TRON Enters U.S. Capital Markets via SRM Merger — TRX Gains Institutional Access

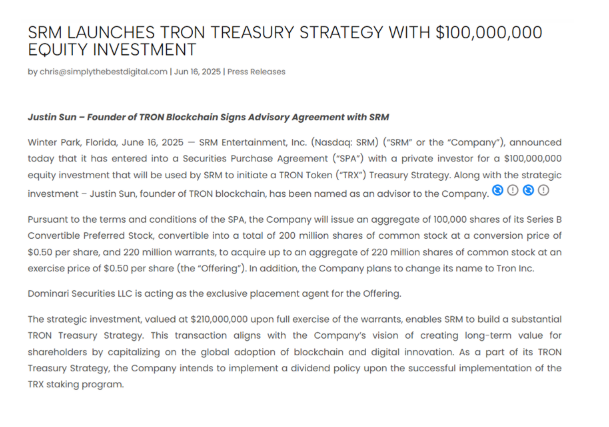

TRON has executed a reverse merger with Nasdaq-listed SRM Entertainment (SRM). The company will rebrand as Tron Inc. and adopt TRX as a strategic reserve asset—a move that mirrors MicroStrategy’s Bitcoin strategy and brings TRX into the U.S. public market sphere.

Key Data & Structural Insights:

SRM Stock Performance: +1,000% in 10 days (from $1.18 to $12.80), reflecting strong investor interest post-announcement.

TRX Market Capitalization: Ranked #8 globally, with a $26B market cap.

DeFi Metrics:

▫️SUN io processes $1B+ weekly volume; ranked Top 6 among global DEXs.

▫️JustLend DAO holds 2B+ TRX staked, positioning it for institutional yield deployment.

Token Reserve Model:

▫️Tron Inc. will hold TRX on its balance sheet, reducing market float and introducing a compliant onramp for U.S. institutional investors.

Strategic Alignment:

▫️Establishes a regulatory bridge between traditional finance and TRON DeFi infrastructure.

▫️Enables access for capital allocators bound by U.S. securities law.

Implications:

▫️Legal Exposure for U.S. Institutions: A publicly listed company holding TRX paves the way for regulated entities (e.g., pension funds, ETFs) to consider TRX as a compliant asset.

▫️Monetary Design Meets Market Infrastructure: This integration brings together real on-chain yield (via TRON DeFi) and Wall Street-grade financial instruments.

▫️Supply & Demand Dynamics: TRX accumulation by Tron Inc. implies reduced liquid supply, increasing long-term scarcity amid growing on-chain activity.

This move elevates TRON from a crypto ecosystem to a regulated investment vehicle with real institutional pathways — a model that may shape the next wave of token adoption.

@justinsuntron #TRON #TRX #TRONEcoStar

32.81K

37

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.