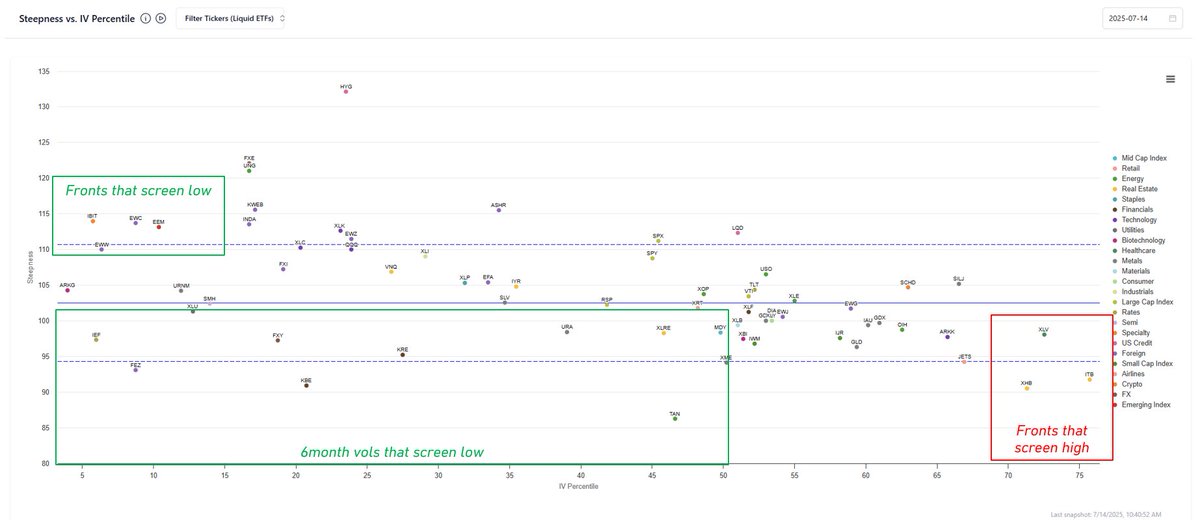

Poking around the Dashboard today at ETF vols

No deferred vols look high, a lot of vega premium absent in the market.

Some place to look dependng if you're looking to hedge or buy vol or a few places of gamma that look a bit rich

Both @Ksidiii & @bennpeifert have mentioned how neard dated SPX calls have been for sale and have very little if any vol premium in them (benn was recently on @Alpha_Ex_LLC )

Those calls could be interesting to own vs some of the calls that screen rich

A word on the view above...that's what I call the top-of-funnel where you start with some candidates depending on your bias to buy/sell (or if you relative value trade that's a good view and the one it was born from but also rv trades are more brain damage)

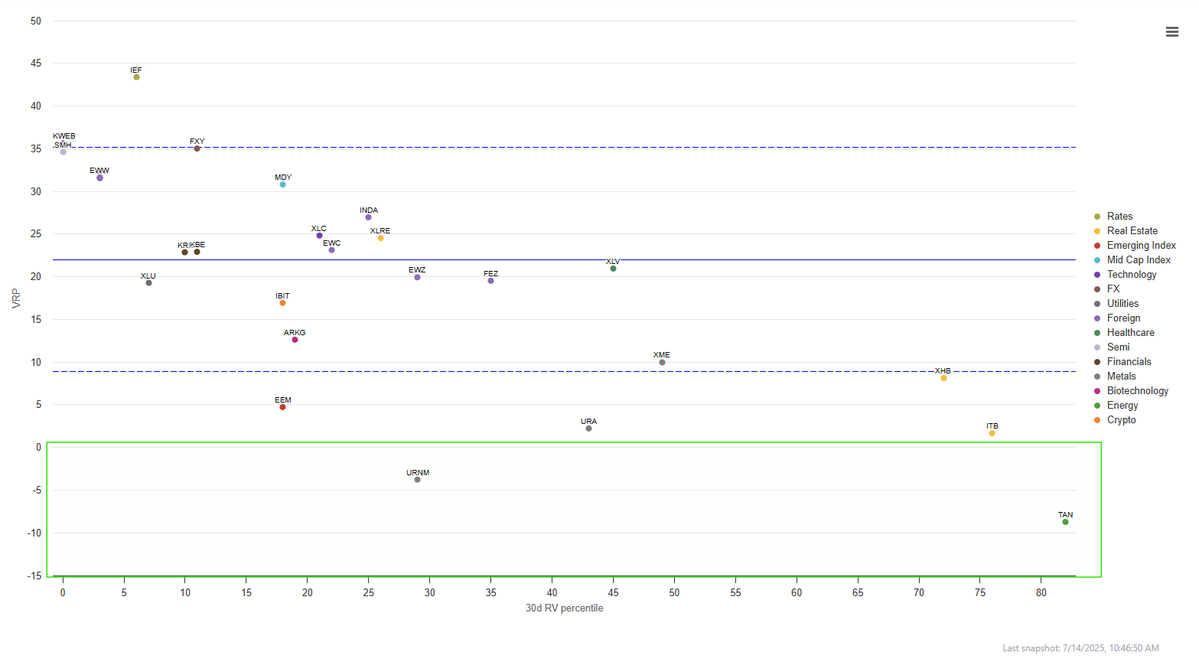

From there you could take the candidates and look at how they're priced compared to realized vol

Used an LLM to extract the names from pic

Then just look at those VRPs

(bottom left is the best for a buyer...low or neg VRP AND low RV percentile so room to go up so you can win 2 ways...uper right is opposite logic. Note market is pretty smart....the names that screen high on vol have low VRP...bottom right)

Once you have a picture of what your interested in then you can zoom in further onto the skew pages and the scanner pages which show how vol is doing today cross sectionally and across term structure (i think of this as execution tool -- "is today a good day to give liquidity?")

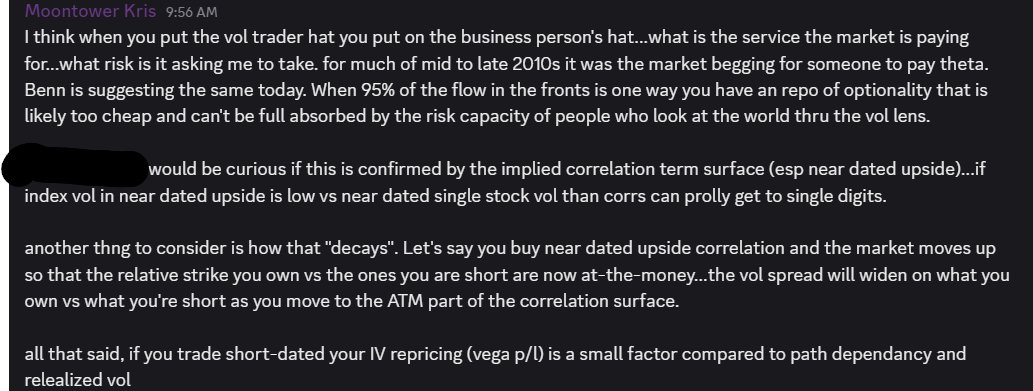

Finally just a though I dropped in the discord riffing off the low index call vols kris and benn speak of

thursday's paid post is going to be about the tradeoff in term structure vs VRP... a way to think about the common understanding that buying time spreads is a hedged way to sell vol risk premia, but the cost is "shadow theta" on the roll down on the premium deferred vol

21.19K

76

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.