?

A new U.S. bill focused on stablecoins could reshape the foundation of the cryptocurrency industry.

🔹 Clear rules for stablecoins 👀

🔸 Institutional greenlight

🔹 Potnetially, Ethereum that wins big

Let’s break it down 🧵

A new U.S. bill proposing a framework for stablecoins:

🔹 Reserve and audit requirements

🔸 Licensing for issuers

🔹 FDIC-style protection mechanisms

🔸 Clear federal oversight

It’s the most serious crypto bill in years.

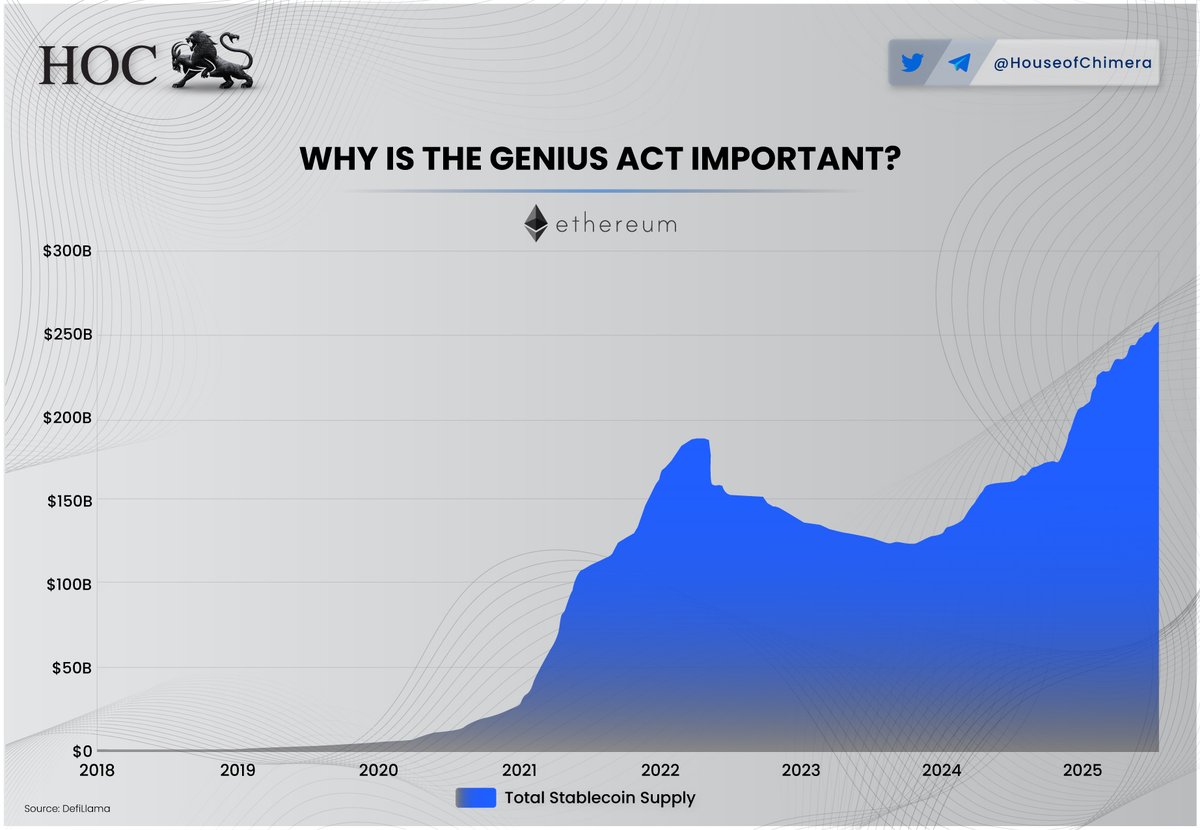

Why does it matter?

Stablecoins = the liquidity of crypto.

🔹 $258B+ in circulation

🔸 Power DeFi, payments, trading

🔹 Currently live in legal gray zones

🔸 Regulation unlocks institutional participation

This is a liquidity unlock event.

