Weekly DeFi Insights #1

1. @pendle_fi

Pendle hit a new milestone with $4.8B TVL, driven by stablecoin demand (87% of TVL). Recent upgrades like Boros, Morpho collateral integration, and seamless Aave yield rollovers strengthen its infrastructure. Regulatory clarity (GENIUS Act) and upcoming Fed rate cuts may further boost institutional adoption. Current strategies offer APYs from 13.14% fixed to leveraged rewards up to 768% APY via Aegis. Analysts are bullish on Pendle’s ability to bridge TradFi and DeFi yields, despite low protocol revenue.

2. @aave

Aave now holds 5% of global stablecoin supply with a record $25B TVL. The upcoming Aave V4 upgrade features unified cross-chain liquidity and risk management improvements. Its stablecoin (GHO) reached a $220M market cap, introducing liquid staking (sGHO) and upcoming stkGHO for extra yield. Aave remains positioned strongly amid regulatory tailwinds and broader DeFi resurgence.

3. @JupiterExchange

Jupiter Exchange expanded with Jup Studio and acquired Moonshot for memecoin launches, sparking community criticism. Strategic integrations now include tokenized equities and institutional partnerships (Anchorage, Kamino). Jupiter maintains Solana DeFi dominance ($1B daily perp trading) but faces backlash on token ratings and memecoin focus.

4. @ethena_labs

Ethena’s $USDe stablecoin thrives despite anticipated Fed rate cuts that could hurt traditional stablecoins. It achieved a $6.7B TVL, $400M+ revenue, and offers attractive fixed yields (7.5-8.5% APY) via Ethena PTs. Strategic collaboration with Converge expands tokenized asset offerings, positioning Ethena strongly in the evolving DeFi landscape amid regulatory discussions.

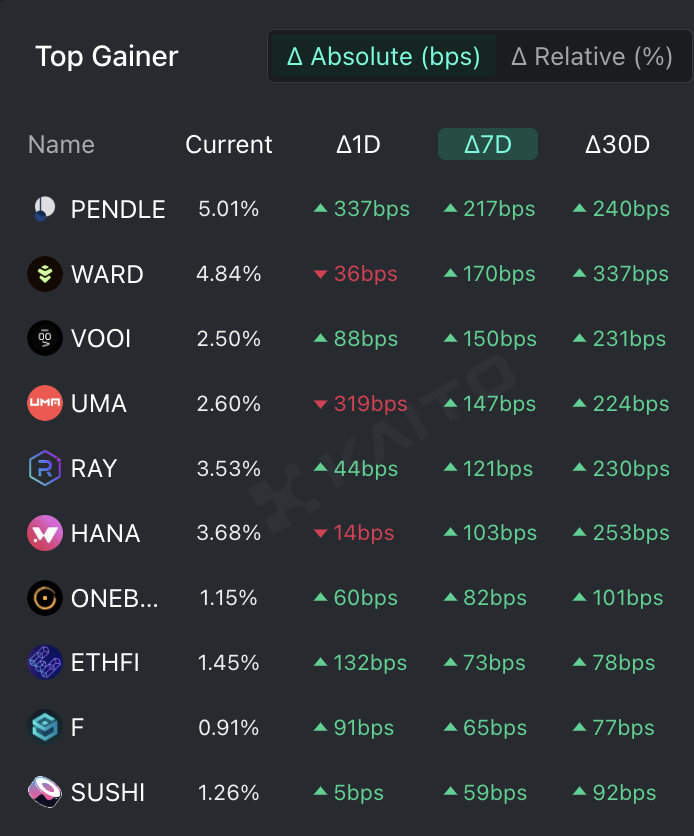

Top Gainers:

$PENDLE

$WARD

$VOOI

$UMA

$RAY

6.7K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.