DeFi Lending Market Insight – July 2025

How has the DeFi lending market evolved over the past 6 months? What key trends and shifts are we seeing now?

Here’s a quick thread with data, insights, and what it means moving forward 👇

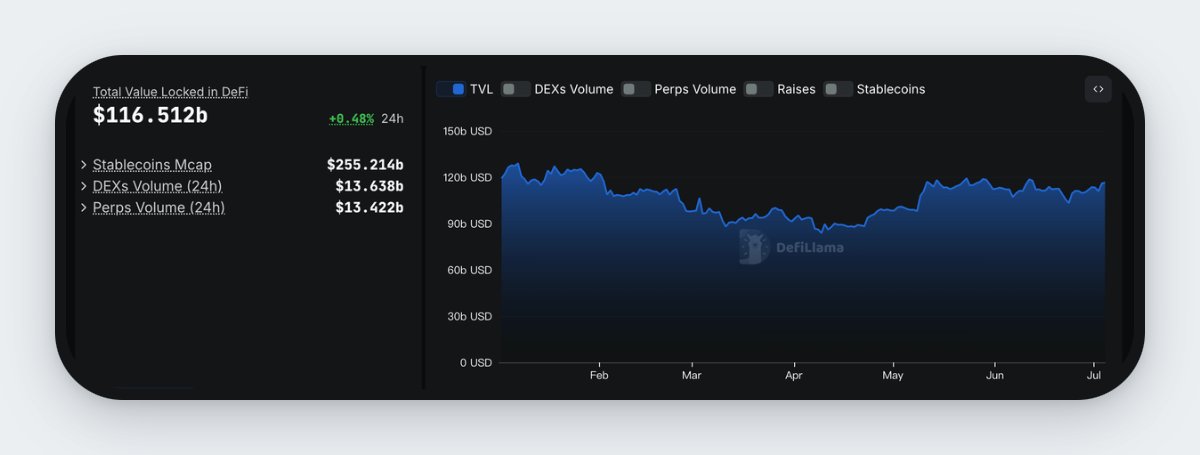

1️⃣ Market Overview

According to DeFiLlama, DeFi TVL dropped from $120B → $80B in April, but has since rebounded to $116B.

This volatility signals renewed capital inflows, improved stablecoin liquidity, and a return of risk appetite — but also reveals the market’s sensitivity to macro pressure.

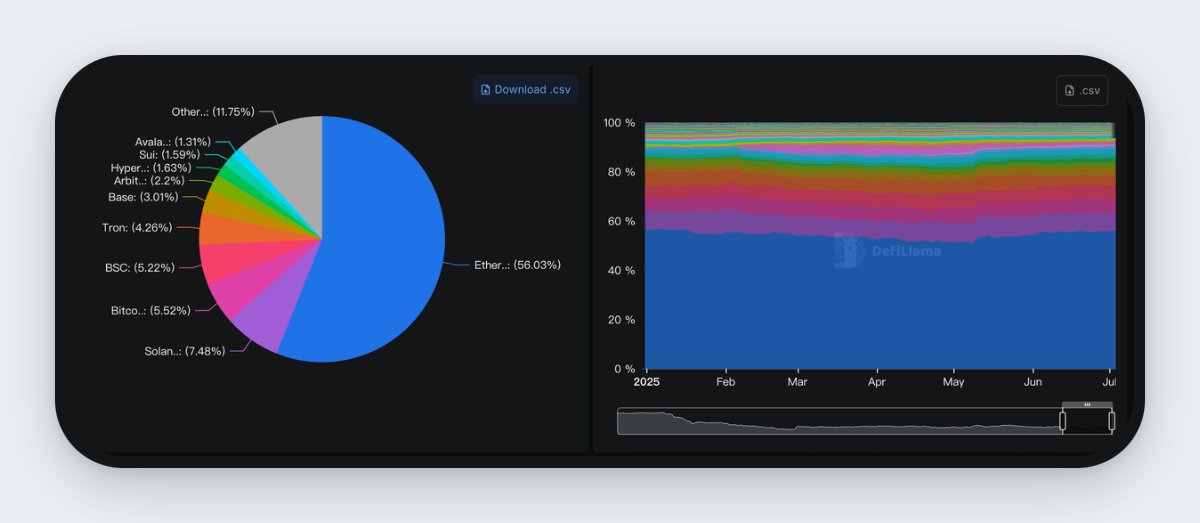

2️⃣ Fragmented Chains, Friction Everywhere

Ethereum remains DeFi’s dominant base, holding over 56%+ of total TVL. In contrast, Bitcoin accounts for just around ~5.5%, despite its massive liquidity.

DeFi is still chain-siloed — assets are trapped, and capital flow is inefficient.

LiquidiumFi is building towards a change.

3️⃣ Lending Leaders: AAVE Still Dominates, Morpho IsRising

The total TVL of lending protocols is ~$56B. And AAVE accounts for about 50%.

Top protocols by TVL:

•Aave: $26.21B

•Morpho: $4.35B

•JustLend: $3.74B

But all remain chain-contained — no native cross-chain lending.

4️⃣ LiquidiumFi: Unlock the potential of sleeping BTC

LiquidiumFi enables decentralized, native borrowing and lending across Bitcoin, Ethereum, and Solana — without bridges, wrapped assets, or custodians.

Users can:

•Supply ETH, borrow BTC

•Supply BTC, borrow USDC

•All without ever leaving Layer-1

8.51K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.