The Fastest Revenue Scalers are in Crypto

Crypto revenue velocity has increased as the ecosystem has evolved from protocols to applications that scale trading attention and monetizing market volatility.

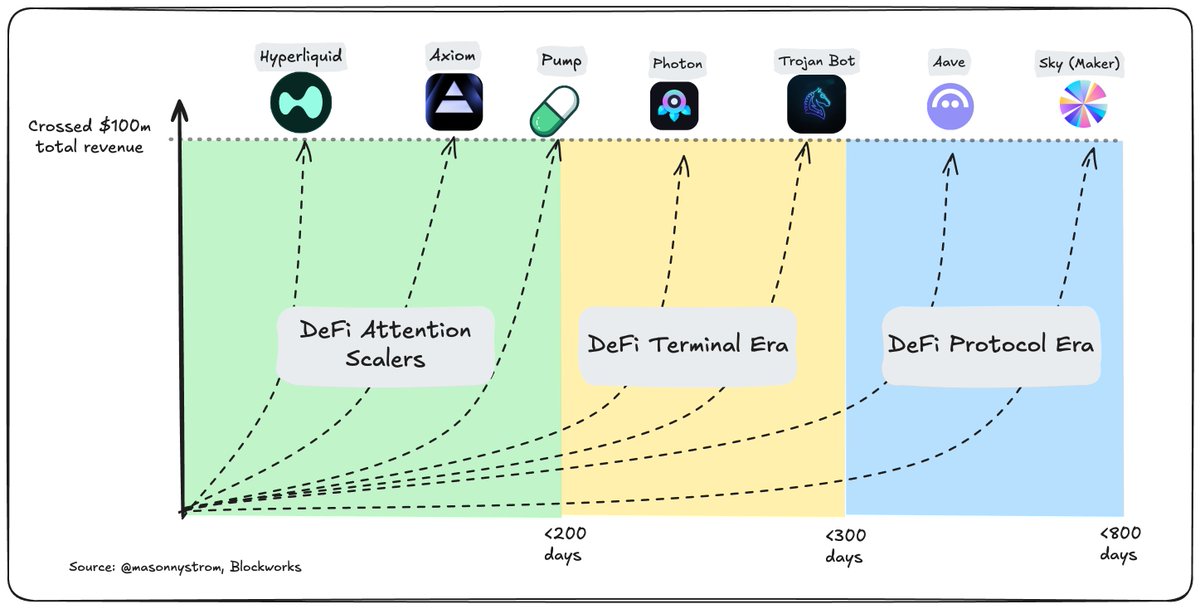

DeFi Protocol Era – crypto companies have historically been very fast at generating revenue, with even initial DeFi protocols like Maker and Aave hitting $100m in cumulative revenue within years of monetizing.

DeFi Terminal Era – trading terminals have compounded the rate at which applications in crypto earn revenue by providing convenience and better discovery experiences for trading.

DeFi Attention Scalers – Apps like Pump, Axiom, and Hyperliquid have more efficiently monetized attention by focusing on rapid product iteration to maximize surface area of products including, spot, perps, leverage, yield, new market contracts, hyper-specific discovery tools, and social products. All of this has been in service of the goal – provide the best product that allows people to trade attention and market volatility.

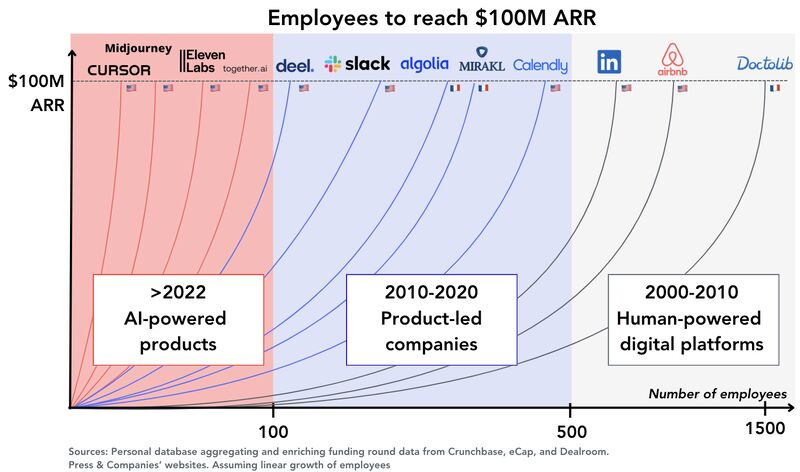

This growth of revenue velocity isn't unique to crypto. It's happening more broadly across tech with traditional SaaS having similarly undergone a transition of explosive revenue velocity in shorter periods of time with more efficient workforces.

The driver for SaaS has been the transition towards product-led companies that now leverage AI-first products that have seen unprecedented usage.

Where do crypto revenue scalers go from here?

Crypto has yet to fully capitalize on leveraging AI within trading and market creation. I expect that a new wave of DeFi Attention Scalers will emerge over time as new apps are able to more effectively use AI to provide curated experiences. This may look like better discovery for prediction markets, social-integrated trading, or otherwise embedding AI-discovery tooling to enable new trading interfaces and token issuance platforms.

In a world where all assets are moving onchain, the quantity of assets is going to 100x, and the programmability of those assets leads to more derivatives, the question for users quickly becomes "what should a buy?".

The application that provides the most compelling answer to users wins.

9.71K

65

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.