Embrace the main upward trend of ETH. If buying a Call seems too expensive, why not try this?

⁉️ How to construct it

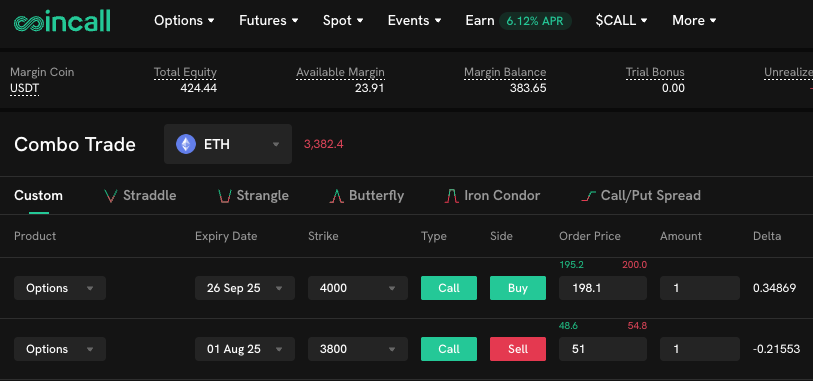

The strategy name is: call diagonal spread; as shown in the diagram, construct a 2-leg options strategy: buy 1 call at $4000 expiring on September 26, and sell 1 call at $3800 expiring on August 1 (initial premium investment of $150, with unlimited maximum profit);

🔴 Suitable for players

This is suitable for players who have a deep understanding and research of the ETH volatility surface, maintaining an overall position with +delta, and continuously shorting calls on the near end to generate cash flow and reduce leverage costs.

🆘 Risk control explanation

If there is a significant drop, a 50% loss of premium can trigger a stop loss; if there is a significant rise, the near end has gamma risk, and you can use a smart covered call to roll over.

Going long on ETH, buying calls is too costly in terms of Theta; saving money is the hard truth, give this a try!

⁉️ How to build it

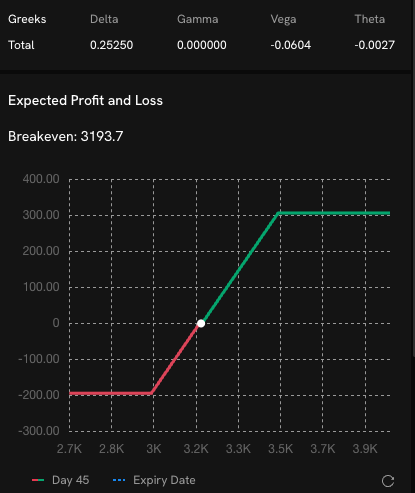

The strategy name is: long call spread (buying a bull call spread strategy); as shown in the figure below, construct a 2-leg options strategy; buy 1 call at $3000 expiring on August 29, and sell 1 call at $3500 expiring on August 29 (initial premium investment of $193, maximum profit of $306, see below for break even);

🔴 Suitable for players

Currently, the smile curve of ETH shows a clear cskew; buying naked calls to go long is very costly in terms of Theta, and the margin for error is not large enough; by using this call spread, we can see that the daily Theta consumption is only $0.004; at the same time, the -Vega exposure is only 0.06; this is very beneficial for controlling greeks in options trading!

🆘 Risk control explanation

If there is a significant drop, a 50% loss of premium can trigger a stop loss, and if there is a short-term surge above $3500, profits can be taken early.

2.95K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.