How to quickly view cross-chain data and understand popular Web3 ecosystems using deBridge?

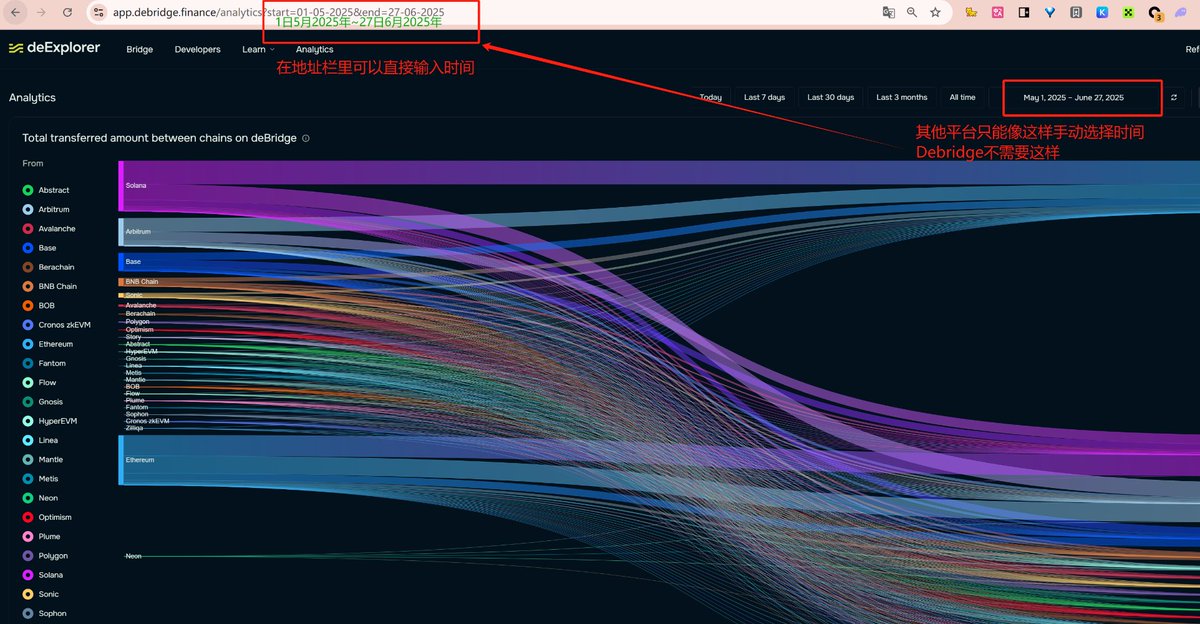

Other cross-chain bridge analysis tools use the POST method to pass date data, while deBridge uses the GET method.

In simpler terms, deBridge's date can be passed in the address bar. As shown in the screenshot, this is checking cross-chain data from May 1, 2025, to June 27, 2025.

For other cross-chain bridges, you must manually select the time to view data, which is very cumbersome. With deBridge, you can simply enter it in the address bar.

You can also enter the deBridge analysis page, select a recent 7 days or 365 days, and then modify the time in the address bar to quickly query cross-chain data for a specified period.

From January to November 2024, Solana shows a clear net inflow, while Ethereum shows a clear net outflow. Holding $SOL during this time will yield good returns.

From December 2024 to January 2025, Solana begins to show a net outflow, making this period suitable for shorting $SOL with low leverage. At the same time, the Arbitrum ecosystem shows a net inflow, but at that time, Arbitrum was the main channel for HyperLiquid deposits.

From February to April 2025, the cryptocurrency market overall declines sharply, and there is not much activity on-chain. Solana, BSC, and BASE show net outflows, while Ethereum, Arbitrum, and Sonic show net inflows. During this phase, deBridge has already supported the HyperLiquid ecosystem.

From May 2025 to now, the market has rebounded, but the Solana ecosystem is still showing a net outflow, while the Arbitrum ecosystem continues to show a net inflow.

Below shows more specific cross-chain data for each ecosystem:

By default, it displays From, which is the data for cross-chain outflows from each ecosystem.

Switching to To allows you to view the cross-chain inflow data for each ecosystem.

This includes the number of cross-chain transactions, capital scale, and cross-chain fee revenue for each ecosystem. Further down, there are daily transactions, daily active users, and other data...

Friends can pay attention to the specific cross-chain data of the ecosystems they hold.

Show original

4.83K

54

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.