Stablecoins, an extension of the Ant Pay empire?

In mainland China, Ant Group's Alipay has accounted for half of the payment, and this time it has entered the field of stablecoins with the help of Ant Digital, with the aim of creating "Alipay on the blockchain".

As the main force that undertakes Ant's accumulation in the fields of payment and blockchain, Ant Digital not only provides digital solutions for global enterprises, but also actively applies for stablecoin issuance licenses in Hong Kong and Singapore.

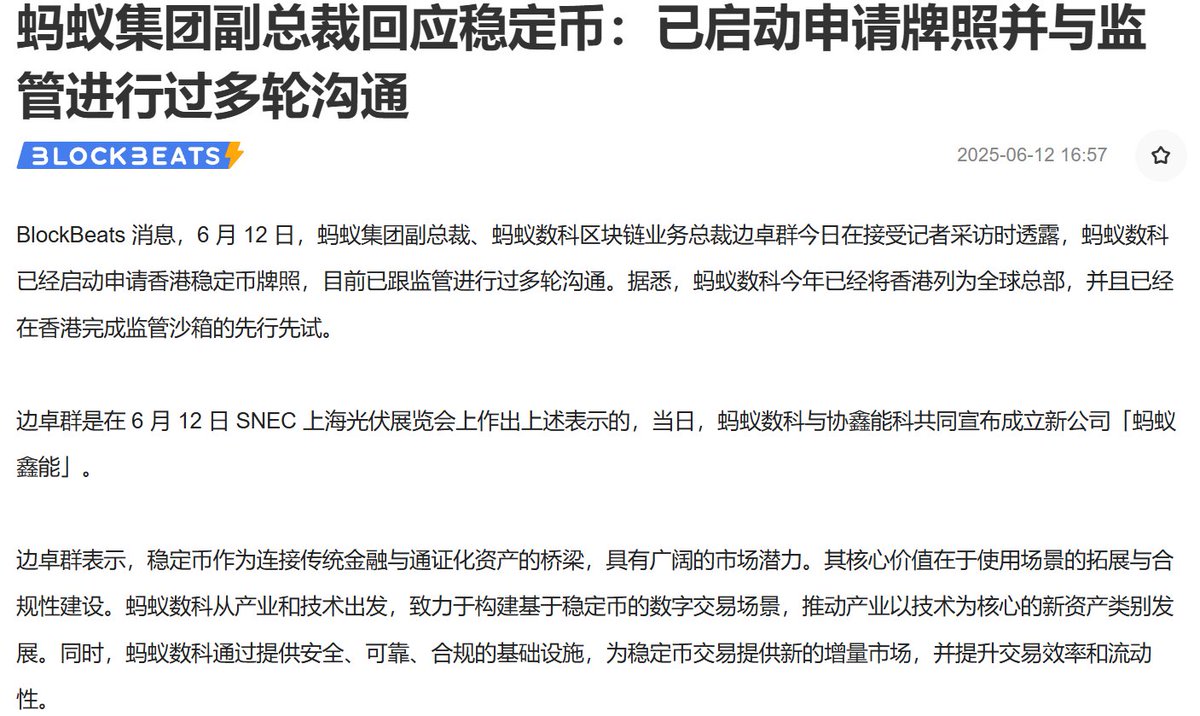

1⃣ In June this year, Bian Zhuoqun, president of Ant Digital's blockchain business, publicly stated that he had launched an application for a Hong Kong stablecoin license and had communicated with regulators many times. At the same time, Ant has also set up Hong Kong as its global headquarters and completed regulatory sandbox testing. Hong Kong's position in its RWA, Web3 and stablecoin strategies is rising.

2⃣ Ant Digital, Conflux and dForce jointly launched the "Green Energy Swap" RWA project, which uses USDT as a settlement tool, demonstrating the application potential of stablecoins in industrial scenarios.

Ant Digital and GCL-ET established a joint venture company, "Ant Xinneng", focusing on the integration of green energy and blockchain.

