Bitcoin vs. Real Estate

Recently, the real estate market has been hot, and my takeaway from actively visiting properties over the past 1-2 years is that I've become a hardcore bull on 'Bitcoin.' It's like, the macro perception I have and the surrounding atmosphere are quite different. To summarize, real estate investors (also known as big players) view Bitcoin and real estate on the same level.

This isn't just because of the current U.S. government's 'pro-crypto' stance, which has changed the perception of crypto investment due to improved investment stability and institutional entry. They already have returns of over +100%, which means they have been steadily accumulating since around 2022.

No, it means they have more conviction in the market than I do, who have been envisioning crypto technology and the future while investing for years, and surprisingly, what they say is simple.

I pretended not to know and asked,

"Should I buy some Bitcoin too?"

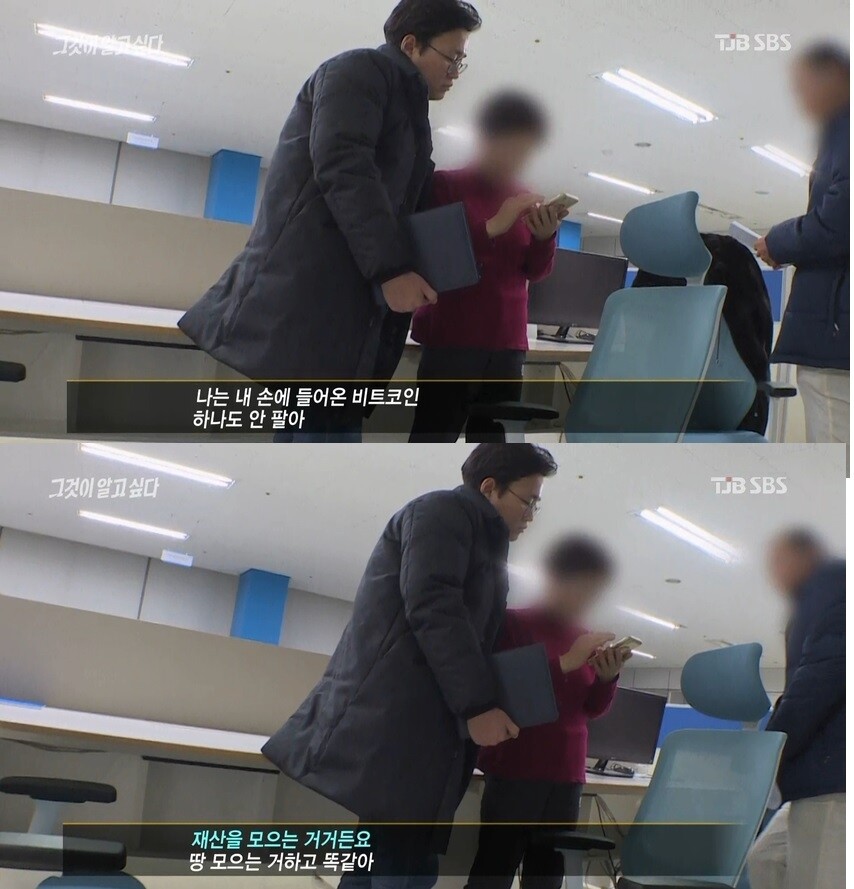

The boss replied:

"Bitcoin has a limited supply, you know? It's the same as there being no land left to build buildings in Seoul, and the location is becoming scarce, so the supply is limited."

"Just like collecting houses and land, you can accumulate it; I have at least one or two around me."

Their response is very simple but powerful.

They let me know that they understand a lot through that short sentence:

1) Extreme Scarcity: The intrinsic value increase driven by limited supply

2) Core Store of Value: Asset preservation function against currency value decline

3) Strong Inflation Hedge: Ability to defend real value in a currency expansion environment

4) Long-term Investment Advantage: Continuous asset growth potential that transcends market volatility

5) First-mover Entry Opportunity: Securing early market advantage by leveraging information asymmetry

6) Flexible Investment Philosophy: Open portfolio strategy encompassing traditional and emerging asset classes

(No bias)

It felt like I got hit on the head; it was an answer that encapsulated the essence of investing.

I know. I knew since 2017, and I still know now.

Yesterday, we talked about the strong real estate loan regulations, and gap investments and moving to higher (premium) locations have been restricted for at least six months. The real estate market will cool down for a while. So, what will they do with their cash? I don't think they'll just leave it sitting in the bank.

Show original

211

0

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.