➥ How Will Potential Interest Rate Cuts Affect Stablecoins?

In the first half of 2025 alone, we have seen the launch of many stablecoins with different mechanics and backing assets.

However, potential upcoming interest rate cuts might present a new challenge for stablecoins issuers.

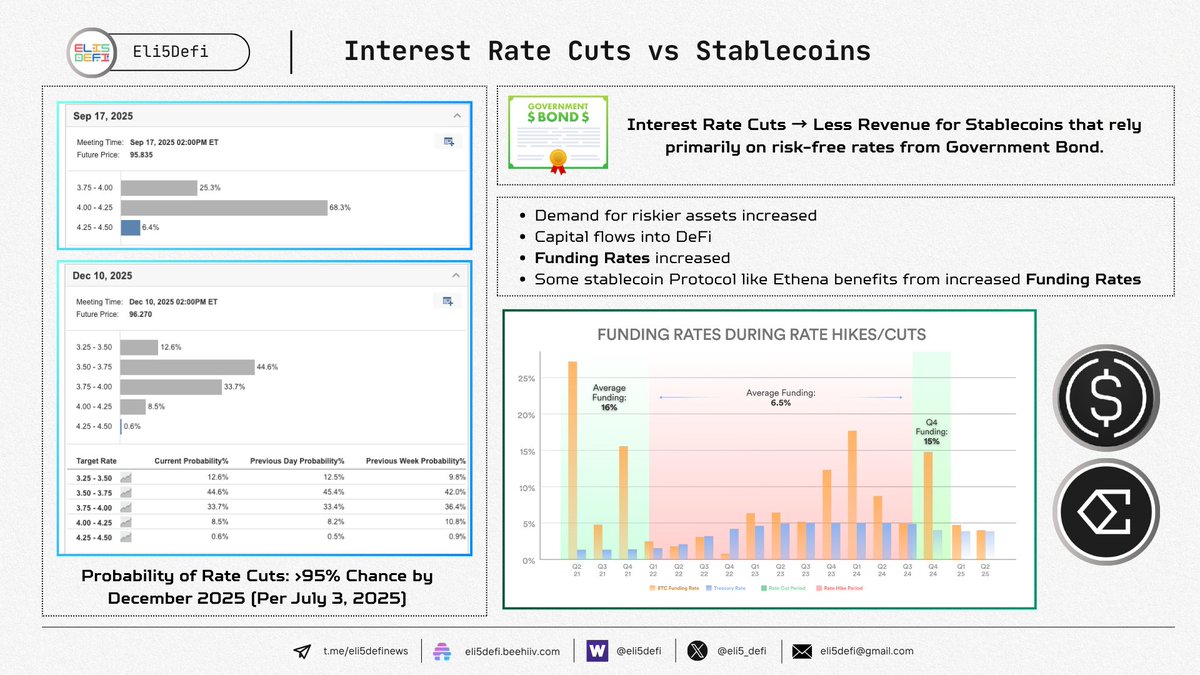

Rate cuts will likely reduce revenues for stablecoin issuers, especially those that rely primarily on risk-free rates from U.S. Treasuries (government debt) like Tether, Circle and other some RWA-based stablecoins.

Imagine this:

→ You mint $1,000 USDC/USDT

→ Issuers keep your $1000 and buy short-term U.S. Treasuries

→ If interest = 4.5%, they earn ~$45/year on your deposit (that's billions of revenue btw if you refer to their marketcap)

→ If interest rate dropped to 1-2% = ~$10-$20/year, around a 60-80% drop in income

This may benefit DeFi borrowers but could prompt issuers to adjust to the low-inflation environment, as their highly profitable business could see diminished revenues.

However, for some stablecoin issuers like @ethena_labs, this is their moment to shine.

Ethena's stablecoin, $USDe, thrives in low inflation by offering yields independent of traditional bank rates, thanks to staking rewards and funding rates.

Plus, $USDe is versatile, user can utilize it across major chains and DeFi protocols to boost their yield on top of the base yield.

In essence, when interest rates drop:

→ Demand for riskier assets rises

→ Capital flows into DeFi, pushing up funding rates (i.e.: +15% in December 2024 as rates cut to 4.25%-4.5%)

→ Ethena's protocol revenue climbs, yield sustained.

---

— Wrap-Up

Ethena's revenue has surged past $400M, with TVL climbing over $6.7B. The future looks bright for DeFi, as a low-interest rate climate could be the perfect spark for stablecoin protocols to discover new revenue streams, moving beyond their past dependency on risk-free rates.

Honestly, we may be in the "All at Once" phase following the "Slowly, Then All at Once" trajectory.

DeFi is destined to win.

8.08K

106

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.