In just a few weeks, @infinifilabs broke through $50M in TVL.

This reinforces my belief the YTs are being undervalued on @pendle_fi.

I did some math 🧵👇

We know Season 1 will be six months.

We also have a good idea of what points will look like then, since we have multipliers and weighting.

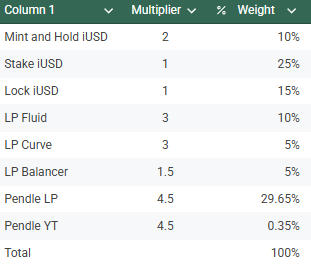

• Hold iUSD: 2x 10%

• Stake iUSD 1x 25%

• Lock iUSD 1x 15%

• LP Fluid/Curve 3x 10%

• LP Bal: 5%

• Pendle: 4.5x 30%

We can then extrapolate total points using an average TVL estimate.

Previously, I was estimating 50M average (linear climb to $100M), but I was clearly way too bearish.

Now I'm assuming $100M average.

That would mean 8.7M points generated. The lion's share going to @pendle_fi

Now we can estimate the airdrop value (%FDV) and divide it by that 8.7M.

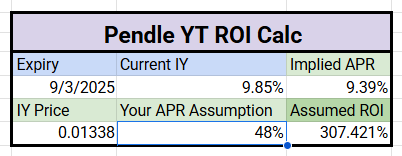

We get IY by multiplying point value by 4.5 (multiplier), then dividing it by 1,000.

We divide by 1,000 since 1,000 gets a "point per day" (times any multiplier), annualizing by multiplying by 365.

Right now, the YT would be a 300% ROI at a very conservative 50M FDV.

At my assumed 200-300M TVL, that would be an insane 1:4 to 1:6 FDV to TVL ratio.

Most stablecoin protocols are 1:1 to 1:3.

Those would generate anywhere from a 5x to a 15x on the YT.

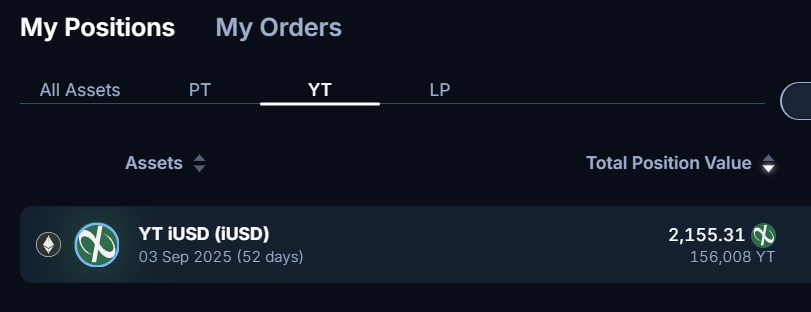

And that's why the YT iUSD was the first YT I've purchased since EtherFi S2.

What was that, like a year ago? It's so hard to remember time in DeFi.

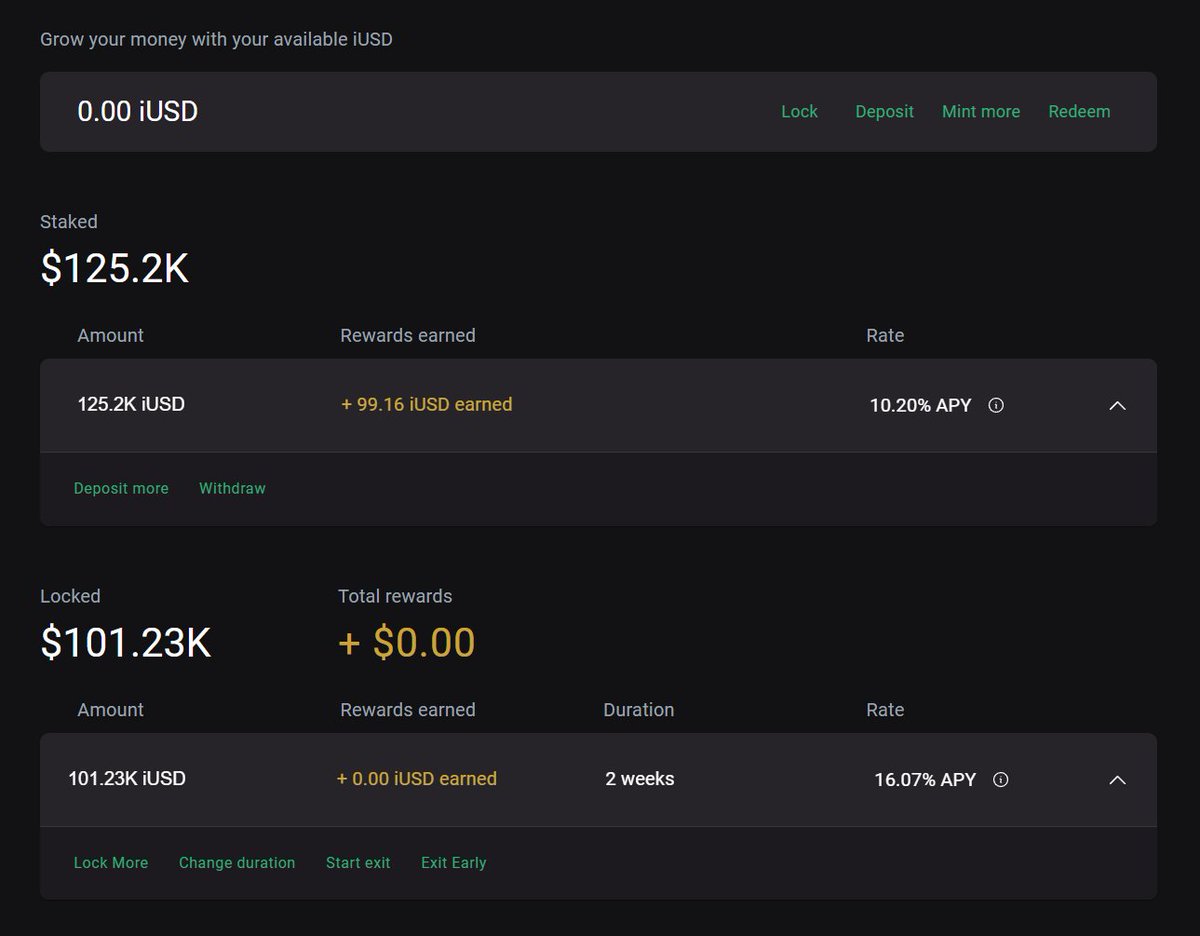

I should also note, I just actually like the infinifi product.

The senior tranche is a slightly better lending aggregator yield plus points.

It's USDC in / USDC out and 6-9% APR.

liUSD is basically a Pendle PT aggregator with way more flexibility.

Anywho, please feel free to audit my math!

I love when people add to the points speculation conversation.

One thing to note is that just because S1 is six months doesn't mean TGE will be exactly after S1.

I hope it is, but I know how DeFi works, delays should be expected.

26.76K

106

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.