🧵 Bitcoin’s Institutional Era Is Here

Wall Street isn’t just investing in BTC—it’s restructuring around it.

$BTC is becoming a strategic reserve asset. On balance sheets, in boardrooms, and across public markets.

Here’s what our Q2 Treasury Report reveals 🧵👇

1/

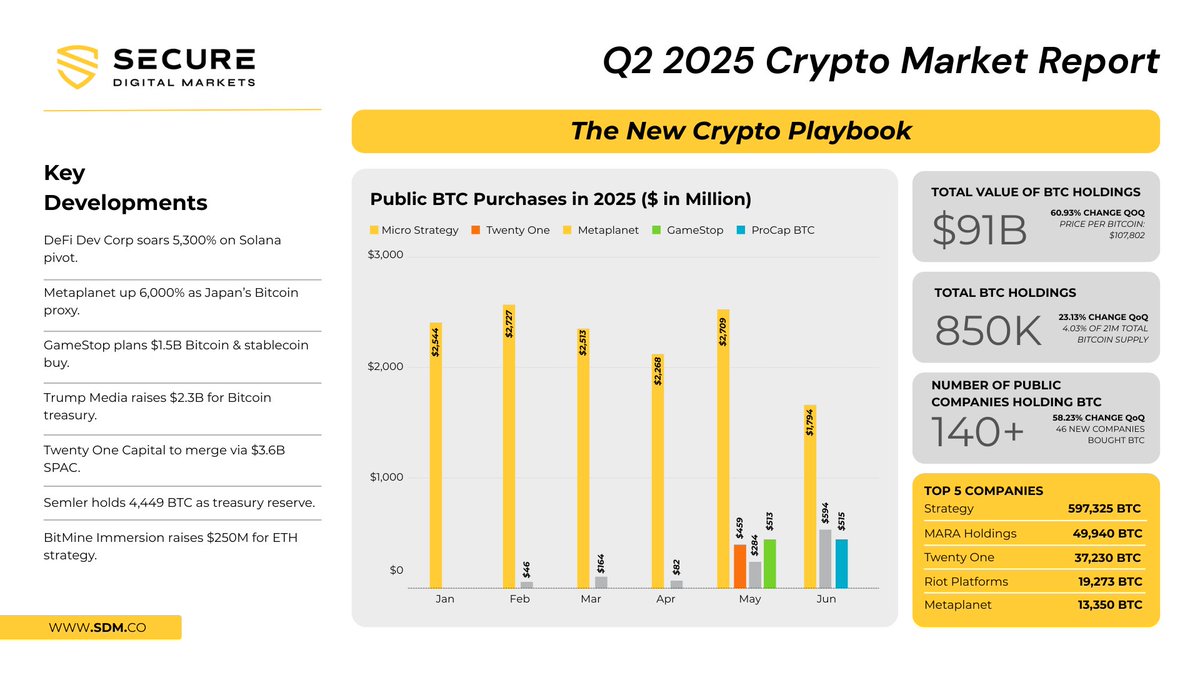

📊 $90.7B in Corporate Holdings

Public companies added 243,615 BTC in Q2—now outpacing ETFs in net accumulation.

Corporate treasuries are becoming major drivers of demand.

2/

🏦 Spot ETFs absorbing BTC 6x faster than it’s mined

With only ~900 BTC/day hitting the market. Liquidity dynamics are changing in real-time.

3/

📈 BTC Derivatives Hit $60B

Institutions aren’t speculating, they’re hedging.

A maturing market means more volatility control, and less wild risk-taking.

4/

⚖️ Regulatory Race Accelerates

- U.S.: GENIUS Act passed

- EU: MiCA finalized

- UK: Launching crypto sandboxes

Regulatory clarity is no longer a dream—it’s here, and it’s global.

5/

📉 Altcoin Bifurcation

- ETH: +34%

- SOL & XRP: strong gains

- DOGE: flatline

Smart capital is flowing to assets with proven utility and regulatory clarity.

6/

📢 Bitcoin Treasuries Go Public

Firms like Twenty One Capital and BitMine are trading at 2–5x NAV, giving investors direct exposure to BTC strategies.

11.06K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.