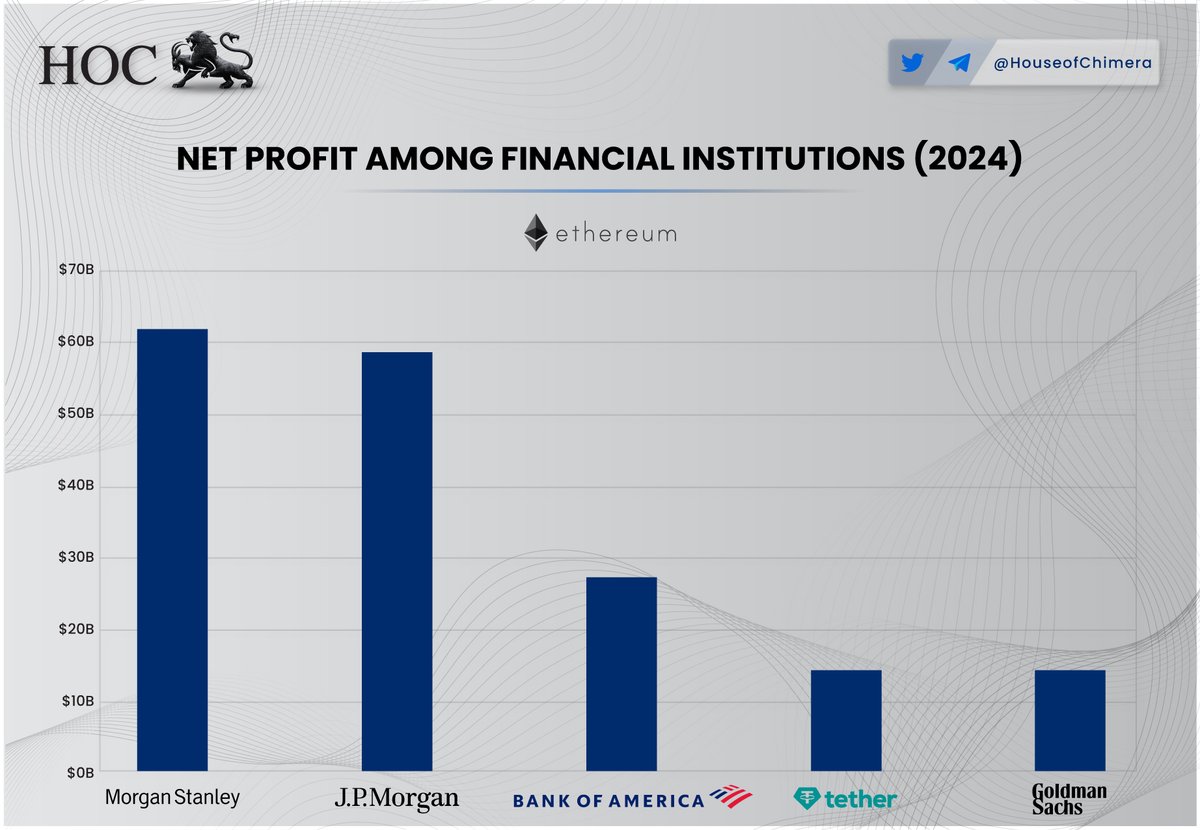

But why do banks care about issuing a stablecoin?

🔹 It's simple, anon - @Tether_to is making bank with approximately 14b net profit in 2024.

🔸 The TradFi behemoths want a piece of the cake with their own stablecoins, as it is the ideal product for them.

But why stablecoins and why not DeFi or anything else?

