On ArbitrumDAO Revenue:

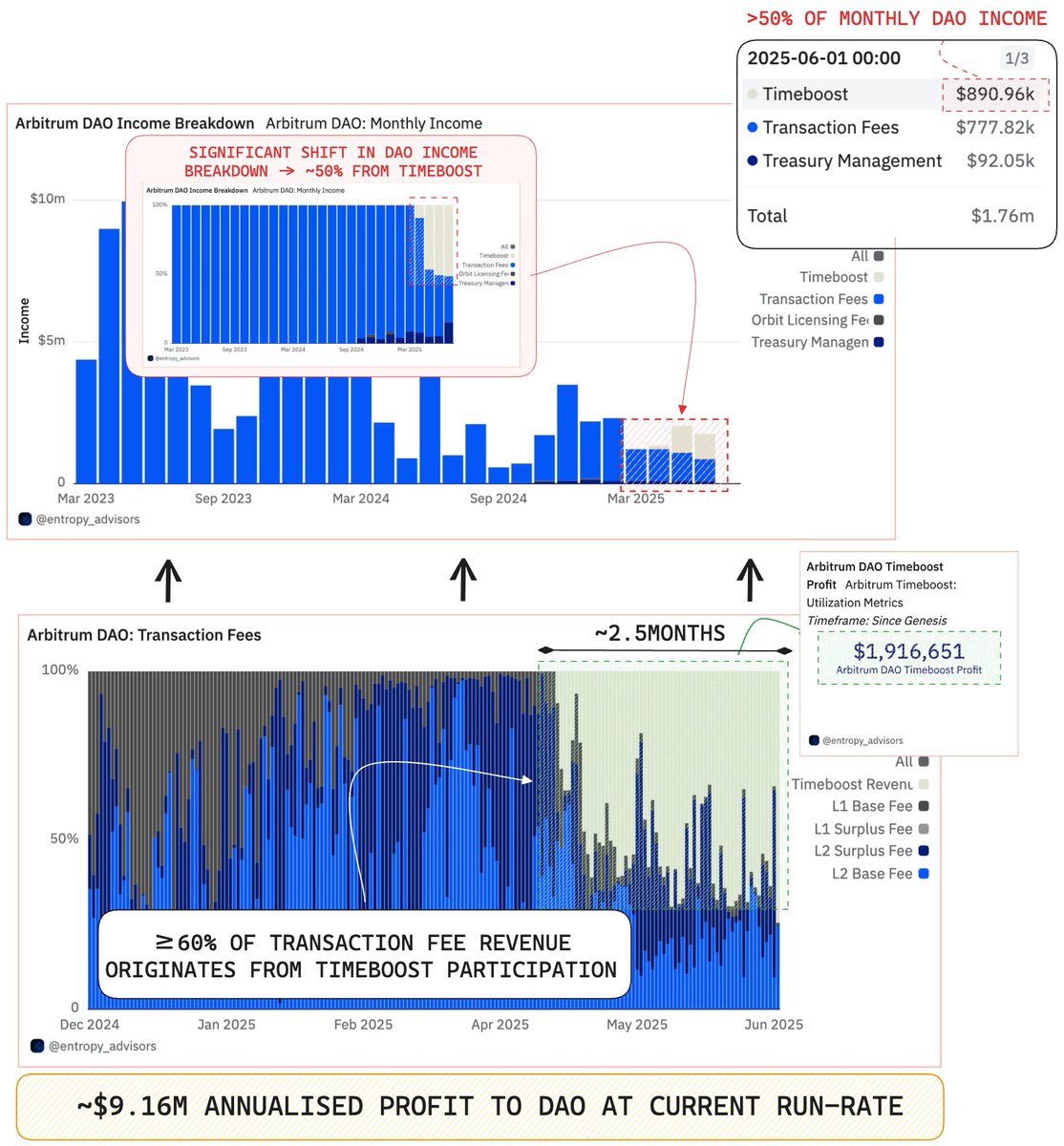

June 2025 marked a pivotal month where 50.5% of Arbitrum’s income came from @arbitrum's Timeboost MEV mechanism ($891k).

That’s a major shift since Timeboost launched just 2.5 months ago.

