── .✦ Vault of the Day: @gauntlet_xyz USDC Core .ᐟ

Curious where nearly $60M USDC is parked to earn optimized yield? Gauntlet USDC Core vault on @MorphoLabs spreads your USDC across diverse markets, from tokenized dollars to BTC pairs while continuously optimizing for risk-adjusted yield.

Let’s break it down ↓

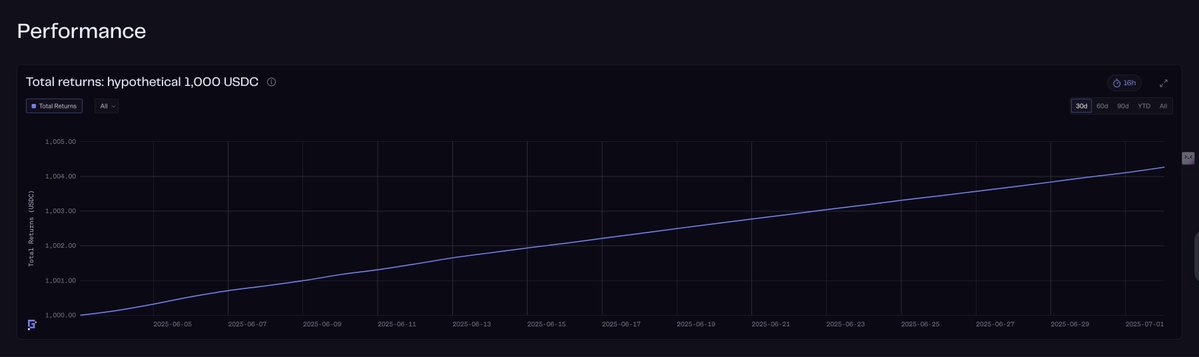

Performance Snapshot

Total Deposits: $59.7M USDC

Liquidity: $22.3M USDC

Current APY: 6.2%

30D Average APY: 6.39%

Daily returns show steady, compounding growth for depositors

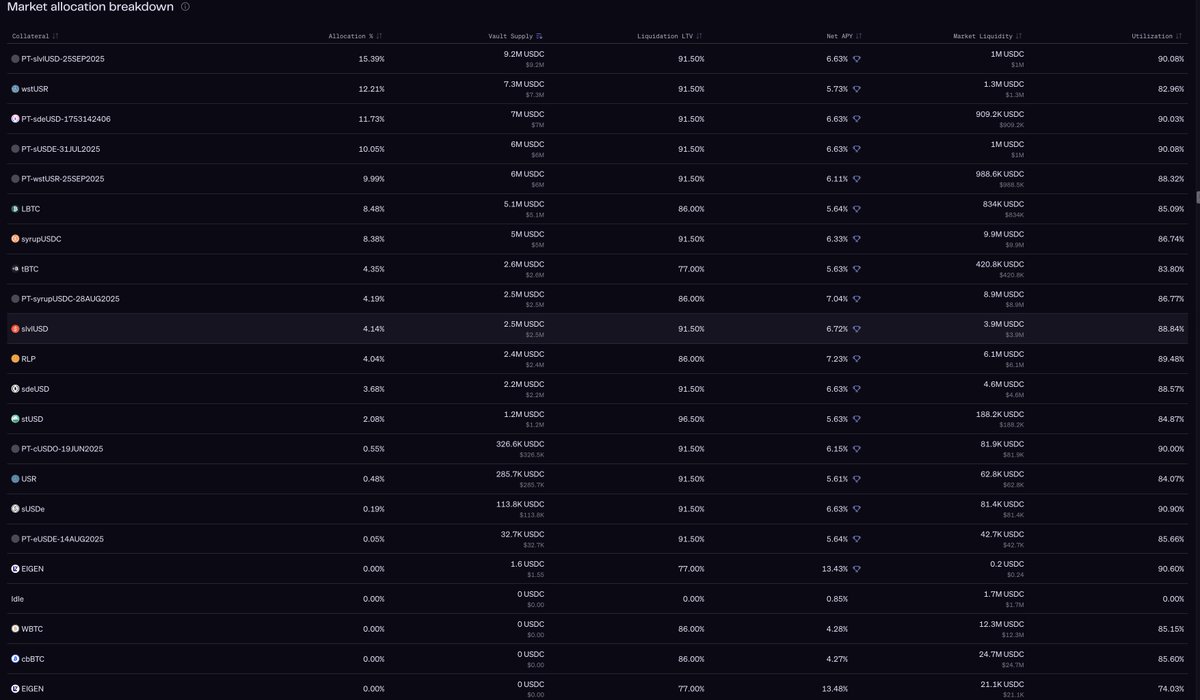

Where does your USDC go?

The vault allocates to a mix of tokenized stable assets & BTC exposure:

15.2% PT-slvUSD (Principal Tokens)

11.7% PT-sdeUSD

11.4% wstUSR (Wrapped USR)

10.8% PT-wstUSR

9.4% PT-sUSDE

8.5% LBTC (Liquid BTC)

8.3% syrupUSDC

And smaller allocations across other stablecoin and BTC markets.

