Is AltSeason on the horizon?!👀

Speculation is heating up across X 🔥

But how close are we, really?!

📄We scraped 100+ posts on “AltSeason” & “AltSzn”

➡️Using Masa’s X-Scraper:

🤖Then piped the data into Anthropic's Claude to analyze the sentiment.

🎥 Watch the demo to see how we did it

👇Full dataset + AI summary in the 🧵

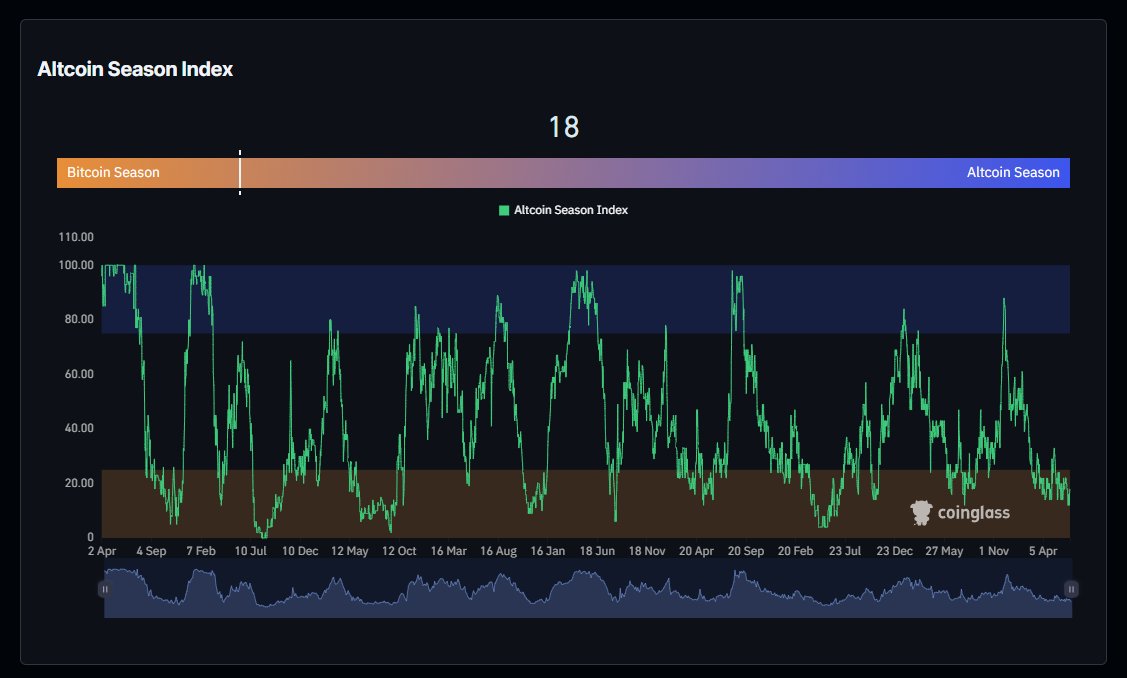

First, let's analyze how the Altcoin Season Index looks. By @coinglass_com

While it’s currently Bitcoin season - it looks like a bottom is forming.

Showing promise within the next few months of alts putting in a bottom against $BTC - kicking off a potential AltSzn in 2025.

What did AltSeason sentiment reveal? 📈

Are we about to enter AltSeason?!

Here’s the full summary of the sentiment based on 100+ X posts scrape by Masa:

AltSeason Sentiment Analysis Report

Based on $MASA X-Twitter Data

Data Summary 📰

Based on analysis of 100+ Twitter posts from June 27, 2025, the cryptocurrency community displays mixed but cautiously optimistic sentiment regarding AltSeason.

The discourse reveals a community caught between hope and skepticism, with evolving expectations about the nature of future altcoin rallies.

Key Sentiment Categories 📊

1. Optimistic Believers (35-40%) ☀️

Conviction: Strong belief that AltSeason is imminent or already beginning

Key Indicators: Bitcoin dominance peaking, ETH showing strength, technical patterns forming

Timeline Expectations: July 2025 - November 2025

2. Skeptical Realists (30-35%) 🌤

Conviction: Doubt about traditional AltSeason patterns recurring

Main Concerns: Market structure has changed, too many tokens diluting gains.