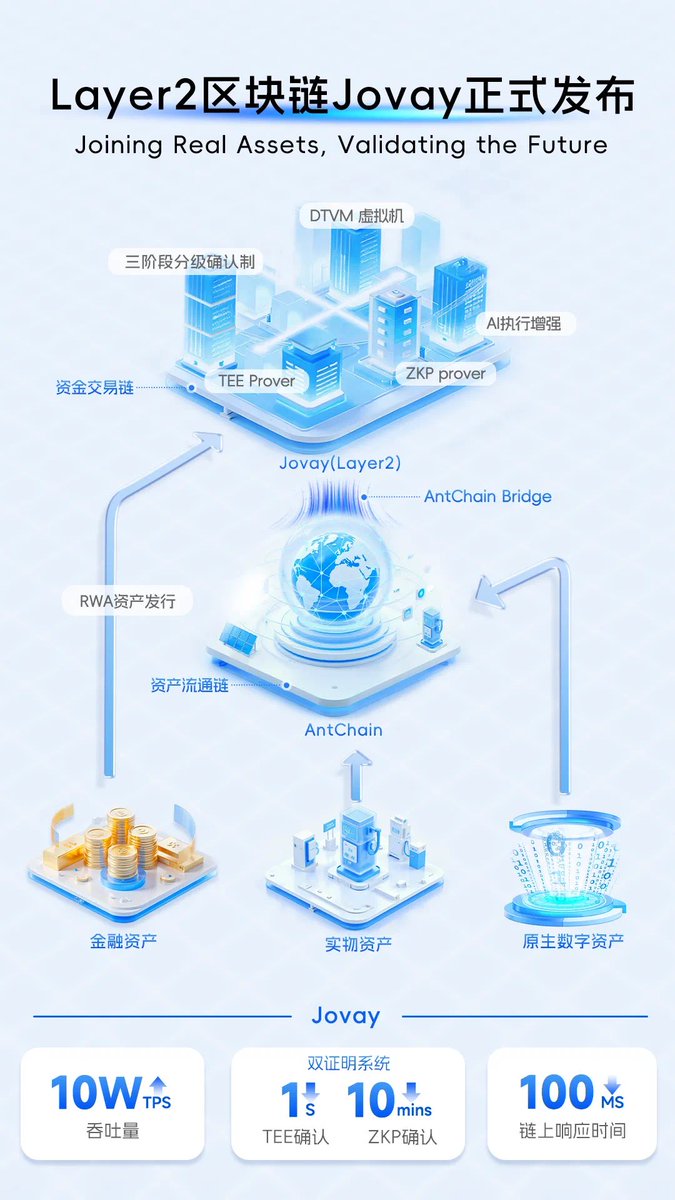

In addition, Ant Digital launched Jovay, a Layer2 blockchain designed for RWA transactions, which supports 100,000 TPS and 100 millisecond responses, integrates the open-source virtual machine DTVM, is compatible with the Ethereum ecosystem, and lowers the cross-platform barrier for developers.

3⃣ From the RWA pilot of "green energy battery swap", to the establishment of "Ant Xinneng" with GCL, to the release of "Jovay", a high-performance blockchain Layer2 platform for overseas markets in Dubai, Ant Digital's layout is very clear: build practical use scenarios around stablecoins, and provide compliant and secure infrastructure to support industrial-level applications.

4⃣ It is worth noting that Jovay not only achieves 100,000 TPS and 100ms response speed, but also is equipped with an open-source virtual machine DTVM, which is compatible with Ethereum, and supports the large model development framework SmartCogent, which is specially designed for RWA scenarios. Against the backdrop of increasing global demand for high-performance chains and trusted asset trading infrastructure, Ant's move is undoubtedly a "card for the future".

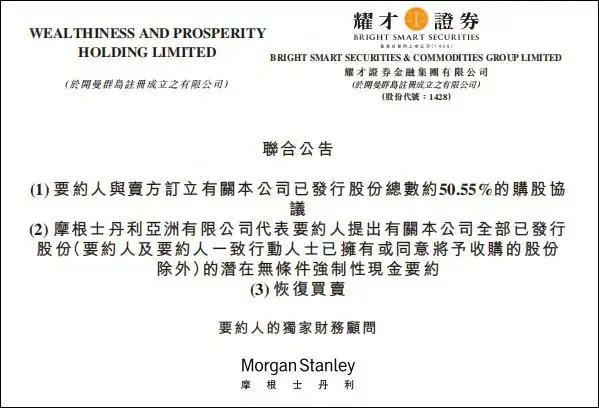

5⃣ In addition, in April 2025, Ant spent HK$2.8 billion to acquire a controlling stake in Bright Smart Securities (50.55%), indirectly obtaining a Hong Kong brokerage license. If Bright Smart obtains a Type 1 license in the future, it may become one of the main distribution channels of Ant stablecoin. It is worth paying attention to in the currency circle that this may mean that a "stablecoin ecological closed loop" covering the whole chain of coin issuance, compliance, trading, and scenarios is taking shape.

Epilogue:

From Alipay's national success to the global ambitions of stablecoins, Ant Group is taking advantage of blockchain to seek a new round of upgrades for its payment empire. Relying on Hong Kong's compliance environment, the technical performance of Jovay Chain, and the support of financial resources such as Bright Smart Securities, Ant Group is accelerating the implementation of the "stablecoin + RWA" ecosystem.

Will it be able to achieve a technological breakthrough on this new track and become a key player in connecting the traditional financial and crypto worlds? It's worth waiting and seeing.

Why is "stablecoin" on the hot search again?

Recently, the buzzword in the stock and currency circles is none other than "stablecoin". The performance of the two leading players is eye-catching: the share price of Circle (CRCL), the first share of the stablecoin, continued to rise and close last night, and the total intraday market value once exceeded the total market value of its issued stablecoin USDC; Tether earned nearly $14 billion in USDT in 2024, and the speed of "printing money" in 2025 has not slowed down at all, minting 2 billion USDT on the Tron network on June 22 alone.

1⃣ The U.S. is licensed, and the U.S. dollar stablecoin is the king of the world

On June 18, the U.S. Senate passed the "GENIUS Act", which clarified that stablecoins must be bound to US dollar assets at 1:1, promise to be redeemed at any time, prohibit investment and income, and stablecoins need to be backed by real US dollars, not pure algorithmic coins, and need to have value support. Circle ushered in regulatory dividends, and its stock price skyrocketed.

2⃣ Hong Kong will sell, and stablecoins such as Hong Kong dollars will be launched

The Stablecoin Ordinance, which came into effect on August 1, supports institutions to issue stablecoins such as Hong Kong dollars and offshore RMB, attracting IDA, Yuta Logistics Technology, and Nano Labs to compete for licenses. Standard Chartered, RD InnoTech Limited and others have also participated in the sandbox test before. Hong Kong stocks-related concept stocks soared, and the market is optimistic that Hong Kong will become a Web3 financial center in Asia.

3⃣ Mainland cautious, turn to "offshore layout"

Although the mainland still prohibits stablecoin trading, it has set up a subsidiary in Hong Kong to deploy cross-border payments. Ant, JD.com, Xiaomi, Conflux and other actions are frequent. At the Lujiazui Forum, the senior management of the central bank frequently mentioned "stable coin + RMB internationalization" to release strategic signals.

Conclusion: Stablecoins are moving from the gray area to the right track of compliance, and are gradually becoming the new infrastructure of global finance.

85.61K

120

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.