16:10 - Siam: "If Templar or IOTA gets decentralized training running, centralized AI is toast."

Correct.

Few actually understand this.

Bitcoin showed us how to align incentives to focus world GPU.

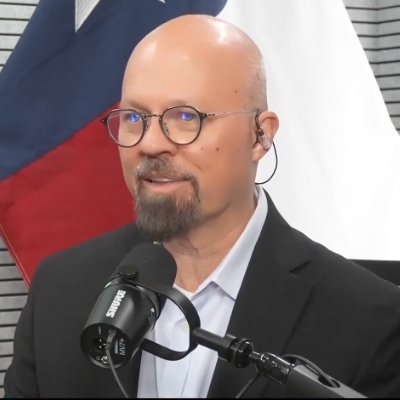

Ventura Labs Ep. 52 - Siam Kidd

Siam Kidd (@SiamKidd), Co-Founder & CIO of DSV Fund (@dsvfund), the world's first hedge fund exclusively focused on Bittensor.

Timestamps:

1:41 – Introduction

2:28 – Welcome Siam Kidd

2:50 – How Siam Kidd discovered Bittensor

4:24 – Investing in virgin landscapes in tech booms

6:44 – Subnets as AI startups under the Bittensor umbrella

8:57 – Why Bittensor isn’t “just crypto”

10:51 – Subnets’ role: public challenges & incentive mechanisms

13:01 – Island infrastructure analogy for Bittensor

15:20 – Phases 1–3: infrastructure → businesses → apps

16:10 – The value of moonshot projects (Templar, IOTA)

18:34 – Centralized vs. decentralized AI compute challenges

19:58 – Core AI stack: energy, data, training & deployment

22:08 – Mapping existing subnets to core infrastructure layers

24:00 – My subnet evaluation framework & criteria

27:20 – Emissions patterns & buy-pressure analysis

29:11 – Emissions growth & alpha-holder concentration

31:01 – Social-media presence & team health checks

32:56 – Founder reputation & handling community feedback

39:21 – dTAO subnet cap & its impact on the ecosystem

41:02 – Outro & Part 1 wrap-up

4.83K

40

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.