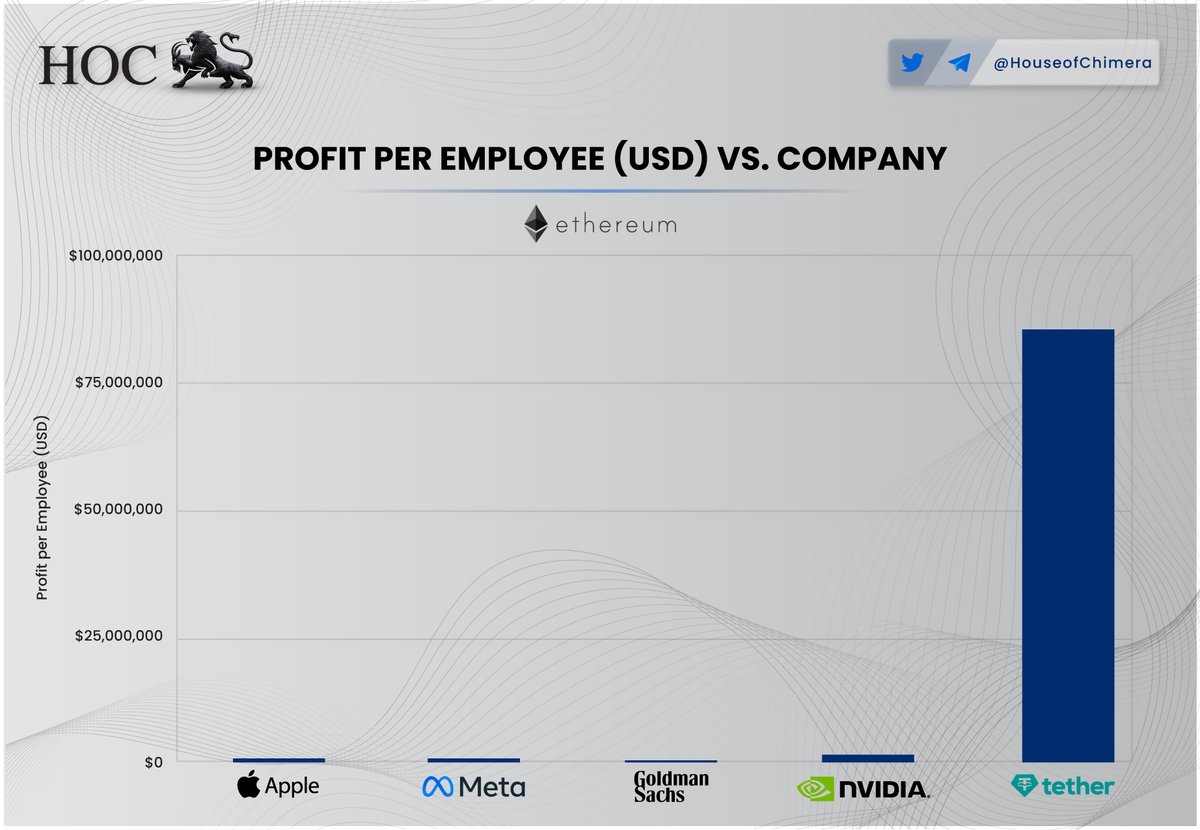

🔹 Well, it turns out that stablecoins are WILDLY profitable, Tether has a ridiculously small team compared with the TradFi behemoths

🔸 In other words, the margins are considerable - and TradFi wants in.

