. After all, @AguilaTrades brother still didn't have the patience to wait for the BTC price to come down: he cut off the $BTC that opened yesterday afternoon, and then reopened more than $160 million in BTC at 1 a.m.

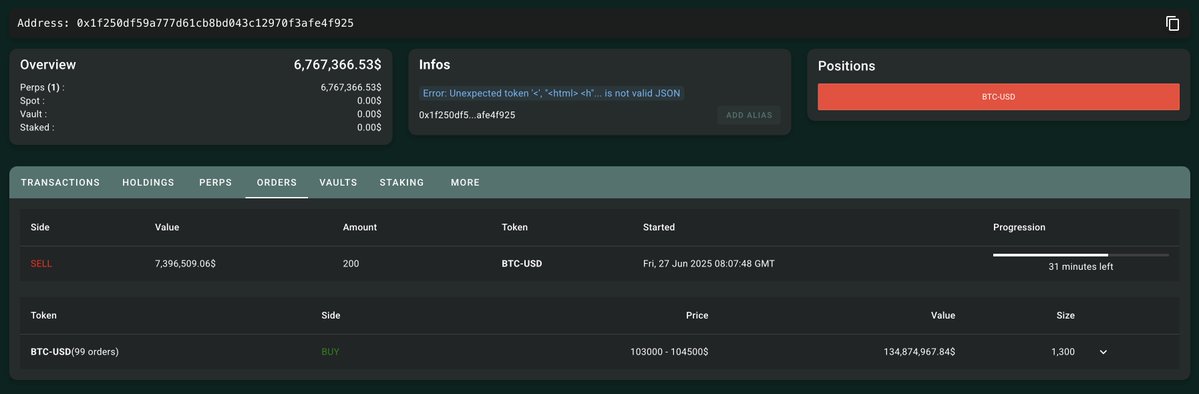

After he made a profit in the early hours of yesterday morning, he closed the long BTC plan in the range of $103,000-$104,500 and waited for the price to come down. But in the afternoon he ran out of patience and opened BTC short.

Finally, at 1 a.m., he closed the short order with a loss of $590,000, and then drove back to BTC again.

But dude... The cost price of your position is so high... Just call back and you'll have to cut the meat 😂 again

20x long 1500 BTC, the position is worth $160 million, the opening price is $107288, and the liquidation price is $101729.

Position onlooker link 🔗👉:

This article was sponsored by #Bitget|@Bitget_zh

Show original

52.06K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.