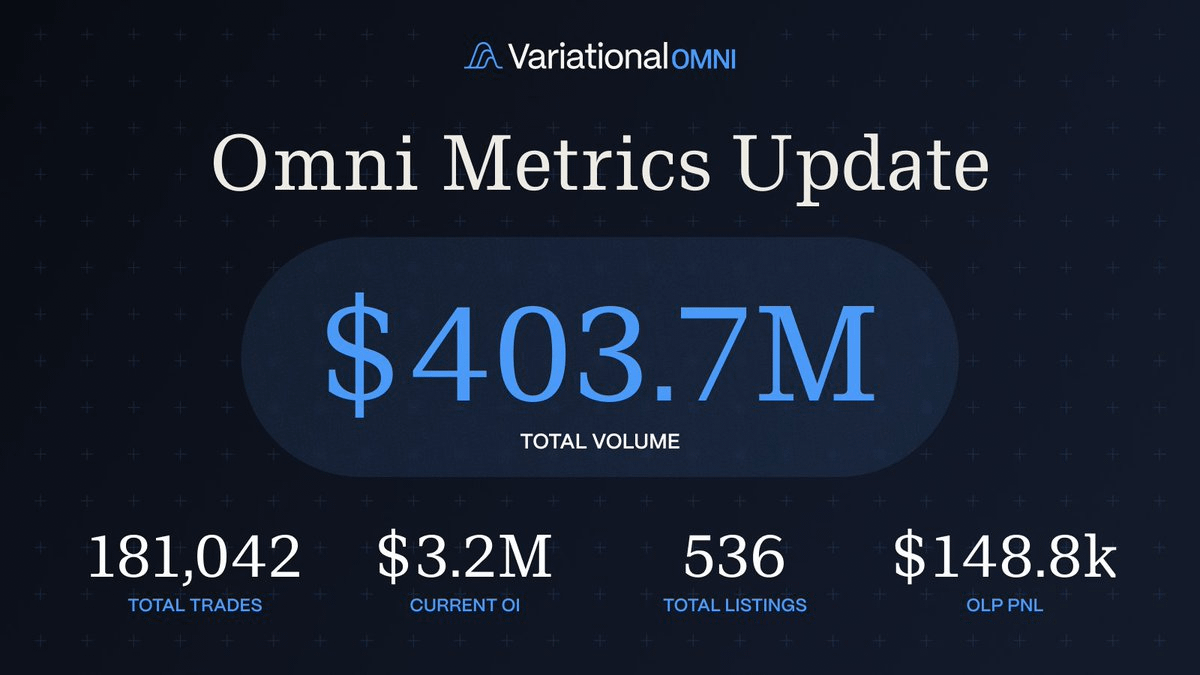

Omni (built on @variational_io) is the most structurally sound trading venue onchain right now, and most still haven’t caught on.

Let's dive a little bit deeper into their product and rewards👇

The product is leveling up fast:

1) Spreads have compressed across the board. You can now route multi-million dollar $BTC trades at 3–4 bps, without touching an order book. That’s tighter than most CEXs.

2) $HYPE markets are back, with spreads ~50% tighter than before. Retail flavor meets institutional-grade infra.

3) Their listing engine is live again, feeding a stream of new tokens. Users now get access to majors, memecoins, vol indices, anything that can be priced can be traded.

Here’s the kicker: Omni charges no trading fees. Just a $0.10 flat fee on deposits/withdrawals. That alone breaks the mold of most onchain venues.

And the architecture makes all of this sustainable:

> Liquidity comes from an in-house OLP that routes and hedges across CEXs, DEXs, and OTC desks

> Pricing is driven by internal quoting, no reliance on external market-makers

> Settlement is instant, with users insulated from counterparty risk via isolated pools

Variational isn't playing some mercenary points game. The reward structure is also native to the protocol. They have:

> USDC refunds on losses

> Spread discounts for high-volume traders

> Referral rewards based on actual traded volume

> Platform credit to activate new/referred users

> A tiered system, so rewards scale with usage

The OLP keeps the spread, not external firms. So rewards aren’t a cost center, but a redistribution of real value captured by the system.

Overall, Variational has all three:

Deep liquidity, aligned incentives, and no-fee execution.

If you’re still farming points elsewhere, pay attention.

Variational isn’t competing for attention, it’s competing for flow. 🔥

3.31K

35

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.