One of the top @Aptos DeFi strategies right now:

• Stake APT → sthAPT on @ThalaLabs

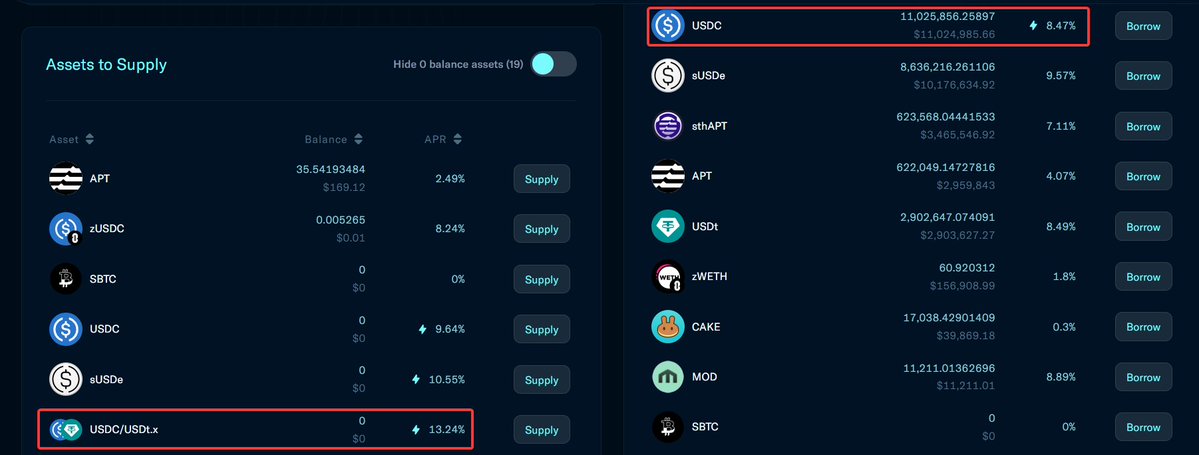

• Use sthAPT as collateral to borrow USDC at 8.61% APR on Echelon

• LP USDC/USDT → xLPT

• Supply xLPT for 12.83% APR

• Loop

Reach ~30% net yield on stables + farm more Echelon Points ⚡️

Aptos 101: Easy Farming

⇥ Mint sthAPT on @ThalaLabs (liquid staking token)

⇥ Supply it on @EchelonMarket for ~7.5% APR and earn Echelon Points

⇥ Borrow USDC on Echelon using your sthAPT as collateral

⇥ Head back to Thala and LP USDC/USDT

⇥ Stake your LP tokens on Thala to receive xLPT

⇥ Supply xLPT on Echelon for ~13% APR

⇥ You can loop your stable exposure if you want

Right now, Aptos ecosystem basically pays you to borrow money, farm the Echelon airdrop, and grow your onchain activity.

By combining liquid staking, supplying, borrowing, and LP farming, you're signaling strong on-chain participation...something that could boost your chances for @shelbyserves airdrop.

Nothing is confirmed for Shelby yet, but this is the perfect time to lean in and build that on-chain footprint on Aptos.

11.75K

29

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.