What makes this vault unique?

Compared to Gauntlet's Prime Vaults, the USDC Core Vault targets a higher risk, higher return profile. It blends exposure to both large-cap and more experimental collateral markets aiming to outperform vanilla stablecoin strategies.

Risks to Know

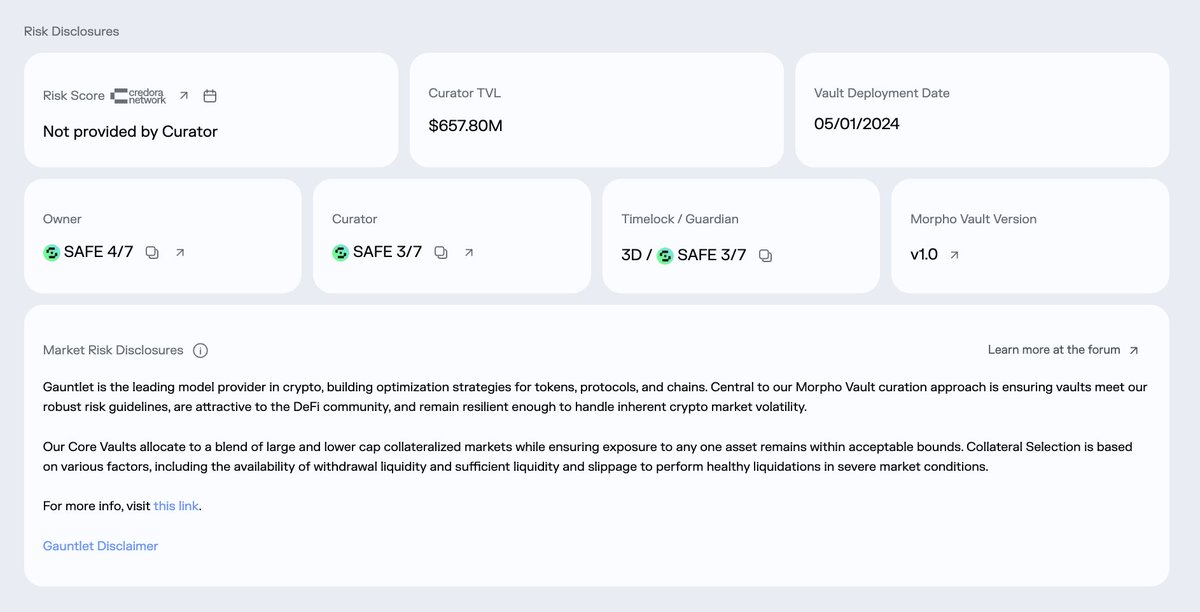

Curator risk score not yet submitted

Market risks like volatility or unexpected liquidity crunches

DeFi smart contract risks

Higher-risk markets can mean higher returns, but require user awareness

For beginners

This vault lets you earn competitive onchain yield on USDC without needing to manage complex DeFi positions yourself. Gauntlet handles the heavy lifting, you just deposit and track your returns.

Explore the vault for yourself:

⚝

⚝

1.26K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.