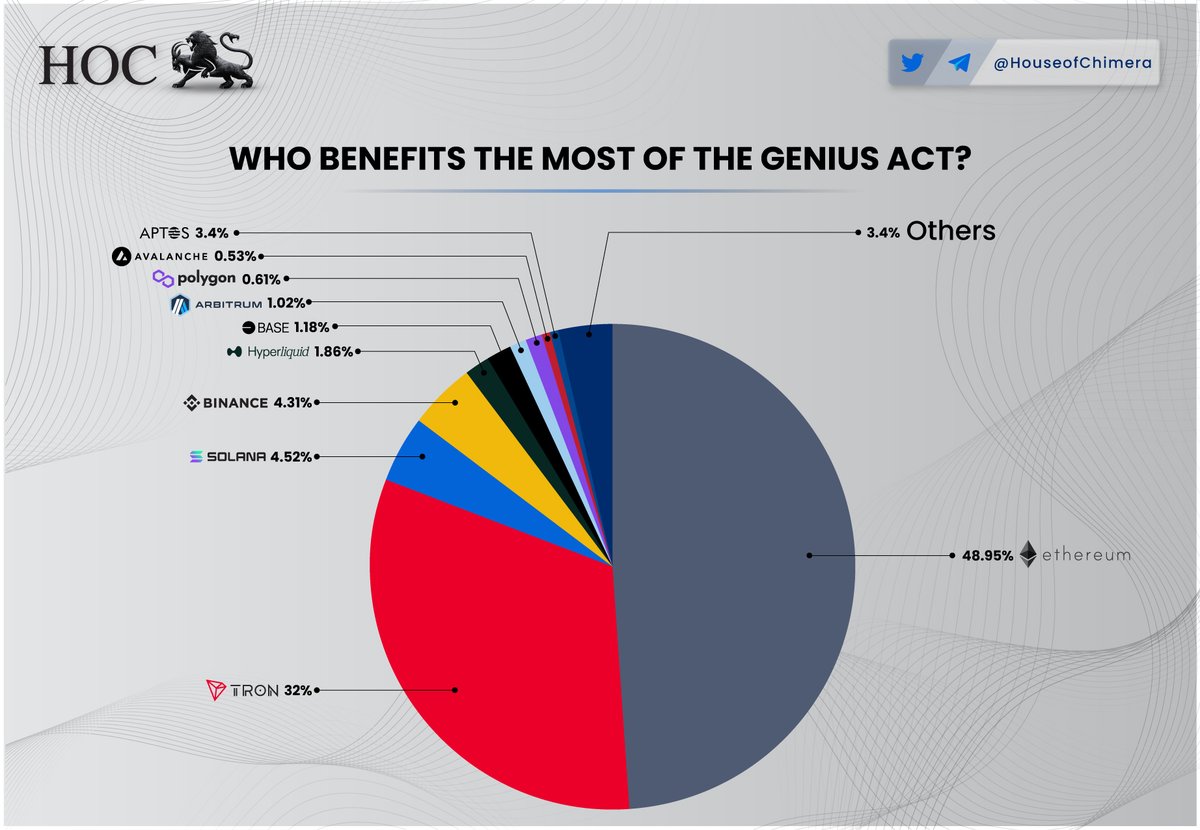

Who wins if the GENIUS Act passes?

🔹 @ethereum ~50% of all stablecoins live here

🔸 USDC/USDT issuers like @circle & @Tether_to

🔹 DeFi protocols & DEXs

🔸 TradFi players looking for compliant rails

ETH becomes the global stablecoin settlement layer.

