BTCFi Alpha File #01

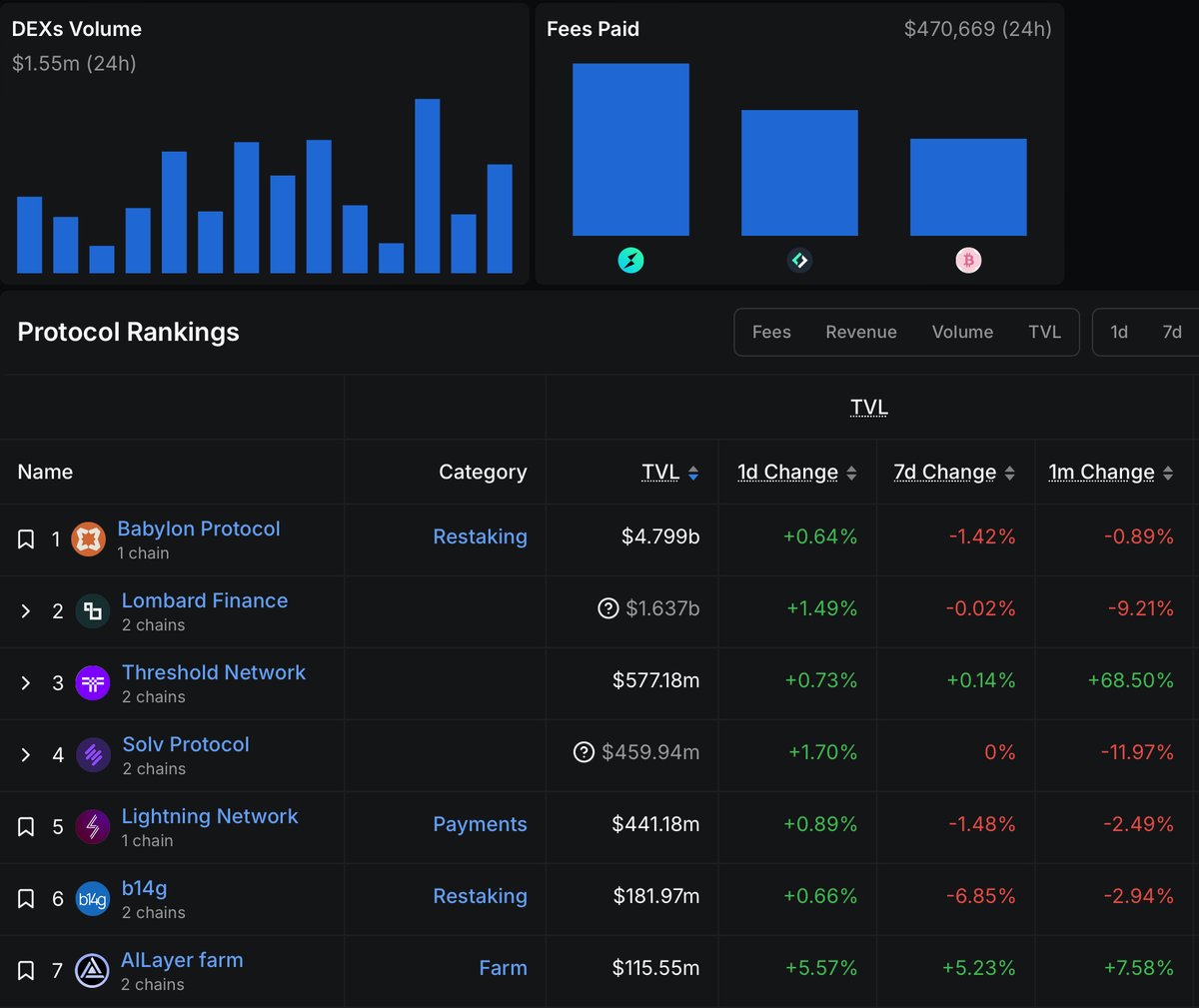

TVL in the BTCFi ecosystem surged 543% YoY, from $987M on July 1, 2024 to $6.35B today.

And this wasn’t a wave driven by airdrop meta or fleeting narrative hype.

It’s the result of deep infrastructure:

> Timestamp finality

> LST abstraction

> Modular security layers

These aren’t just built for Bitcoin, they’re built into it.

Under the hood? A stack of protocols solving structural limits of Bitcoin’s base design.

This is Bitcoin, re-architected for DeFi.

◢ Here are my top BTCFi protocol picks:

1️⃣ @babylonlabs_io

TVL: $4.8B

Narrative: Bitcoin-native restaking.

Babylon enables self-custodial $BTC staking using timestamp proofs. $BTC stays on L1, but secures PoS chains and earns $BABY rewards.

Why It’s Unique:

• No bridges or wrapped $BTC

• Native restaking using Bitcoin’s consensus

• 80% of BTCFi TVL flows through it

Babylon made BTC restaking trustless and composable.

2️⃣ @Lombard_Finance

TVL: $1.63B

Narrative: Liquid staking + yield vaults.

Built atop Babylon, Lombard issues $LBTC and deploys it across DeFi strategies (@Morpholabs, @pendle_fi, and DEXs) via vaults on chains like Ethereum, Sui, and Berachain.

Why It’s Unique:

• Unlocks liquidity for staked $BTC

• Integrates with real yield markets

• Cross-chain from day one

Lombard turns $BTC into productive, composable capital.

3️⃣ @SolvProtocol

TVL: $461M

Narrative: Cross-chain BTC liquidity abstraction.

Solv introduces $SolvBTC and SolvBTC.LSTs, which can be staked across @babylonlabs_io, @eigenlayer, and @symbioticfi. The Staking Abstraction Layer (SAL) coordinates validator routing, LST issuance, and yield flows.

Why It’s Unique:

• Dual-reserve $BTC architecture

• SAL abstracts staking infrastructure

• Interoperable by default

Solv builds the abstraction layer Ethereum’s $BTC bridges never had.

4️⃣ @b14g_network

TVL: $182M

Narrative: Modular restaking with dual-token security.

Users stake both BTC and the b14g token, aligning incentives and allowing protocols to plug into customizable restaking layers.

Why It’s Unique:

• Dual-token model reduces sell pressure

• Modular security design

• Sustainable tokenomics from inception

b14g expands the BTCFi design surface with restaking flexibility.

✍️ My Take

BTCFi isn’t chasing Ethereum’s composability arms race.

It’s custody-first, trust-minimized, and structurally sound.

Each of these five protocols unlocks a key piece of financial functionality:

• Babylon → self-custodial restaking

• Lombard → cross-chain DeFi for $BTC

• Solv → liquidity abstraction & LST routing

• b14g → modular restaking rails for appchains

Bitcoin isn’t just hard money anymore.

It’s evolving into a full-stack economic system, slowly, securely, and irreversibly.

PS: I didn't include $CORE because it's a chain on its own. But still one of my favorites.

10.88K

68

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.