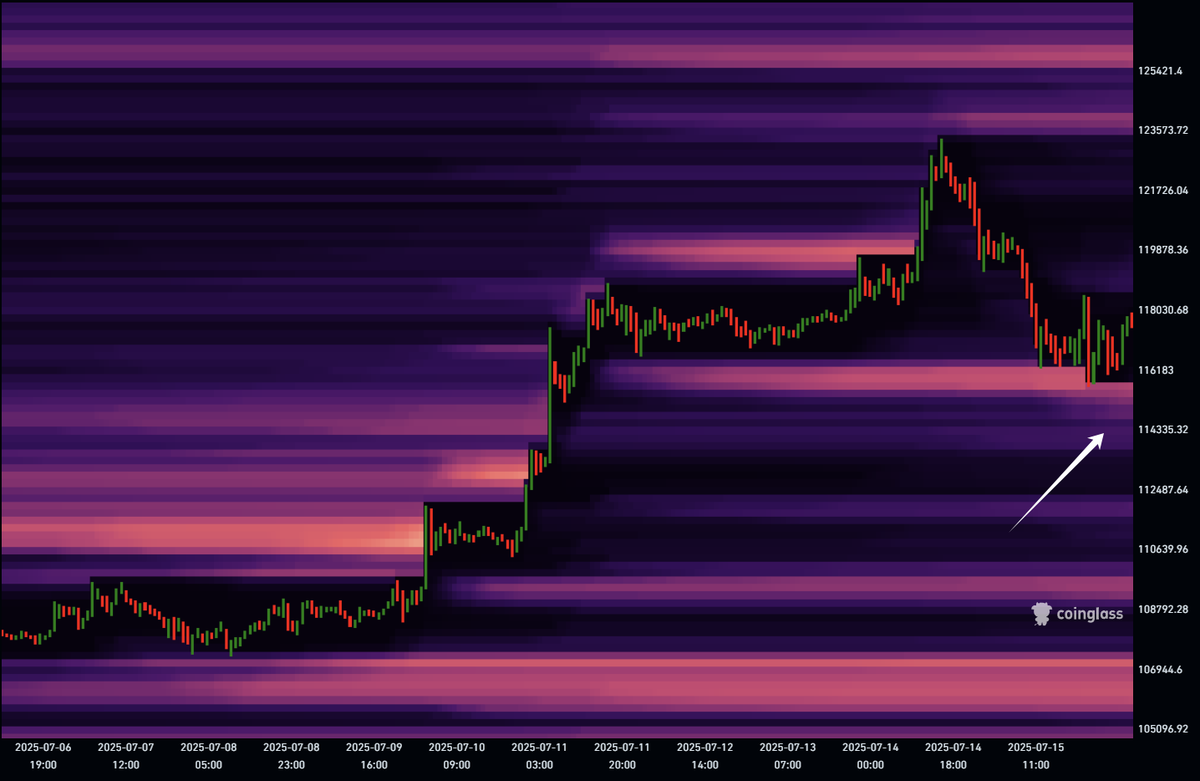

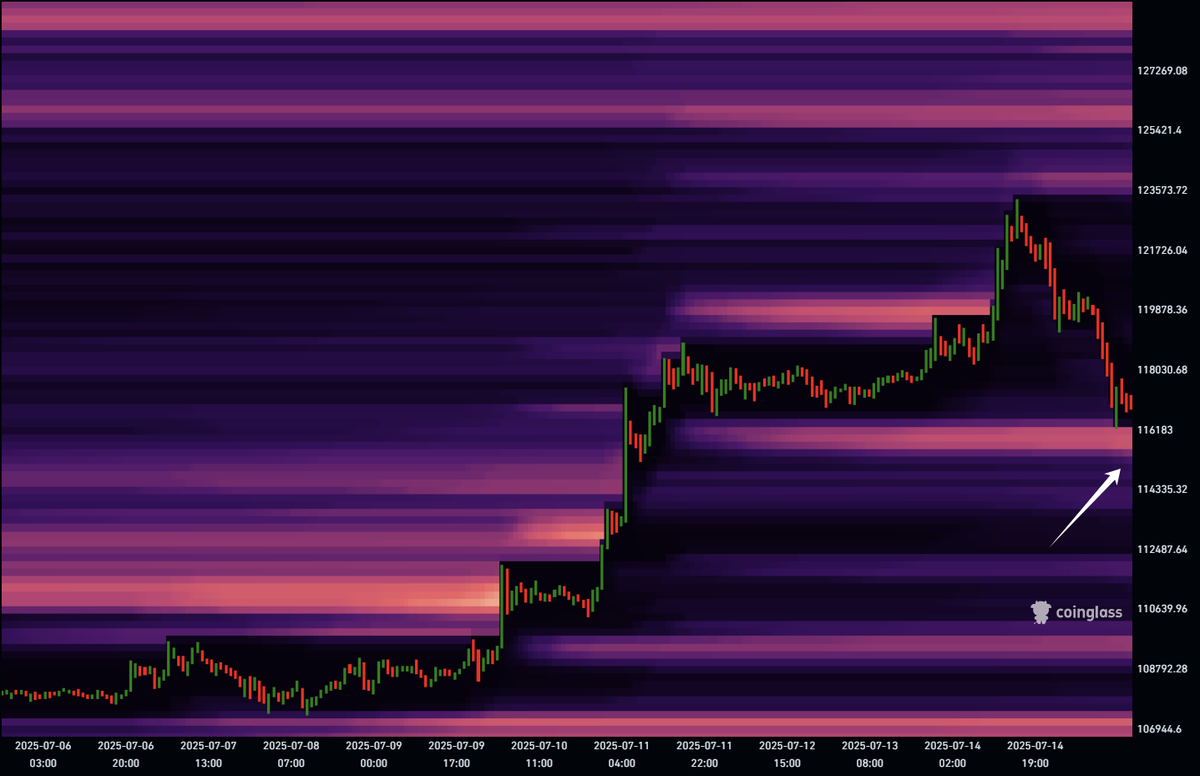

$BTC's long liquidity rebounded before it was cleared...

In the short term, there is actually the possibility of another needle downward, but the spot congo has returned to positive, and futures positions have begun to decline, and the risk of direct door drawing has now been lifted.

It's good to close out short-term longs, but the most unfavorable factor for the price rally right now is the lack of short liquidity...

So I feel that even if we can get out of a nice rally here (0.618), we will have to come down and liquidate 2 more times...

The bulls will not be scared away by a wave of pullbacks, just like the bears have been liquidated many times in a row before they become today's state of opening a small position with low leverage...

The small-level trend is still in the bearish trend, and the large-level trend is still in the bullish trend, so you can see the small rebound + pullback, but you can't see the reversal for the time being...

The diagram of the falling wedge sent earlier can be referred to ~

This liquidity analysis should be done very well today~

The liquidation area below is at 115k~113.8k, and the long position has not yet declined, which means that the short-term bulls have not surrendered, and the small-level structure is biased towards the bears, and the large-level is still conducive to the bulls, so look at a path of rapid downward decline and then recovery.

Spot copy chassis seems to be reluctant to take over before the price fills the gap...

We don't know if the giant whale will move in the short term, and it is unknown whether the CPI data is negative or bullish, so I choose to continue watching the show at this time...

If the price does not break the lower edge of the liquidation zone below for 2 consecutive tests, and there is a phenomenon that it should be cleared, then you can consider going long.

It's that in terms of probability, it's lower...

63.24K

67

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.