The numbers are actually q insane:

🔸$1.92M profit since launch → ~$9.16M annualised at current run-rate

🔸 >60% of transaction fee revenue now stems from Timeboost participation

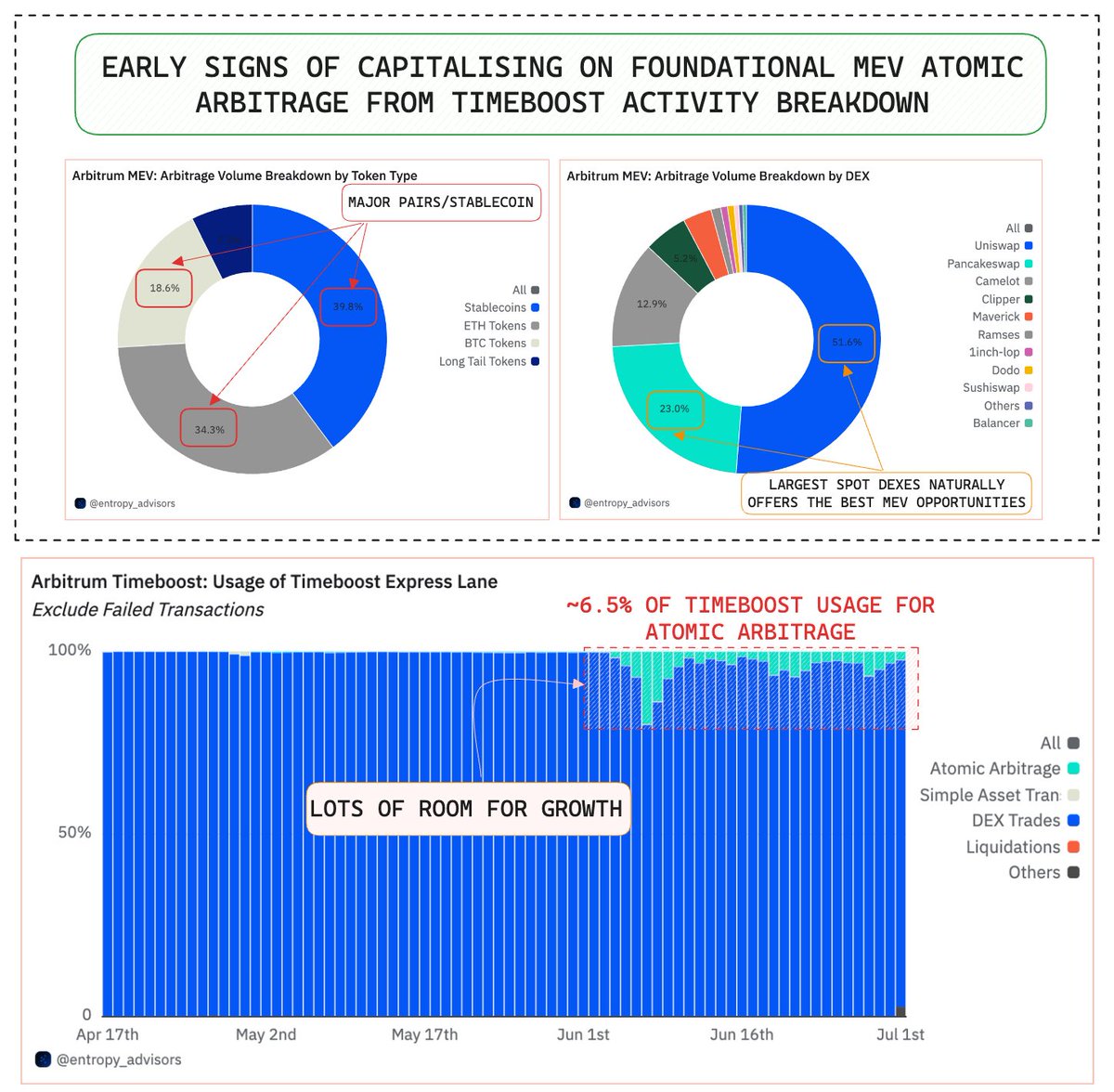

Yet even with this explosive growth, we're still early.

Only 6.5% of Timeboost transactions are atomic arbitrage, with most MEV activity centred around large-cap pairs like WBTC/ETH/USDC.

IMO the real signs of maturity will show when long-tail assets start participating, signalling that the mechanism is robust & lucrative enough to incentivise deeper MEV strategies native to the ecosystem.

h/t @Dune @EntropyAdvisors for the data insights

6.81K

81

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.