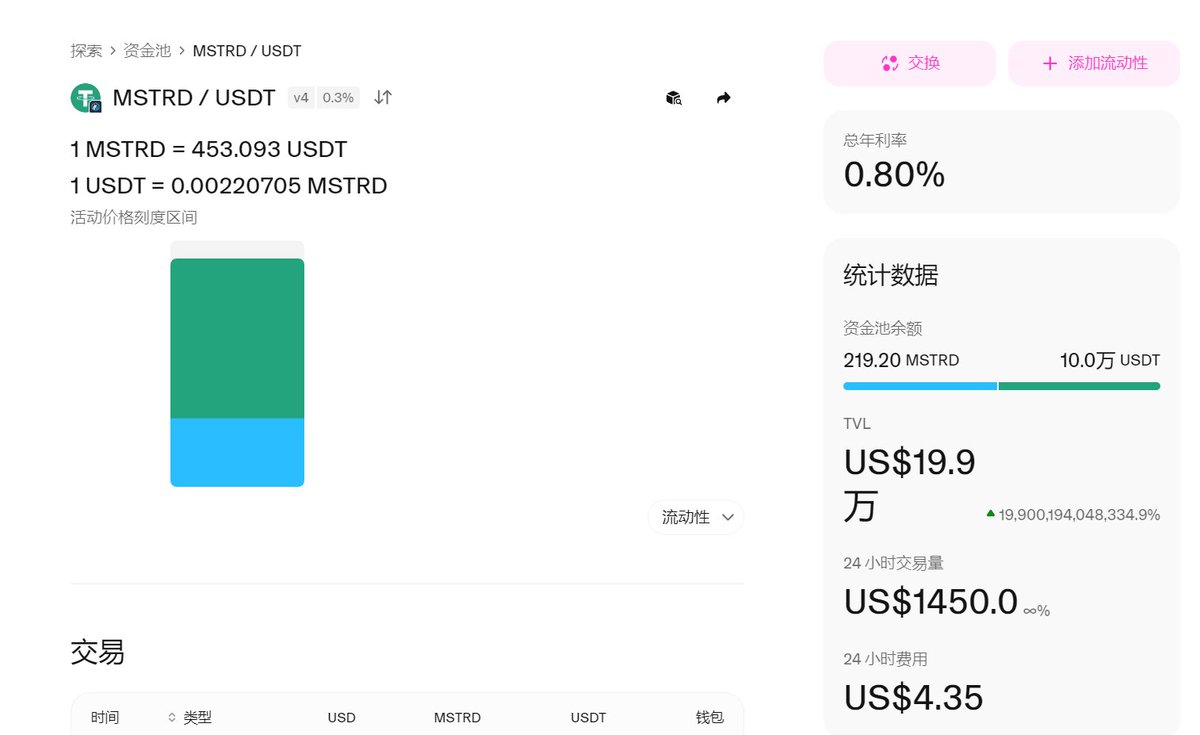

Dinari dShares stock tokens have finally opened on-chain trading channels, and currently, approximately $200,000 in liquidity has been added for MSTR.d on Arbitrum – Uniswap.

Dinari is one of the earlier projects in this batch to tokenize stocks, with the first stock token, Apple Inc. - Dinari, deployed as early as February 2024. However, it previously only operated through its official website using its issued USD+ for trading, which was relatively limited in scale.

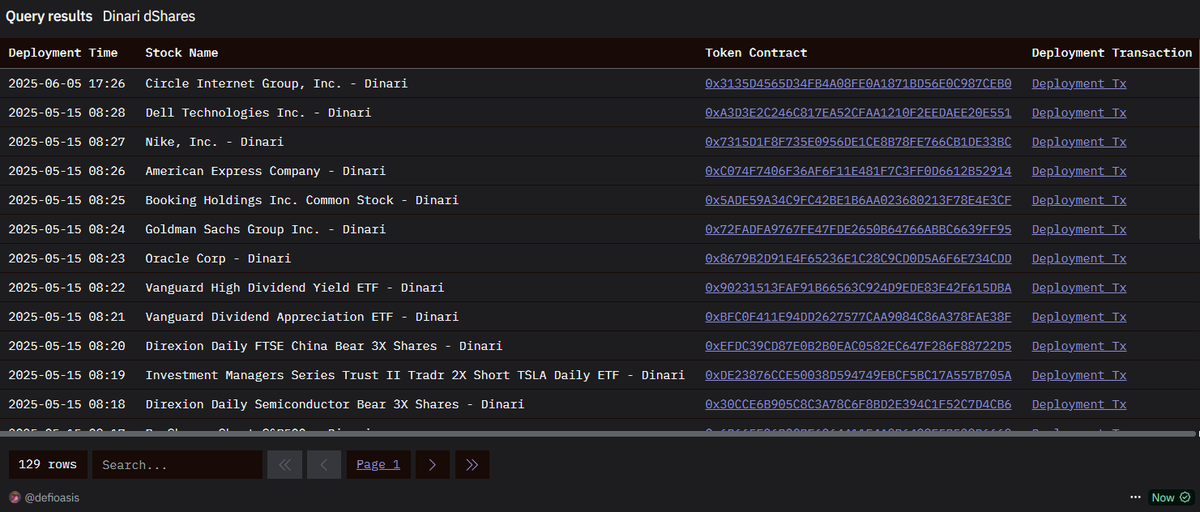

Over the past year, Dinari has deployed a total of 129 types of dShares stock tokens. These can be categorized into stock tokens, industry/asset class ETF tokens, strategy ETF tokens, and REITs tokens.

In the future, stock tokens will be mixed like the various stablecoins we see today. The key points are:

First, liquidity; who will provide the liquidity for stock tokens in terms of coin-based and USD-based liquidity;

Second, high-leverage stock token perpetual contracts, which will give rise to new on-chain perpetual trading models;

Third, distribution channels; similar to which stablecoin different exchanges use as their main trading pair. xStocks has the widest distribution channels among exchanges, including Kraken and Bybit; Dinari has Gemini; Robinhood has Robinhood EU and Bitstamp; and it is expected that Binance will support stock tokens on the BNB Chain.

Show original

1.83K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.