🚨LDO - The most sustainable growth model in Ethereum eco

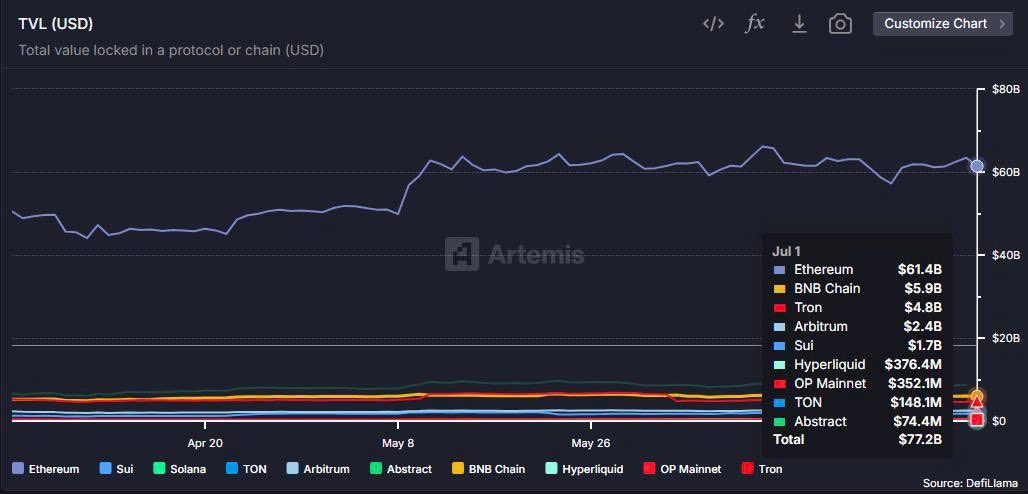

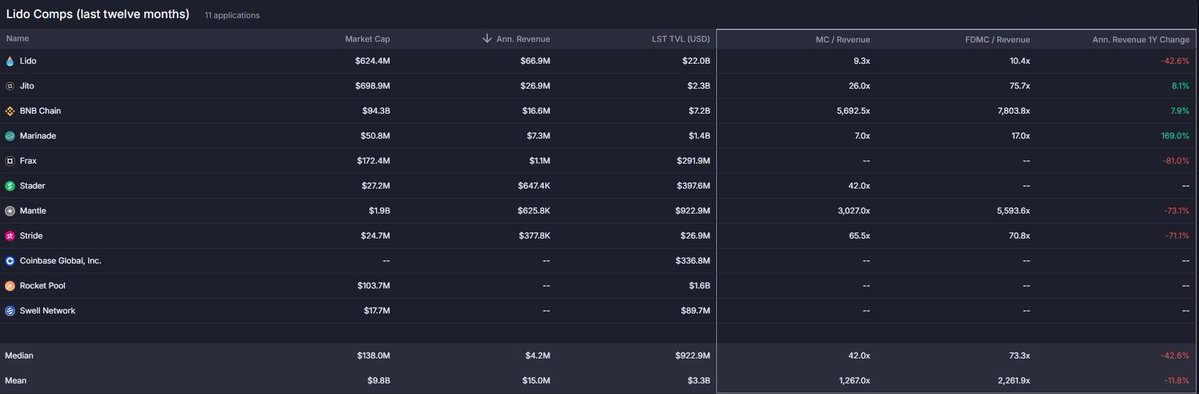

✨If ETH can break the $7,500 mark in the next few years, Lido could generate $120M–$194M in earnings per year, compared to a loss of $114M in 2022. This is the classic leverage effect with fixed costs, profits directly proportional to the price of ETH.

✨Importantly, Lido does not need to expand operating costs to increase profits like traditional markets. No additional personnel, no farm opening, no need for user incentives. Revenue comes from collecting fees from ETH staking, as long as the cash flow is still in ETH.

✨While a project that has not yet been released on the chain has been valued at several billion USD, a model with stable revenue like LDO only has a capitalization of $600M with 90% of the tokens unlocked.

👉🏻If you book $ETH will reach $10k–$15k in the next few years, then booking for $LDO looks more "delicious" than the entire Ethereum eco.

Show original

44.63K

67

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.