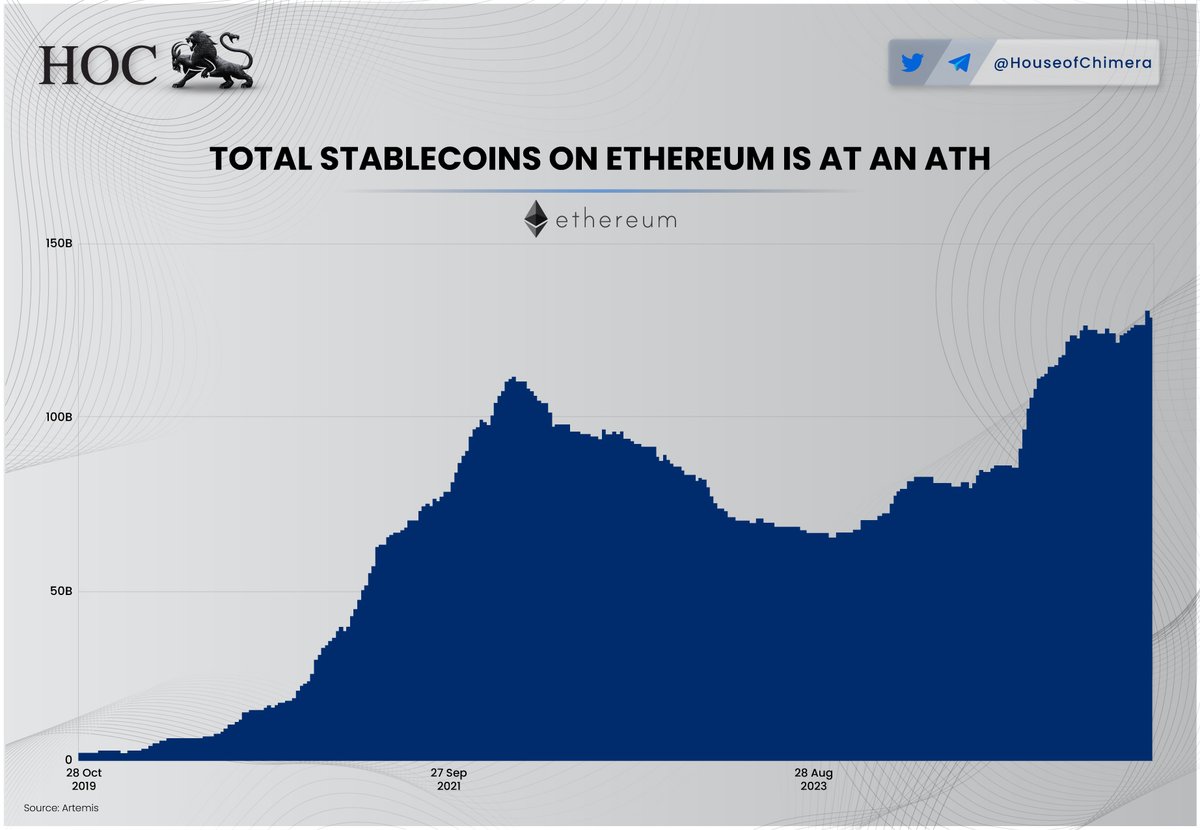

The total supply of stablecoins on Ethereum has just hit an all-time high.

🔹 More value parked than ever

🔸 Growing dominance of USDC

🔹 On-chain velocity increasing

🔸 Base layer for serious volume

The foundation is already set.