Key Arguments: 🔥

Institutional adoption changing dynamics

Token proliferation (16 million cryptocurrencies vs. 10,400 in 2021)

Different market cycles than previous years.

3. Cautious Optimists (25-30%)

Conviction: AltSeason will happen but differently than before. Expectations: More selective, not all altcoins will benefit equally

Strategy: Focus on utility, low-cap gems, and strong fundamentals #NFA

Technical Analysis Mentions

➡️Bitcoin Dominance Signals

🔹Current Level: 65-66% (multiple mentions)

🔹Key Resistance: 71% cited as critical level

🔹Historical Context: 2017 (89% to 41%) and 2021 (71% to 40%) cycles referenced

🔹Sentiment: BTC dominance rejection seen as bullish for alts

➡️ Ethereum as Catalyst

🔹ETH/BTC Ratio: 0.026 cited as key level to watch

🔹ETH Dominance: Potential drop to 8.39% before Wave 3 rally

🔹ETF Impact: Ethereum ETF flows mentioned as rotation catalyst

➡️ Sector-Specific Sentiment

🔹Meme Coins

🔹Status: Currently outperforming

🔹Sentiment: Mixed - some see as market distraction, others as opportunity

➡️Specific Mentions: DOGE, SHIB, PEPE, SPX6900

RWA (Real World Assets)

🔹Sentiment: Highly optimistic

🔹Projects Mentioned: ONDO, GEMO, BKN

🔹Thesis: Altseason + RWA narrative convergence

🔹DeFi Tokens

🔹Sentiment: Underperforming but positioned for rotation

🗓Timeframe Expectations

🔹 Immediate (July 2025)

Sentiment: 25% expect immediate start

Catalysts: Fed rate cuts, BTC dominance breakdown

🔹Short-term (Q3 2025)

Sentiment: 40% expect Q3 AltSeason

Reasoning: Historical patterns, technical setups

🔹Medium-term (Q4 2025)

Sentiment: 30% expect late 2025

Approach: More conservative, waiting for clearer signals

🔹Long-term (2026+)

Sentiment: 5% push timeline further

Reasoning: Structural market changes

Risk Factors Identified

🔹Market Structure Changes

🔹Token Dilution: Massive increase in available tokens

🔹Institutional Influence: Different capital flows than retail-driven cycles

🔹Regulatory Environment: Ongoing uncertainty

Technical Concerns

🔹Failed Breakouts: Multiple mentions of alts failing at resistance

🔹Liquidity Issues: Concerns about sustained rallies

🔹Correlation Patterns: Traditional BTC/Alt relationships questioned

Investment Strategies Mentioned

🔹Conservative Approach

Focus: Established alts with utility

Examples: ETH, ADA, SOL

Thesis: Lower risk, steady gains

🔹Aggressive Approach

Focus: Low-cap gems under $10M market cap

Risk: High volatility, potential for 50-200x gains

Thesis: Early positioning for maximum upside

🔹Hybrid Strategy

Allocation: Mix of established and emerging projects

Sectors: RWA, DeFi, select memes

Timing: DCA approach mentioned frequently

In Conclusion

The AltSeason sentiment on June 27, 2025, reflects a maturing cryptocurrency community that has learned from previous cycles. While optimism remains, expectations have become more nuanced and realistic.

The community appears to be preparing for a different type of AltSeason - one that may be more selective, utility-driven, and influenced by institutional capital rather than pure retail speculation.

📈Overall Sentiment Score: 6.5/10 (Cautiously Optimistic)

The data suggests the community is positioned for opportunity while maintaining healthy skepticism about timing and scope of potential altcoin rallies.

Want to dig into the AltSeason sentiment data yourself? 📊

We uploaded the full dataset to @huggingface 🤗

Use the data to train AI models, write articles, or track market momentum.

Open, free & AI-ready.

🗂️ Grab the dataset →

20.97K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.