What happens when you burn 0.5% of a token’s liquidity every day for 2 years?

Let’s break down the deflationary mechanics of $NOVA—

A protocol that burns supply automatically and routes ETH to its treasury. 🧵👇

At launch, $NOVA has a fixed supply of 1 trillion tokens.

45% of that supply—450B NOVA—is paired with ETH in a liquidity pool.

Every 24 hours:

✅ 0.5% of the LP is removed

✅ ETH goes to the treasury

✅ NOVA is permanently burned

This creates a programmatic supply contraction—an economic flywheel that runs on code, not hype.

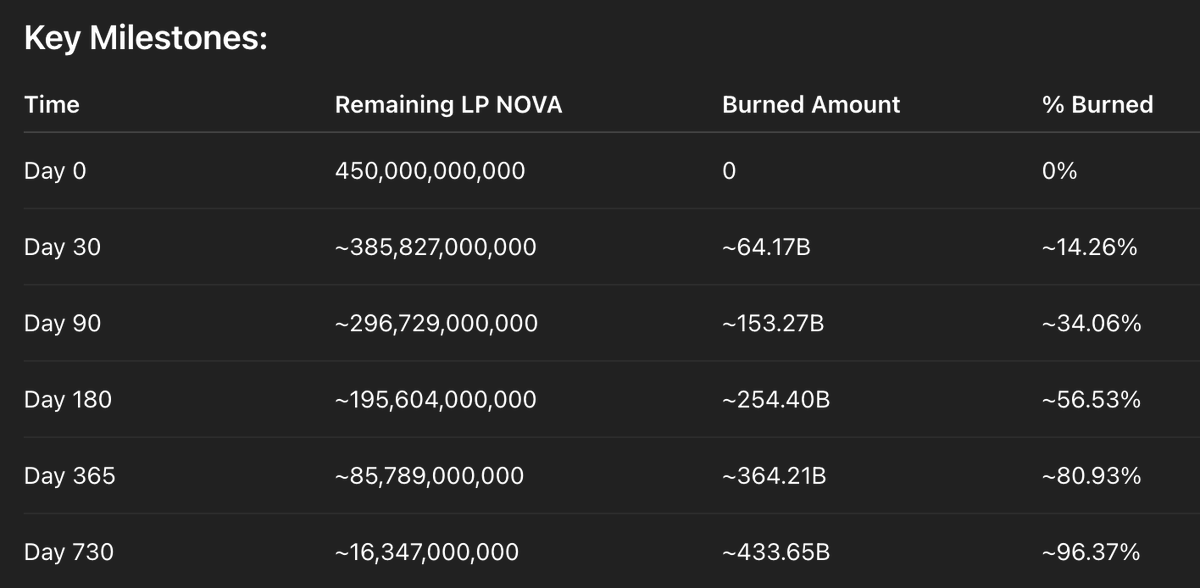

The result? A rapidly shrinking token supply and a growing ETH-backed treasury. What does that look like over time?

But remember: only the LP supply is burned. The rest (LGE, team, treasury) is untouched.

So the total supply drops from 1T → ~566B by year 2.

Scarcity is built-in. No staking. No emissions. Just an ever-tightening float.

Meanwhile, ETH from the LP is funneled into the treasury.

This growing ETH base becomes the intrinsic backing for every remaining $NOVA token—

A dynamic value floor that increases over time as supply shrinks.

1.31K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.