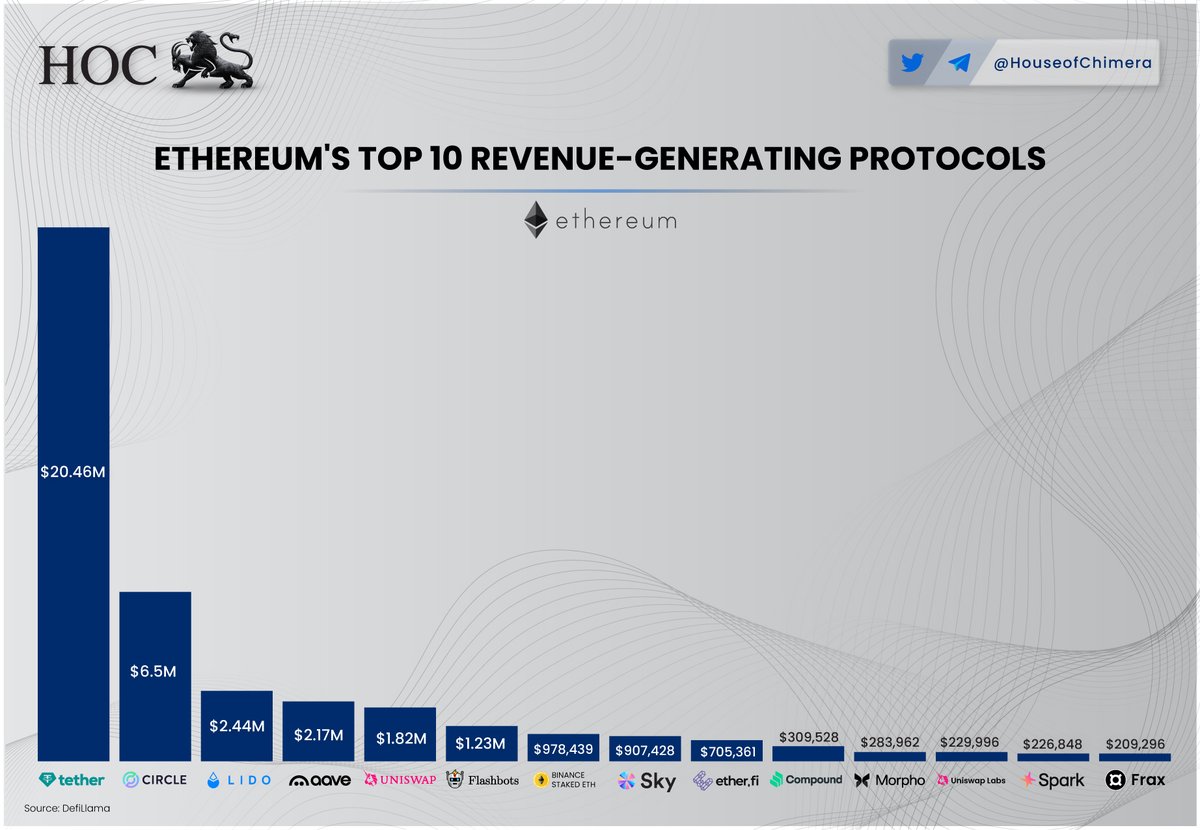

Stablecoins generate more revenue on Ethereum than anything else.

Not NFTs. Not memecoins. Not gas wars.

🔹 $127B+ stablecoins live on ETH

🔸 100s of millions in annual fees

🔹 Powering DEXs, lending, bridges

🔸 Tether & USDC lead the flow

The GENIUS Act could unlock even more if banks start issuing stablecoins, ETH wins.

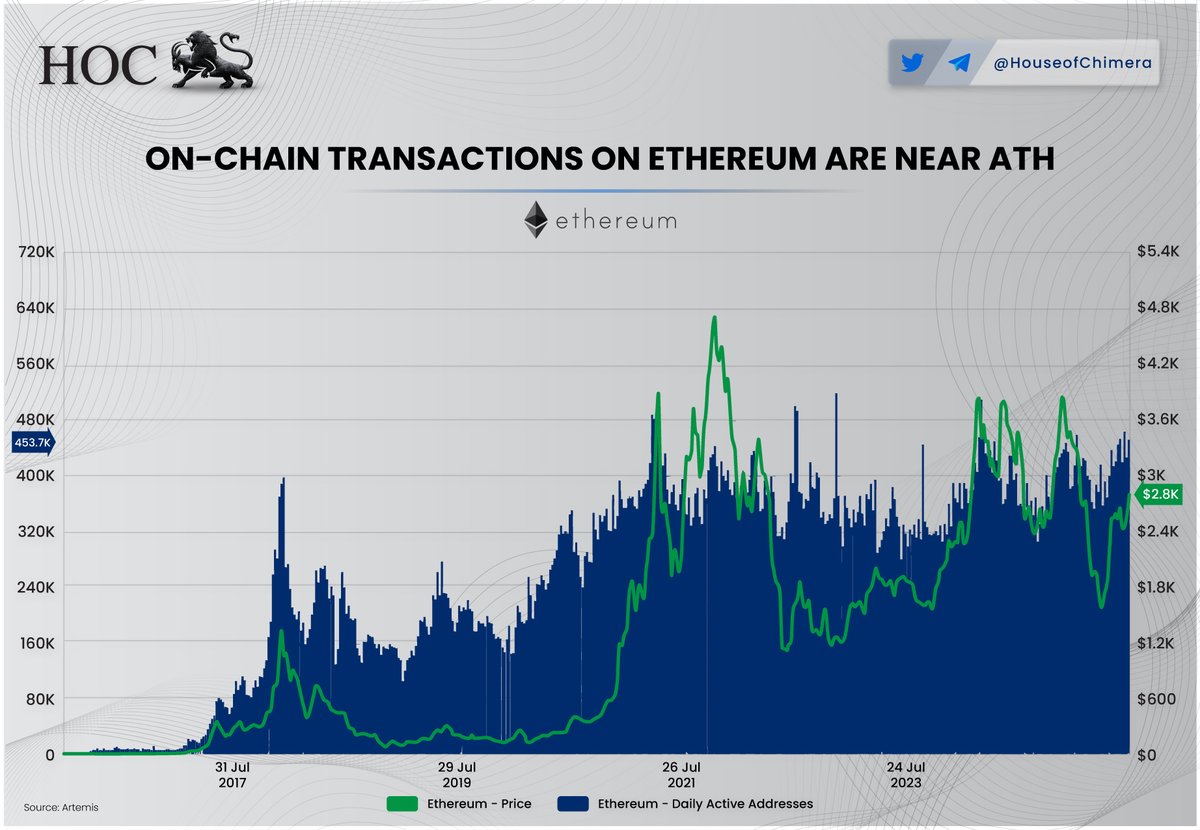

On-chain activity is surging.

