Therefore, Bybit's coin stock landing plan is a stock token issued by xStocks on the chain, and then the exchange supports trading.

At present, there is also a leading exchange in the same industry, which will also be connected to xStocks, which should be officially announced recently.

To put it simply, the principle of xStocks is to buy real stocks at a brokerage first, and then issue the corresponding stock tokens on the chain, so it can also be said that it is a stock anchor coin.

The advantage of this is that it allows non-European and American residents to buy stocks directly through on-chain or offshore exchanges, so as to indirectly invest in and hold U.S. stocks.

In addition, the on-chain addresses are anonymous, and if you don't deliberately track them, it is difficult to let the local tax authorities know that you hold stocks on the chain, which also solves the recent tax inspection turmoil.

At present, Bybit was the first to list Coinbase and NVIDIA stock tokens yesterday, and then on July 1, Apple, Tesla, McDonald's and other remaining more than a dozen tokens.

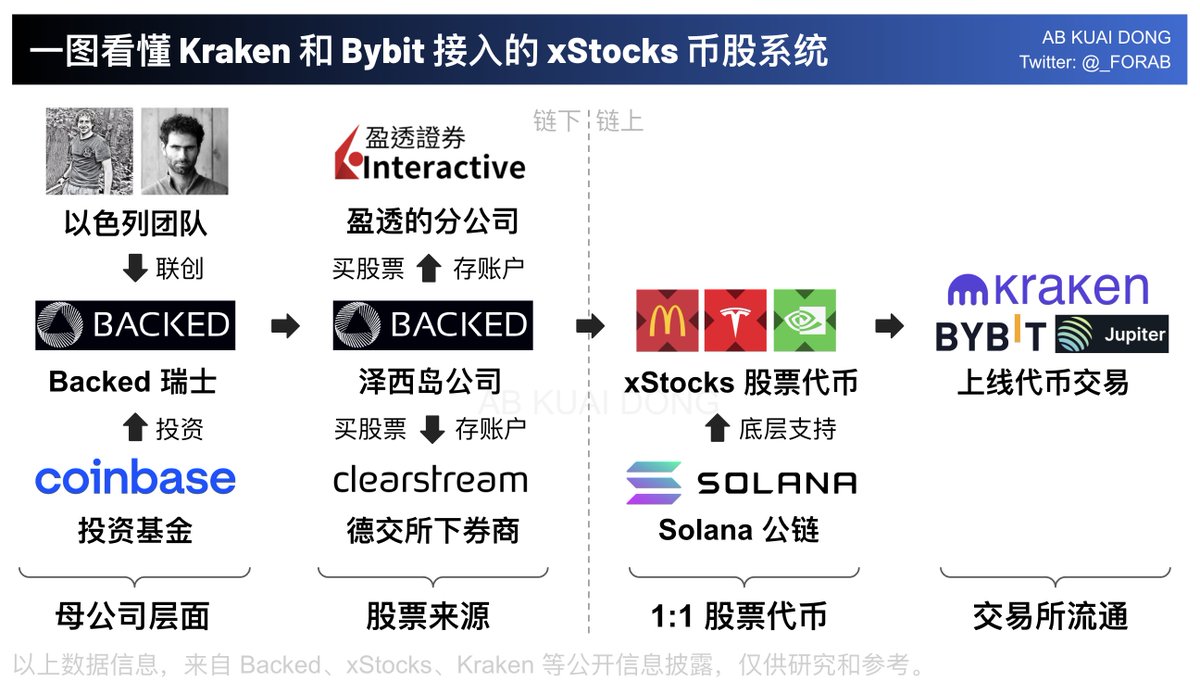

To elaborate, Kraken, Bybit, and Jup are integrating with xStocks, explaining the principles behind crypto stocks.

The parent company registered in Switzerland controls the Backed Assets located in Jersey. They purchase stocks in the U.S. market through the IBKR Prime channel under Interactive Brokers, and then transfer them to a segregated account held under Clearstream.

Clearstream is the custodian institution under the Deutsche Börse, which helps them safeguard these stocks.

Once the buying, transferring, and depositing operations are completed, it triggers a contract deployed on the Solana chain, corresponding to the issuance of stock tokens. For every 1,000 shares of Tesla stock purchased and securely stored, 1,000 TSLAx tokens will be minted on-chain at a 1:1 ratio.

The control address of the token contract belongs to Backed, the issuer. Subsequently, third-party exchanges like Kraken, Bybit, and Jupiter can directly list these tokens for spot and futures trading.

If investors or market makers purchase one or more TSLAx tokens, they can approach Backed to redeem them for actual Tesla stocks under the brokerage.

In this way, the entire process of collateralizing, minting, issuing, and redeeming crypto stocks is completed, which is quite similar to stablecoins next door.

69.05K

120

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.