Alright, let’s dive into a🧵about $OGN, the native token of @OriginProtocol, and the game-changing buyback program that’s fueling positive pressure and momentum for token holders and stakers (xOGN).

Here’s the breakdown:

1/ What’s the $OGN Buyback Buzz? 📳

Origin Protocol has committed 100% of its protocol revenue and millions of $ in DAO assets to buy back $OGN on the open market. This started June 30, 2025, and it’s a massive shift toward real yield from revenues, not token emissions.

2/ Why Buybacks Matter:

Buybacks reduce the circulating supply of $OGN, creating scarcity that can drive token value higher. With 5-10% of the circulating supply targeted, this adds serious buy pressure—potentially boosting prices as demand grows. No new token emissions mean no dilution either!

3/ Impact on OGN Holders:

For $OGN holders, this is huge. Reduced supply + increased demand from buybacks can stabilize and potentially increase token prices. The market’s seeing $4.5M+ in new buy pressure, signaling confidence in Origin’s future.

4/ xOGN Stakers: The Big Winners🥇🤑

Stakers who lock $OGN for xOGN get a direct share of the protocol’s success. All bought-back $OGN is distributed to xOGN holders, boosting staking rewards. Early stakers could see double-digit APYs as protocol revenue scales with TVL.

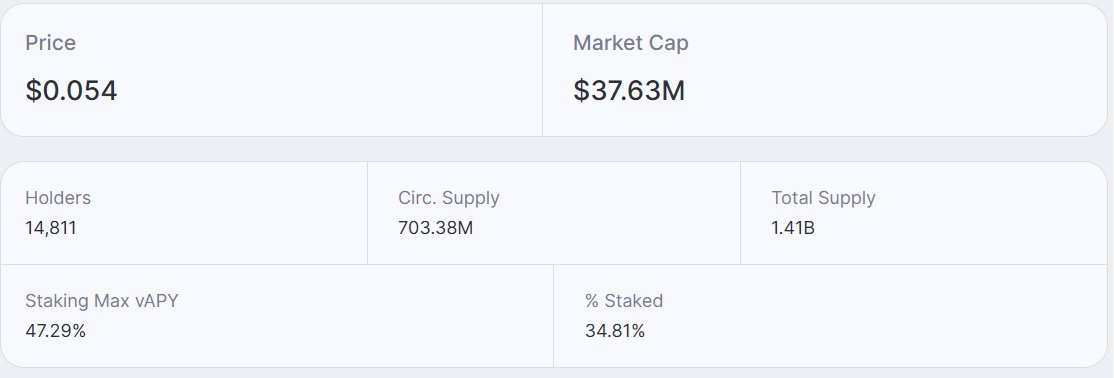

Current staking max vAPY is already at 47.3% with 34.8% of OGN supply staked.

More stats:

5/ The Flywheel Effect ⚙️🔄

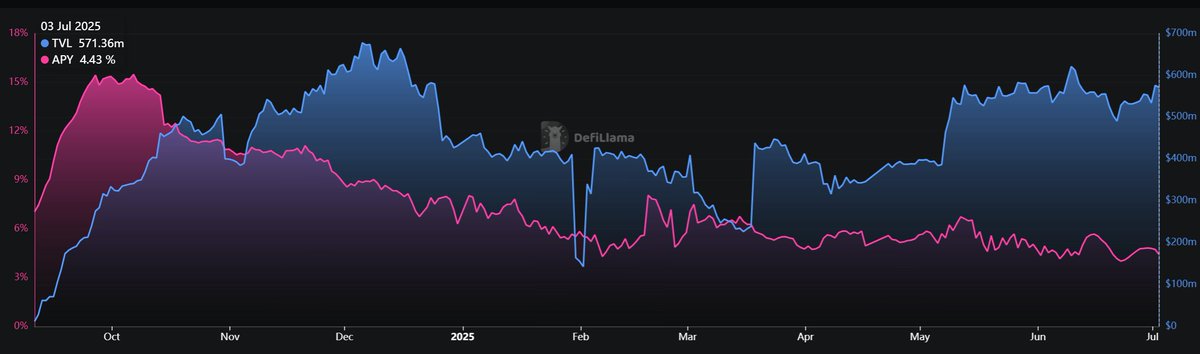

Origin’s products ( $OETH, $OUSD, Super $OETH) generate real yield. As TVL grows, protocol revenue increases, fueling more buybacks. This creates a virtuous cycle: more revenue → more $OGN buybacks → higher rewards for xOGN stakers → stronger token demand.

6/ For instance, Super $OETH on Base has seen tremendous growth this year, surpassing $500m in TVL while offering a consistently high staking APY above 4%, which is significantly higher than competing ETH liquid staking products.

7/ No Inflation, Just Real Cashflow 💸✅

Unlike many projects, Origin’s buybacks are funded by real protocol revenue, not new token minting. This transparent, sustainable model aligns token value with protocol growth, making $OGN a compelling long-term hold.

6.95K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.