After a night of socializing, I’ll write a few lines. It’s only been half a year since @KaitoAI raised the banner for InfoFi, yet it feels like a lifetime ago, profoundly changing the Twitter information flow and the marketing landscape in the crypto space.

However, I always feel that my understanding of InfoFi differs somewhat from @Punk9277, which is why I’ve always been somewhat distant from the various discussions, finding them not very interesting.

Here are some random thoughts, which do not constitute financial investment advice:

- Kaito's core focus is distribution (currently the slogan also mentions "Distribution layer"), which is a good broker business.

- But the core issue is that brokers cannot set prices; essentially, they lack a traffic pool and capital. This aligns with what @cyrilxuq said: "web2 media cannot set prices, platforms can."

- Therefore, aside from staking and multi-platform operations, there will definitely be a trend towards launching a launchpad, trying to initiate asset launches. Thus, being bullish on $kaito at this point makes logical sense.

- However, previous attempts like @stayloudio were quite unsuccessful. The launch and operation were decent, but the biggest issue was creating a psychological ceiling for the launchpad, which is not a good thing. Teacher Yuhu was used as a pawn by the bad actors in the crowd.

- The core of InfoFi is to price information, if the information itself can influence the prices of other assets. The latter part is quite important because a bunch of AI-generated information with near-zero entropy is simply not worth pricing. More often, it’s the project parties paying, with Kaito acting as a conductor to get KOLs to promote, creating a false prosperity among the lower mid-tier crowd.

- The reason for my interest in InfoFi and the urgency of this matter is because ████████████████████████. Things are in progress, and it has nothing to do with the crypto space; learning by doing is better than just talking, and I will share at the appropriate time.

- This topic is quite meaningful to think about, and it won’t just be a simple rhyme from previous cycles; the core points are:

1. The way humans interact with information is about to undergo a fundamental change compared to search engines and recommendation systems.

2. The marginal cost of humans producing and spreading disinformation is rapidly approaching zero.

3. The decision-making methods of most marginal buyers (Marginal buyer, inspired by @primitivecrypto) are undergoing fundamental changes in the sense of behavioral finance.

As the rational person hypothesis drifts further away, the focus time is drastically decreasing, and decision-making is becoming quicker and more straightforward, blurring the lines between entertainment and investment.

If the fruit is rotten, it will just continue to rot; the world will become increasingly chaotic. Both taking risks and adding fuel to the fire are choices, and we always choose the more difficult one.

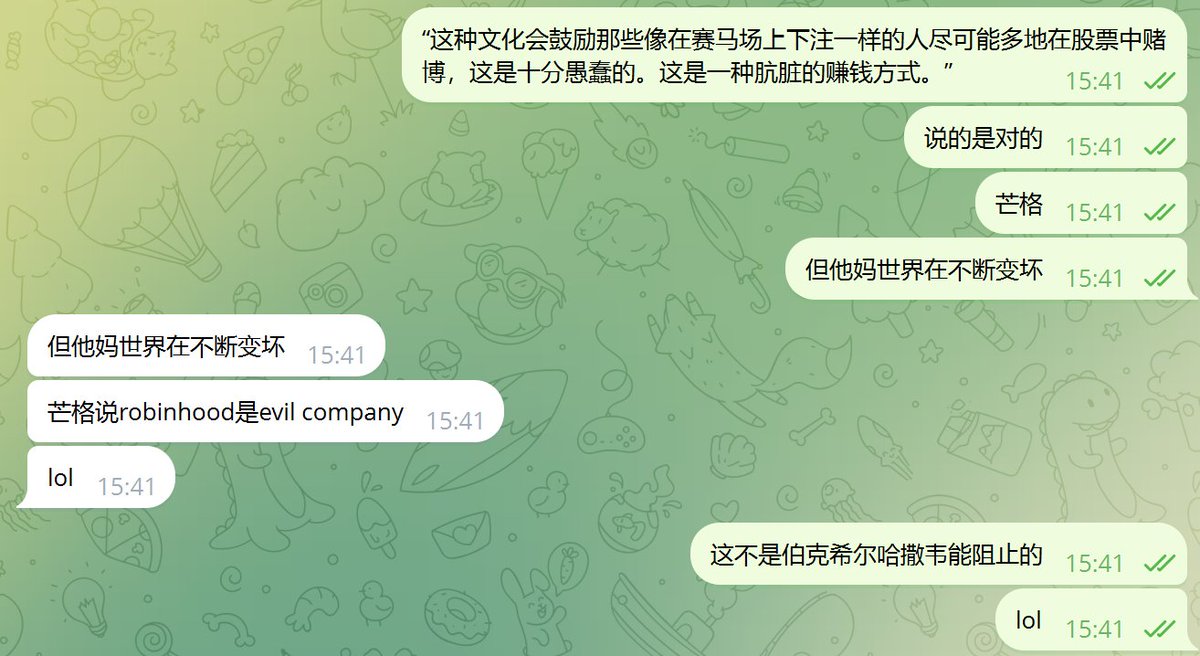

I’ll end with a conversation with a friend:

Show original

20.88K

105

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.