🔹 Daily gas usage is climbing

🔸 Transactions near ATHs

🔹 Layer 2s feeding into L1

🔸 Usage across DeFi, staking, and restaking

Ethereum isn’t asleep. It’s building pressure.

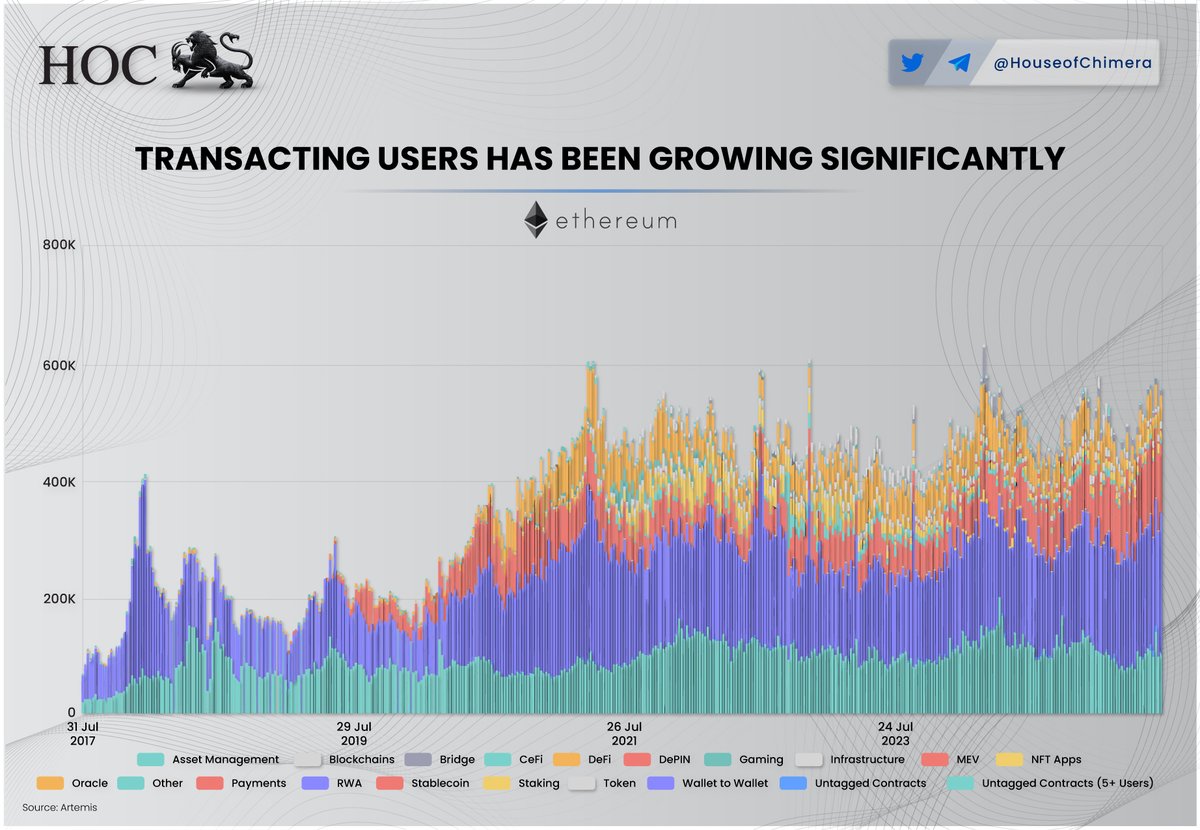

User growth is back.

🔹 Daily active wallets on the rise

🔸 L2s onboarding new users

🔹 Bridges funneling traffic to Ethereum

🔸 More demand = more ETH burned

This time, it’s sticky.

33.17K

59

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.